28 December 2012

Update | Sector: Financials

IndusInd Bank

BSE SENSEX

S&P CNX

19,324

5,870

CMP: INR416

TP: INR500

Buy

Leveraging niche presence, fuelled with capital

Upgrading FY14 EPS estimate by 8%; 20% upside

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

M.Cap. (INR b)

M.Cap. (USD b)

IIB IN

521.8

436/222

3/12/52

217.1

3.9

Valuation summary (INR b)

Y/E March

2013E 2014E 2015E

NII (INR b)

21.9 28.5 35.4

OP (INR b)

18.5 24.5 30.9

NP (INR b)

10.5 13.7 17.2

EPS (INR)

20.1 26.3 32.9

EPS Gr. (%)

17.4 30.5 25.2

BV/Sh. (INR) 142.2 164.7 192.8

ROE (%)

17.6 17.1 18.4

ROA (%)

1.7

1.8

1.8

P/E (x)

20.7 15.8 12.6

P/BV (x)

2.9

2.5

2.2

Business growth remains strong and asset quality stable. We model in FY12-15 loan

CAGR of 25%+ and credit cost of ~70bp.

Expect 2HFY13 margin to improve ~40bp+ over 1HFY13; FY14 margin to further

improve 20bp YoY on the back of capital raising and higher CASA ratio.

Addition of new products and deeper penetration of existing fee businesses led to

strong growth in fee income. As a result fee income to average assets has improved

from 1.3% in FY09 to 1.8% in FY12. Expect healthy growth to continue.

Recent capital infusion of INR20b will improve Tier 1 capital to 15%+ (highest amongst

private banks), sufficient to fuel growth for the next three years.

We upgrade our FY14 EPS estimate by 8%+ to factor in higher margins. Maintain Buy

with a revised target price of INR500 (3x FY14BV), 20% upside.

Growth and asset quality remains strong

IIB continues to enjoy strong growth (35%+ CAGR over last three years) and

superior asset quality (GNPA of 0.8%) in CV loans (24% of total book), despite

sector slowdown. The underlying success factors are: (1) strong credit appraisal,

(2) high repeat business, and (3) focus on the lower-stress SRTO segment (small

road transport operators). In corporate loans segment, IIB's asset quality is helped

by (1) diversified loan book, and (2) low proportion of term/unsecured loans.

Management is confident of maintaining healthy loan growth of 25-30% and

superior asset quality (which would keep credit cost under control).

Shareholding pattern %

5-Dec-12 Sep-12 Jun-12

Promoter

Foreign

Dom. Inst

Others

17.4

36.6

9.3

36.7

19.4

34.3

8.8

37.6

19.4

34.2

8.7

37.7

Expect margins to improve gradually

We expect IIB to be a key beneficiary of likely reversal in interest rate cycle in

4QFY13 - high-cost deposits will be re-priced at a lower rate, whereas higher

mix of fixed rate loans (~50% of overall) implies lower decline in yields. Further,

improving CASA ratio and recent capital infusion of INR20b would help margin

expansion. Expect 2HFY13 margin to improve ~40bp+ over 1HFY13; FY14 margin

to further improve 20bp YoY on the back of capital raising and higher CASA ratio.

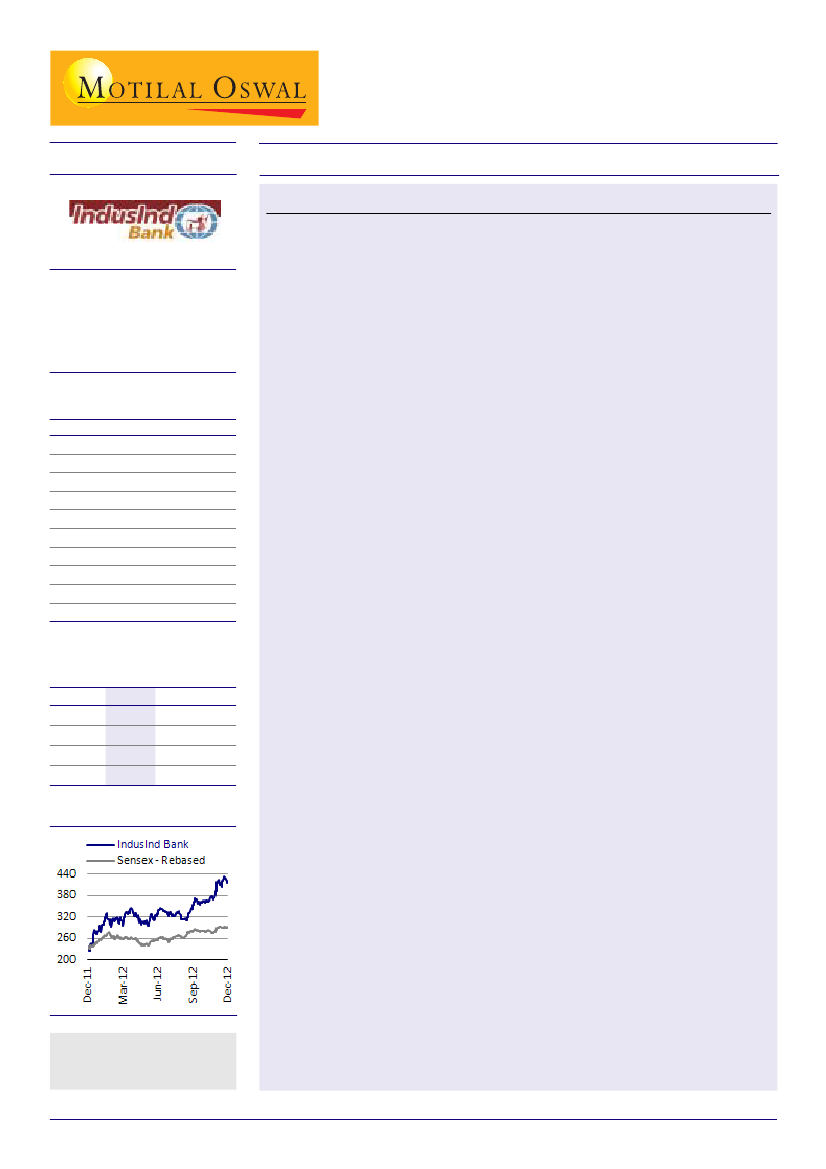

Stock performance (1 year)

Strong traction in new customers continues; positive for CASA, fees

Rapid branch expansion (to 441 from 210 in FY10), product innovation and higher

interest rate on savings deposits has led to 75%+ increase in new customers

(average of 0.08m in FY11 v/s 1.45m in 2HFY13). This is positive for CASA and fee

income generation through cross selling of third party products.

FY14 EPS estimate up 8%, revised target price to INR500

We upgrade IIB's FY14 EPS by 8% to factor in higher margins. Our comfort with IIB

is based on: (1) Strong capitalization (15%+ Tier I post 10% equity dilution), (2)

Healthy business growth (25%+), (3) Margin expansion, and (4) Healthy asset

quality outlook. Maintain

Buy

with a revised target price of INR500 (3x FY14BVE),

20% upside.

Investors are advised to refer

through disclosures made at the end

of the Research Report.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); + 91 22 3982 5415

Sohail Halai

(Sohail.Halai@motilaloswal.com) +91 22 3982 5430