10 January 2013

3QFY13 Results Update | Sector: Financials

IndusInd Bank

BSE Sensex

19,664

S&P CNX

5,969

CMP: INR434

TP: INR500

Buy

Bloomberg

Equity Shares (m)

M. Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

IIB IN

521.8

227/4.1

441/242

3/15/52

Financials & Valuation (INR b)

Y/E March

2013E 2014E 2015E

29.0

24.3

13.6

4.0

26.0

29.9

164.4

17.0

1.7

14.6

16.7

2.6

2.7

0.7

36.1

30.7

17.1

4.1

32.7

25.8

192.3

18.4

1.8

14.6

13.3

2.3

2.3

0.9

NII (INR b)

22.4

OP (INR b)

18.1

NP (INR b)

10.5

NIM (%)

3.8

EPS (INR)

20.0

EPS Gr. (%)

16.8

BV/Sh. (INR) 142.2

ROE (%)

17.5

ROA (%)

1.6

Payout (%)

14.6

Valuations

P/E(X)

21.7

P/BV (X)

3.1

P/ABV (X)

3.1

Div. Yield (%)

0.6

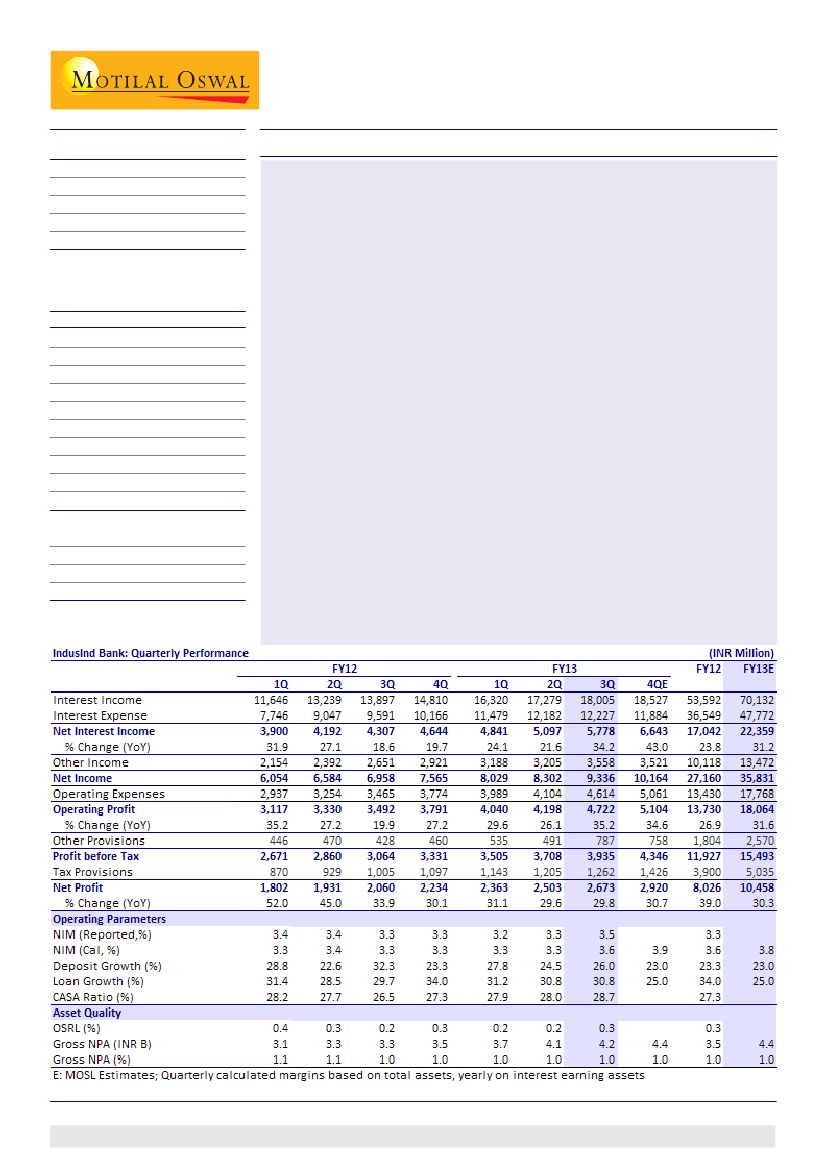

IndusInd Bank's 3QFY13 PAT grew 30% YoY and 7% QoQ to ~INR2.7b (in-line with

estimates). Strong loan growth (+31% YoY), 20bp+ QoQ improvement in margin

to 3.5% and strong fee income, led to highest-ever core income and core PPP (as

a percentage of average assets) of 5.6% and 2.7% and quarterly RoA of 1.65%.

Key highlights:

Asset quality was stable (GNPA up 3% QoQ) despite recognizing one large

media account of INR1b as NPA. After valuing the securities that bank held

towards the exposure, it sold the exposure to ARC and provided ~INR400m

as provisions. Slippage ratio in consumer finance segment was stable at 2%.

Post moderation in 2QFY13, SA deposit growth bounce backed to 16% QoQ

(+55% YoY) - a positive, driving overall CASA growth (+10% QoQ and 36% YoY).

CASA ratio stood at 28.7% vs 28% QoQ.

Fall in cost of funds (down 26bp QoQ), higher funding of loans via CASA

(43%), largely stable yield on funds (down 5bp QoQ) and benefit of capital

infusion led to margin improvement of 20bp+ QoQ.

Traction in fee income remains impressive (up 32% YoY and 11% QoQ to

~INR3.3b)

Valuation and view:

With ~50% of deposits wholesale in nature, and high

proportion of fixed rate loans on the balancesheet, IIB is most leveraged to

systemic interest rates and liquidity. This coupled with recent capital infusion

would boost NIM. Improving liability franchise, structural improvement in RoA

and 20%+ asset growth should help IIB to post one of the highest PAT CAGR

(~29%) among the banks under our coverage. Maintain

Buy.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com) + 91 22 3982 5415

Sohail Halai

(Sohail.Halai@MotilalOswal.com) + 91 22 3982 5430

Investors are advised to refer through disclosures made at the end of the Research Report.

1