12 March 2012

Update

Maruti Suzuki

CMP: INR

TP: INR1,690

Buy

Entering upgrade cycle; Blue-sky EPS of INR122 in

FY13; Potential ~50% return in 12 months; Buy

After 2 years of earnings downgrades, we believe Maruti Suzuki is entering

an upgrade cycle.

We estimate FY13 bull-case EPS of INR122 based on 5% JPY/INR appreciation

from current estimate of 0.62 (to 0.59), monthly run-rate of 121,000

units/month (i.e 28.5% volume growth in FY13 over FY12s low-base) and

normalization of discounts.

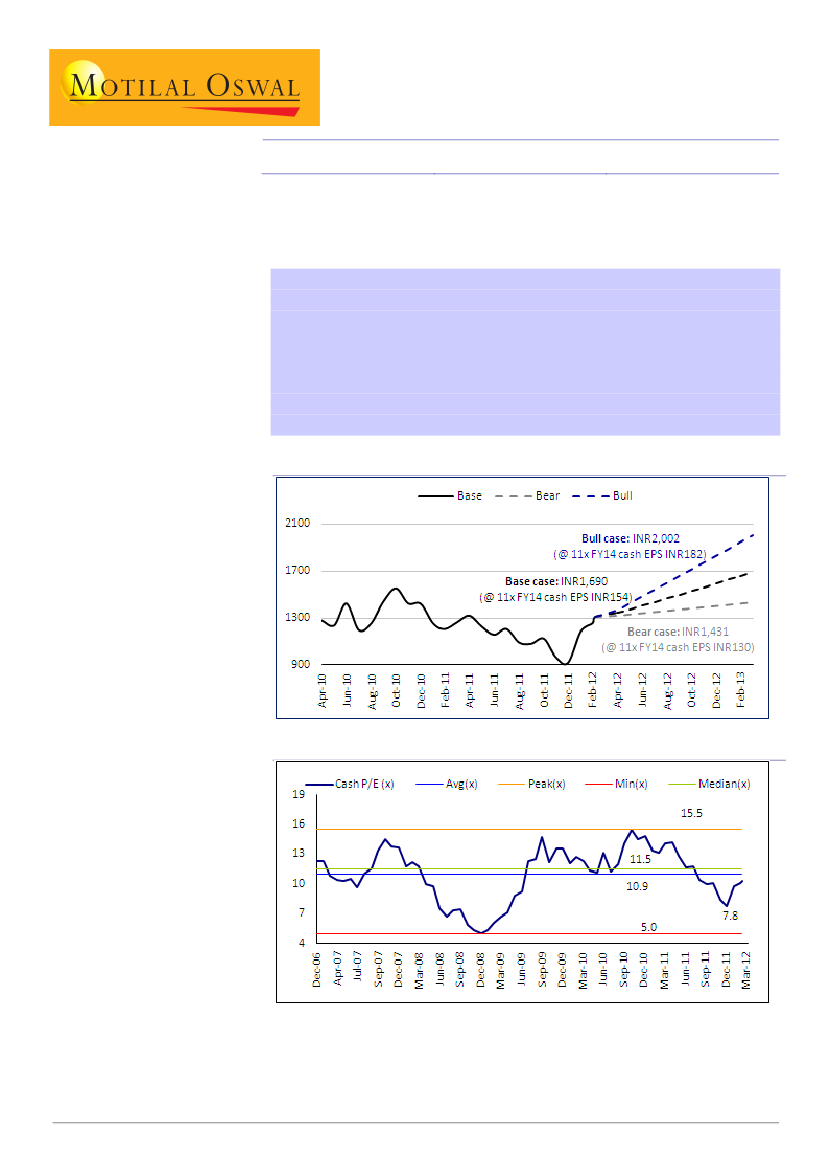

Our base-case 12-month target price is INR1,690, 29% upside. We estimate

blue-sky 12-month target price is INR2,002 (11x FY14 cash EPS), 53% upside.

MSIL offers ~29% return in base case and ~53% return in bull case

MSIL trades near historical average cash PE of ~11x

1