30 January 2013

3QFY13 Results Update |

Sector: Retail

Shopper's Stop

BSE Sensex

19,991

Bloomberg

Equity Shares (m)

M.Cap. (INRb)/(USD b)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

S&P CNX

6,050

SHOP IN

82.2

34.9/0.6

494/283

-11/3/32

CMP: INR425

TP: INR400

Neutral

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

Adj. PAT

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

2013E 2014E 2015E

22.5

1.2

0.4

4.4

-43.5

82.5

5.4

6.8

15.0

96.2

5.1

30.6

0.2

26.8

1.7

0.7

8.1

84.4

89.2

9.1

10.6

15.0

52.1

4.8

20.9

0.3

31.2

2.2

1.0

11.6

42.8

98.8

11.8

13.5

15.0

36.5

4.3

16.1

0.4

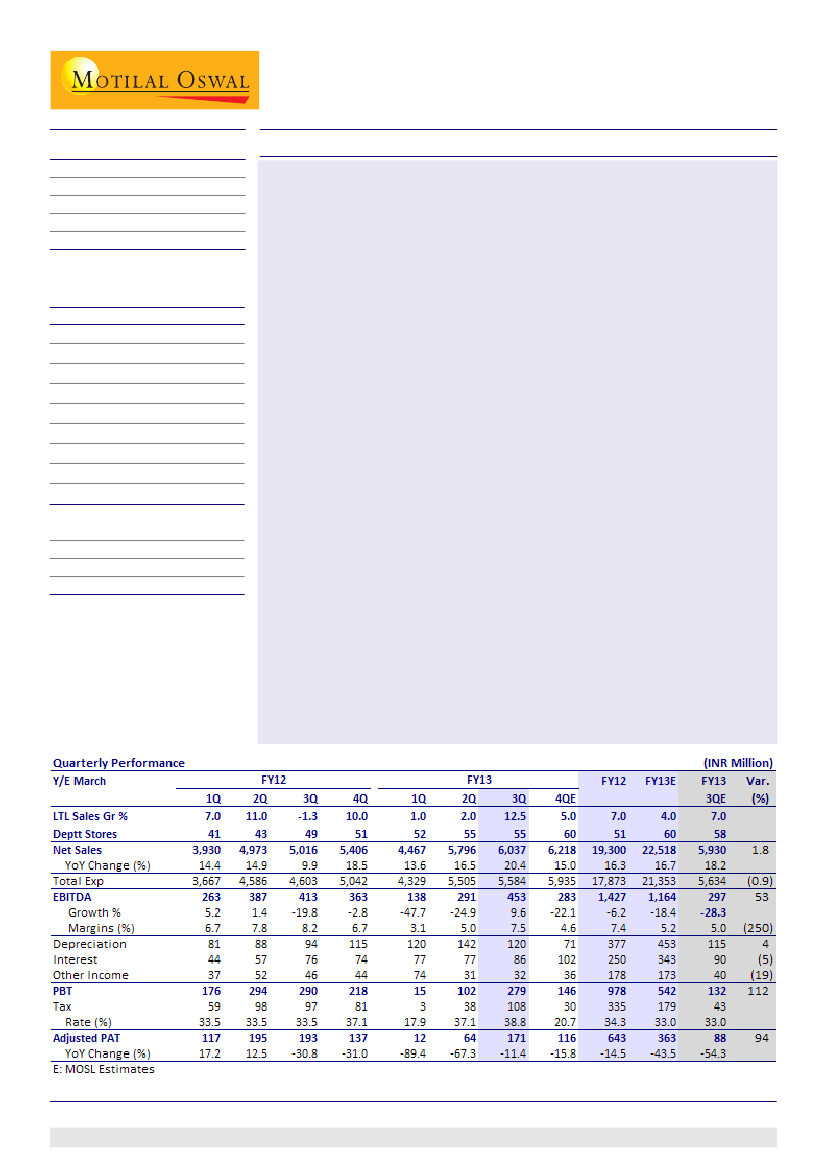

Standalone results for 3QFY13 better than expected

Standalone sales grew 20% to INR6b v/s our estimate of INR5.9b. Like-to-like

(LTL) sales grew 12.5%, aided by strong festive and wedding season sales. LTL

volumes grew 4%, the highest in eight quarters. For stores < 5 years old, LTL

sales grew 25%.

Gross margin expanded 40bp to 37.5%. However, increase in administrative

expenses (up 60bp) and employee expenses (up 60bp) led to operating margin

contraction of 70bp to 7.5%. EBITDA grew 10% to INR453m v/s our estimate of

INR297m. Sharp spike in capital costs (interest cost up 14%; depreciation up

28%) led to 4% decline in PBT. Tax rate increased 530bp, leading to 11% decline

in standalone PAT to INR171m (v/s our estimate of INR88m).

In 3QFY13, SHOP added 1

Shoppers Stop store

at Bangalore and opened 1

Crossword store, 3 M.A.C.,

1

Clinique store.

Total retail space stood at 4.8msf.

HyperCITY Retail: LTL growth improves to 3%; 3QFY13 loss at INR236m

HyperCITY Retail (51% stake) reported sales of INR2b (v/s INR1.87b in 2QFY13).

LTL sales growth improved to 3% (-2% in 2QFY13) but LTL volumes fell 14%.

Gross margin rose 150bp YoY to 19.3%. Store-level EBITDA was up 2.6x QoQ at

INR20m. Despite overall EBITDA loss of INR72m, LTL EBITDA improved to

INR41.6m (INR38.3m in 3QFY12). Net loss was INR236m (INR209m in 2QFY13).

Revising estimates upwards; maintain Neutral

SHOP reported consolidated PAT of INR43m for 3QFY13 v/s loss of INR56m in

2QFY13. Strong festive season coupled with improvement in consumer

sentiment helped SHOP to achieve its best LTL growth in 8 quarters.

We revise our FY13/14 estimates to incorporate the better than expected

3QFY13 results. The revision is sharp for FY13. We expect margin recovery in

FY14, driven by high single-digit LTL (7-8%) sales growth.

SHOP trades at 52x FY14E EPS. Maintain

Neutral,

with a TP of INR400 (SOTP:

Shoppers Stop at 20x FY15E EPS, HyperCITY at 1x FY15E sales).

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +9122 3982 5404

Sreekanth P V S

(Sreekanth.P@MotilalOswal.com); +9122 3029 5120

Investors are advised to refer through disclosures made at the end of the Research Report.

1