31 January 2013

3QFY13 Results Update |

Sector: Consumer

Dabur India

BSE Sensex

S&P CNX

20,005

6,056

Bloomberg

DABUR IN

Equity Shares (m)

1,740.7

M.Cap. (INR b)/(USD b) 226.3/4.2

52-Week Range (Rs)

140/92

1,6,12 Rel. Perf. (%)

-2/-9/21

CMP: INR130

TP: INR156

upgrade to Buy

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

Adj. PAT

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

29.8

10.3

22.4

1.4

23.8

8.5

18.3

1.8

20.0

7.0

15.3

2.1

2013E 2014E 2015E

61.6

10.1

7.6

4.4

16.7

12.6

34.7

38.5

40.3

72.0

12.2

9.5

5.5

25.2

15.3

35.7

40.9

42.7

84.0

14.3

11.3

6.5

19.1

18.6

35.1

40.9

42.7

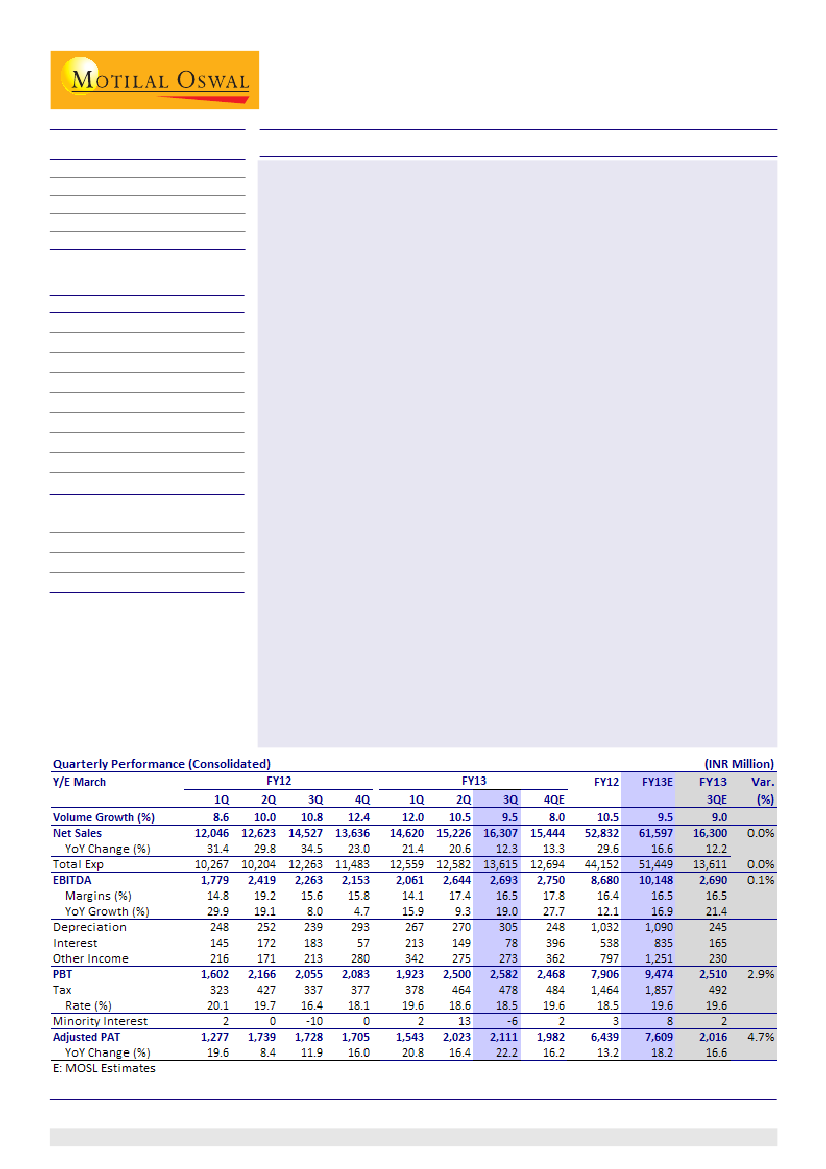

Dabur's 3QFY13 results were largely in line with our estimates. Consol net

sales grew at 12.3% YoY to INR16.34b (est INR16.3b), EBITDA grew 19% YoY to

INR2.69b (est INR2.69b), while Adj. PAT was higher than est at INR2.1b (est

INR2.01b) due to higher-than-estimated other income and lower tax rate.

Gross margin expanded 220bp to 51.2% due to softening in key input costs.

EBITDA margin expanded 90bp to 16.5% as ad expenses increased 80bp.

Domestic sales grew 13.6% to INR11.9b, with underlying volume growth at

9.5%. Gross margin remained flat at 46.2%, while EBITDA margin contracted

50bp to 16.5% due to 60bp increase in ad spend. Steep increase in tax rate

(450bp) to 20.4% curtailed Adj PAT growth at 7.5% to INR1.5b.

International business grew 9%, while organic business grew 22.4% (constant

currency growth at 16%). Reported growth is lower at 9% as Namaste business

was impacted by restructuring in Africa and re-branding in the US. Correction

in input costs led to significant gross margin expansion in international

business (gross margin up 860bp YoY in consolidated-standalone entity).

Dabur's consistent volume growth is a reflection of its investments behind

brands and distribution. Recovery in shampoo, oral care and hair care is a key

positive, while deterioration in international business though disappointing,

was a one-off. We expect Dabur to get tailwind benefits from its recent

distribution expansion initiatives and estimate PAT CAGR of 22% for FY12-

15E, one of the best in our staples universe.

Dabur trades at 23.8x FY14E and 20x FY15E EPS and has underperformed the

BSE FMCG index by 35% in the past 24 months. We expect the valuation gap

to narrow as a) volume growth sustains in 8-10% band driven by recovery in

core categories and b) margins improve led by international business division.

We value the stock at 24x PE (earlier 23x), roll over to FY15E and arrive at a

revised target price of INR156. Upgrade to

Buy

with a potential 20% upside.

Slowdown in rural FMCG growth and spike in input costs are key concerns.

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +9122 3982 5404

Sreekanth P.V.S.

(Sreekanth.P@MotilalOswal.com); +9122 3029 5120

Investors are advised to refer through disclosures made at the end of the Research Report.