7 February 2013

3QFY13 Results Update |

Sector: Healthcare

Cipla

BSE Sensex

19,640

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

S&P CNX

5,959

CIPLA IN

802.9

325.2/6.1

435/287

-4/4/4

CMP: INR405

TP: INR452

Neutral

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

Net Profit

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

2013E 2014E 2015E

83.0

22.0

13.5

16.8

20.2

110.5

15.2

22.6

20.0

24.0

3.7

14.8

0.8

89.7

22.4

15.8

19.7

16.8

125.2

15.7

20.7

25.0

20.6

3.2

14.5

1.0

102.6

25.6

18.2

22.6

14.9

142.2

15.9

21.4

25.0

17.9

2.8

12.7

1.2

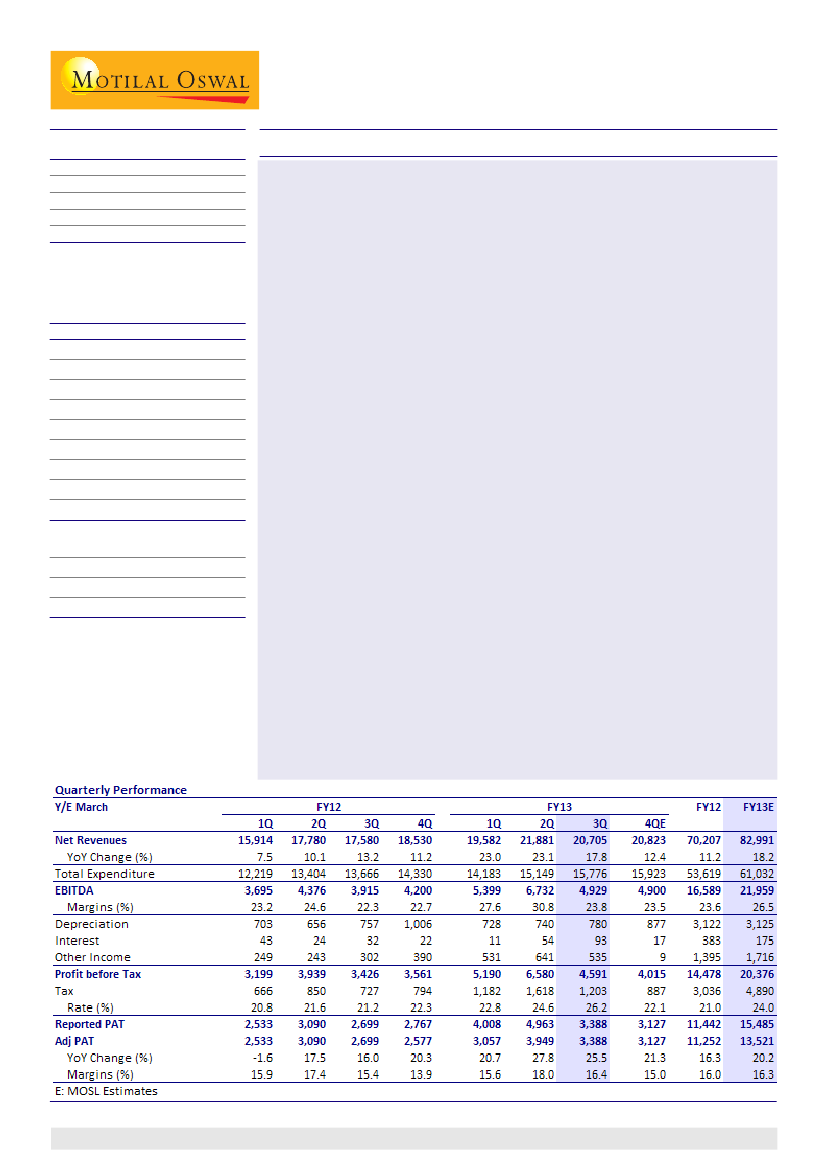

Revenues grew 18% YoY to INR20.71b (v/s est INR20.17b), EBITDA grew 26%

YoY to INR4.93b (v/s est INR4.71b) and PAT was up 26% to INR3.39b (v/s est

INR3.25b). Top line growth was primarily led by 38% YoY growth in export

formulations, while domestic formulations grew a modest 10% YoY. Export

APIs stood at INR1.38b and declined by 16% YoY on a high base.

We are positively surprised by the strong growth in export formulations,

driven by Lexapro supplies (now part of the base business) and strong growth

witnessed across key therapeutic areas. Also, there was a 6-7% benefit from

currency; however, management indicated that this high growth is not

sustainable, going forward. The muted domestic formulations growth of 10%

is below our expectation of 15%.

EBITDA margin increased 150bp YoY and stood at 23.8% (v/s our est of 23.3%).

Margin improvement was driven by favorable product mix, with higher

contribution from anti-depressants segment (includes generic Lexapro

supplies, now part of base business) and anti-allergics (includes Dymista,

currently a small contributor).

PAT growth was aided by strong top line growth coupled with healthy

operational performance. There was a forex gain of INR190m for the quarter.

While export formulations grew 38% YoY in 3QFY13, Cipla's core quarterly

performance has not been encouraging in the past many quarters. Its muted

export performance had raised uncertainty on the timelines of ramp-up at Indore

SEZ. We believe it is imperative for the company to improve asset utilization at

Indore to drive future growth and derive benefits of operating leverage

(overhead expenses continue to adversely impact performance). Post 3QFY13

performance, our core EPS est for FY13E has witnessed an upgrade of 2%, while

FY14E/15E est are largely unchanged. Our revised est take into account better-

than-expected performance in export formulations during this quarter, partially

offset by the muted growth in domestic formulations. The stock trades at 20.6x

FY14E and 17.9x FY15E EPS. Maintain

Neutral

with a TP of INR452 (20x FY15E EPS).

Hardick Bora

(Hardick.Bora@MotilalOswal.com)

Investors are advised to refer through disclosures made at the end of the Research Report.

1