WEEK IN A NUTSHELL

WIN-dow to the week that was

Week in a Nutshell (WIN)

Week

ended

th

8 Feb 2013

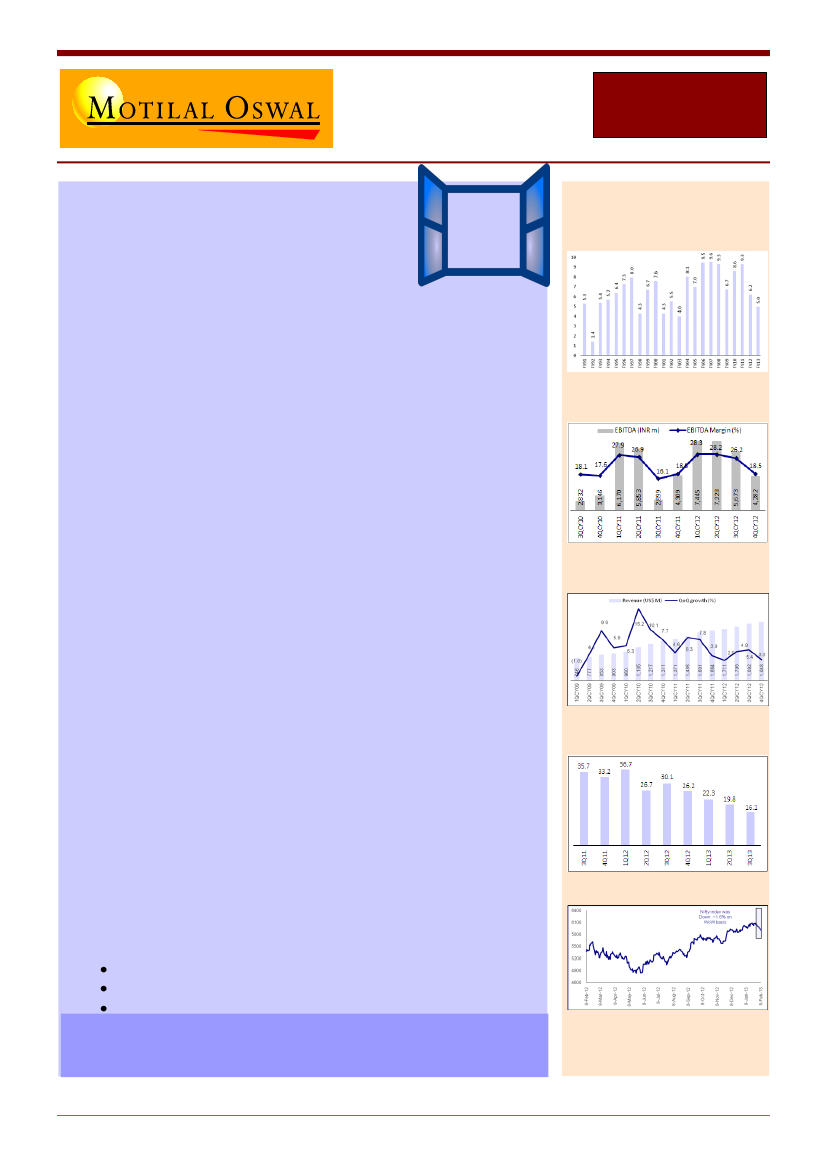

Key WIN-dicators

GDP growth is the lowest in a

decade

Another one came and went. One of the largest offerings in recent times

was lapped up in bigger proportions than expected. Subscription of 1.7x

for NTPC. The GoI has done a fantastic job in managing the last two

issuances – Oil India and NTPC. HOOK of extensive meetings, LINE of

reform announcements and SINKER of cheap valuations. All said and

done, finally kudos to the government.

Indian markets have seen issuance of a staggering USD 4.5 Bn this Calendar

Year. FII Inflows of USD 6 Bn and DII Outflows of USD 4.2 Bn. Will the retail

investor ever come back!

RBI released its final recommendation on gold import in India. The focus

was clearly on curbing gold import for non economic purpose.

The

possibility of linking import of metal to base rate can severely impact

working capital and margins for the jewellery companies in India. Gold

lending NBFCs’ existence was not questioned while the need for controls

and slowdown in growth was focussed on.

Coal Price Pooling

approval means Coal India is now liable to supply 68% of

total coal requirement for the identified projects below which they would

have to cough up penalties. This ensures safety net for the debt holders

while returns for equity holders is still a question mark

BHARTI

continued to disappoint with India business lagging Idea and Africa

profitability continuing to struggle. The only silver lightning was the net

debt declining from INR668b to INR643b

URBAN CONSUMPTION

continued to show signs of slow down with

Jubilant’s SSSG at a 14 quarter low and margin contraction of 120 bps YoY.

SPECIALITY restaurants faced the same issue with Q3 topline growth at 14%

and EBITDA de-growth.

HOLCIM major companies

reported the worst among the peer set with

both profitability and volume growth impacted. The possibility of increase

in royalty post 2014 can impact the long term multiples for the companies

Some of the highlights of this edition:

Coal Price Pooling:

Financials & Utilities impact

Financial Technologies:

Initiating Coverage

Result Notes

Ambuja Cement: Trend in

profitability

Cognizant: Revenue beat

guidance

Jubilant: SSS growth dips to 16.1%

(lowest in 14 quarters)

Nifty (-1.6%)

WWW – WIN Weekend Wisdom

In the stock market, luck never gives, it only lends

WIN – Week In a Nutshell

1

8

th

Feb

2013