11 February 2013

3QFY13 Results Update | Sector: Financials

Canara Bank

BSE Sensex

S&P CNX

19,485

5,904

Bloomberg

CBK IN

Equity Shares (m)

443.0

M. Cap. (INR b)/(USD b)

198/3.7

52-Week Range (INR)

566/306

1,6,12 Rel.Perf.(%)

-12/17/-25

CMP: INR446

TP: INR600

Buy

Financials & Valuation (INR b)

Y/E March

2013E 2014E 2015E

98.0

70.9

35.7

2.4

80.7

23.1

585.9

475.2

14.6

0.8

17.4

5.5

0.8

0.9

2.7

115.0

83.2

42.0

2.4

94.7

17.4

664.7

535.6

15.1

0.8

17.4

4.7

0.7

0.8

3.2

NII

79.1

OP

57.0

NP

29.0

NIM (%)

2.2

EPS (INR)

65.5

EPS Gr. (%)

-11.6

BV/Sh. (INR) 518.6

ABV/Sh. (INR) 431.2

ROE (%)

13.3

ROA (%)

0.7

Payout (%)

17.4

Valuations

P/E(X)

6.8

P/BV (X)

0.9

P/ABV (X)

1.0

Div. Yield (%)

2.2

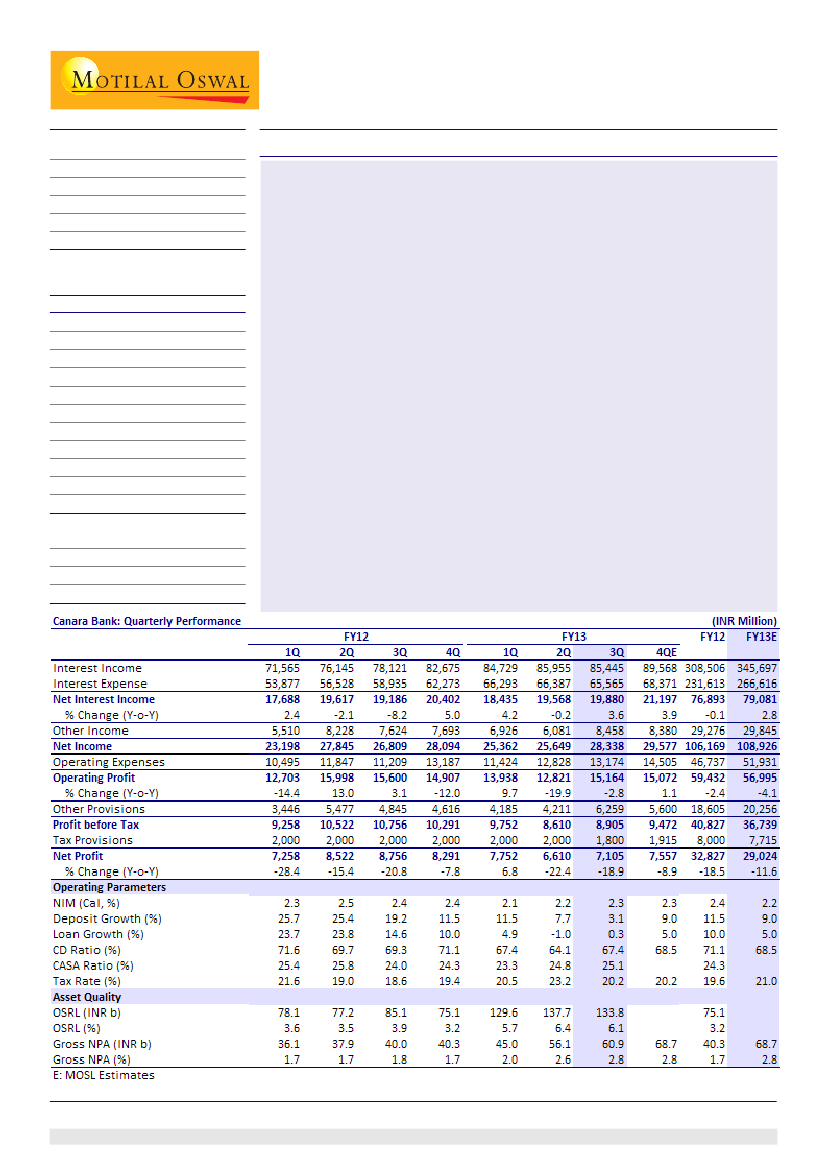

Canara Bank's 3QFY13 PAT of ~INR7.1b (-19% YoY and +7% QoQ) was 6% above our

estimate of INR6.7b. Higher non-interest income (27% above estimate)

compensated for higher than expected provisions and tax rate. NII was 3% below

estimate (+4% YoY and +2% QoQ to INR19.9b) led by lower-than-expected loan

growth (flat both QoQ and YoY). NIMs calculated improved 4bp QoQ to 2.27% (in-

line est).

Key highlights:

Net slippages remained high at INR11b v/s INR12.8b in 2QFY13. GNPAs/NNPAs

grew 9%/12% QoQ and PCR, including write-offs stood at 61%.

CBK restructured loan of INR8.7b during the quarter. However, repayment of

INR12.5b, took cumulative restructured loans (facility-wise) to INR145b v/s

INR149b a quarter ago. OSRL stood at INR134b (6.1% of loans facility-wise).

Non core income (forex + trading + recoveries + MTM on investment) stood

at INR4.2b (v/s INR3.3b) in 3QFY13 and INR9.3b (v/s INR8b) in 9MFY13.

CASA deposits grew 8% YoY (down 3% QoQ) led by 8% YoY growth in SA

deposits (down 3% QoQ). CASA ratio improved marginally to 25%.

Valuation and view:

CBK has aggressively built up investment portfolio, leading

to higher share of trading (including AFS gains) in the profitability. With expected

revival of growth from FY14 onwards, asset reallocation will be positive for

margins, further, benefit on cost of funds (due to fall in above card rate deposits)

will aid margin improvement in FY14. RoA and RoE will be healthy at 0.8%/16%

over FY14-15E. Maintain

Buy.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com) + 91 22 3982 5415

Sohail Halai

(Sohail.Halai@motilaloswal.com)+ 91 22 3982 5430

Investors are advised to refer through disclosures made at the end of the Research Report.

1