14 June 2012

Update

Raymond

CMP: INR385

TP: INR462

Buy

Restructuring initiatives bearing fruit; Land bank base

case value INR147/share; Reiterate Buy

We met the management of Raymond (RW IN, Mkt Cap USD0.4b, CMP INR385,

Buy). Key takeaways:

Restructuring initiatives are bearing fruit with FY12 RoE climbing to ~11%

from negative to low single digits earlier.

There is tremendous scope to increase efficiencies and rationalize costs,

including lower working capital, higher focus on key brands, etc.

Expect FY13 performance to be muted with PAT down 10% to INR1.3b.

We estimate the value of its 125 acres land at Thane plant at INR147/share

(based on INR120m/acre sold monetized within 2 years, discounted @ 14%)

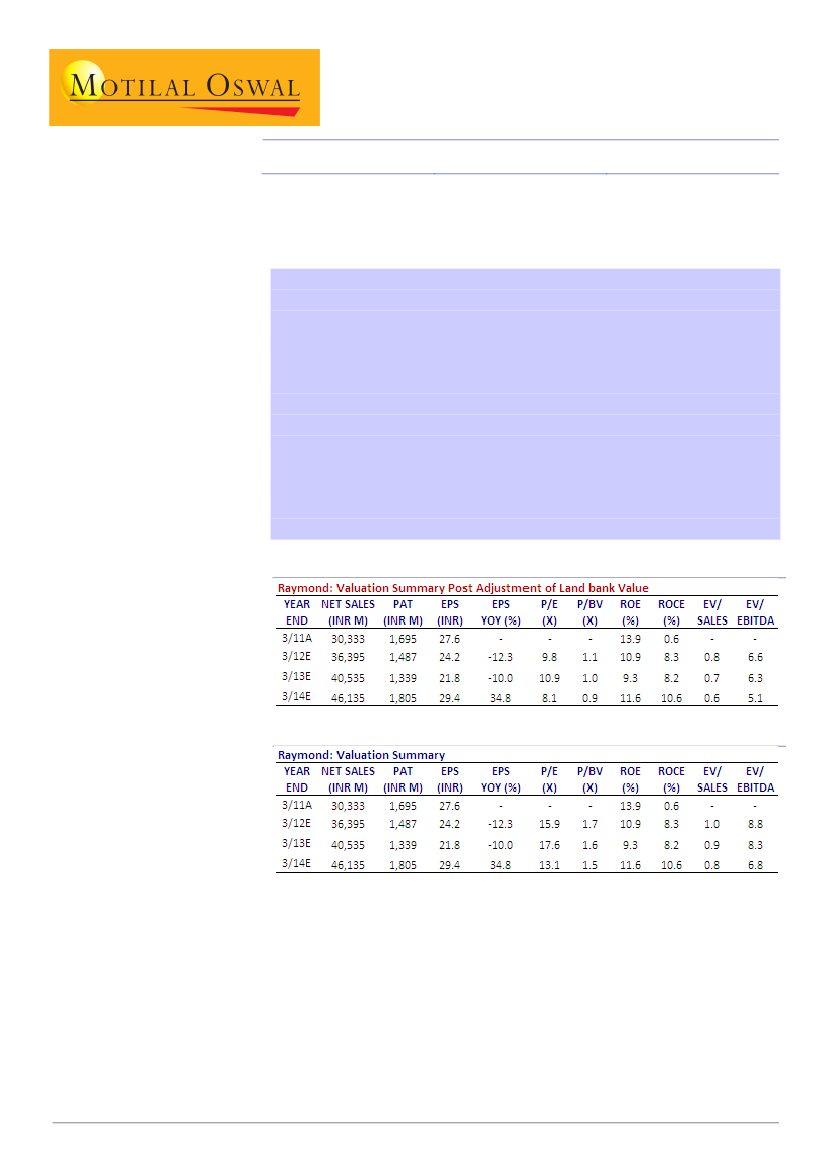

Adjusting for real estate value, Raymond trades at FY14E P/E of 8x and EV/

EBITDA of 5x.

We reiterate Buy with a target price of INR462 (21% upside), based on

intrinsic EV/EBITDA of 6x FY14E and land bank value of INR147/ share.

Restructuring initiatives bearing fruit

Over FY10-12, the restructuring initiatives undertaken by the management has

started showing some encouraging results:

RoE in FY12 has climbed up to ~11%

Legacy issues at Thane have been successfully resolved resulting in labor cost

declining from ~17% of sales in FY10 to ~13.1% in FY12

Rationalization and renewed focus on its branded retail franchisee business.

Raymond added 269 new stores (net) over FY10-12, taking its retail store

count to 853 in FY12 from 584 stores in FY09. The management has a target

1