26 February 2013

6QFY12 Results Update |

Sector: Retail

Pantaloon Retail

BSE Sensex

19,332

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

S&P CNX

5,855

PF IN

217.1

43.0/0.8

239/125

4/16/7

CMP: INR208

TP: INR199

Neutral

Financials & Valuation (INR b)

Y/E June

Sales

EBITDA

Adj. PAT

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

25.5

1.5

7.6

0.4

23.8

1.5

8.3

0.4

43.5

1.5

8.1

0.6

2010

89.3

8.2

1.7

8.2

25.8

136.1

6.0

14.2

9.8

2011 2012E*

110.1

9.6

1.9

8.7

7.1

140.1

6.2

12.1

10.3

122.5

11.0

1.1

4.8

-45.2

139.5

3.4

12.0

25.0

* 18 months; Y/E December

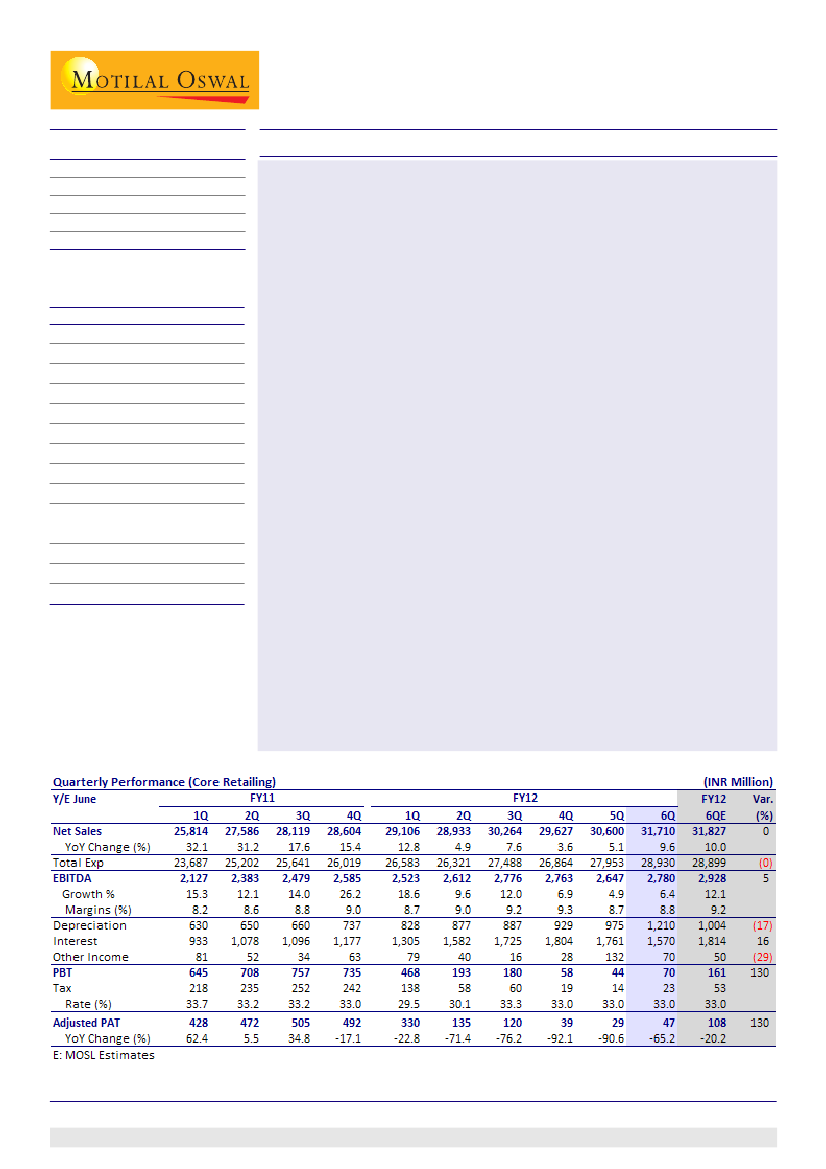

Pantaloon Retail's (PF) 6QFY12 results are below estimates, with continued

miss on profit expectations. Core retail PAT was down 63% YoY to INR70m

(est INR161m). Net sales grew 10% to INR31.7b (est INR31.8b), while EBITDA

margin was at 8.8% (est 9.2%), as EBITDA grew 6.4% to INR2.78b (est INR2.92b).

Same store performance improved, as expected, led by festive season sales.

Same store sales (SSS) growth was 12.7% for Lifestyle division, 5.1% for Value

and -3.4% for Home division.

Gross space addition during the quarter stood at ~0.41msf; for the 18 months

ended Dec-12, PF ended with 16.38msf of retail space, an addition of 2.93msf.

Core retail EBITDA increased 6.4% to INR2.78b, while margin declined 20bp

YoY at 8.8%. Flat interest costs and 38% increase in depreciation expenses

led to 63% YoY decline in PBT at INR70m.

Core retail debt as on Dec 31, 2012 stood at INR54b. Management has

undertaken several rounds of restructuring, including sale of Pantaloon

format business to ABNL and de-merger of fashion business of Pantaloon.

Once these transactions are complete, debt will further reduce by INR28.2b,

according to management. Core retail debt after including a) OFCD of INR8b

(to ABNL) and b) CCD of INR6.8b for Future Value Retail (financial institutions)

will stand at INR41b.

Full year consolidated results published by PF include contribution of Future

Capital till Sep-12. Consolidated balance sheet is largely core retail business.

Approvals for the above mentioned transactions are expected in March

quarter. Post the same, standalone entity will include the current value retail

business (Food Bazaar and Big Bazaar), while the consolidated entity will

reflect other support businesses - Ecommerce, Logistics etc.

We await clarity on the verticals' financials, post the recent business

restructuring initiatives, before revisiting our investment views. Maintain

Neutral.

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +9122 3982 5404

Sreekanth P V S

(Sreekanth.P@MotilalOswal.com); +9122 3029 5120

Investors are advised to refer through disclosures made at the end of the Research Report.

1