17 April 2013

4QFY13 Results Update | Sector: Oil & Gas

Reliance Industries

BSE Sensex

S&P CNX

18,745

5,689

Bloomberg

RIL IN

Equity Shares (m)

3,228.0

M. Cap. (INR b)/(USD b) 2,598/47.7

52-Week Range (INR)

955/674

1, 6, 12 Rel. Perf. (%)

-1/-1/-2

CMP: INR805

TP: INR867

Neutral

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

Adj. PAT

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

12.4

1.3

8.6

1.1

11.9

1.2

8.7

1.2

11.2

1.1

8.1

1.2

2013E 2014E 2015E

3,603

308

210

71.9

4.8

619

12.3

11.7

16.1

3,653

302

218

74.2

3.9

682

11.7

11.3

16.4

3,608

323

232

78.7

6.3

747

11.3

11.2

16.2

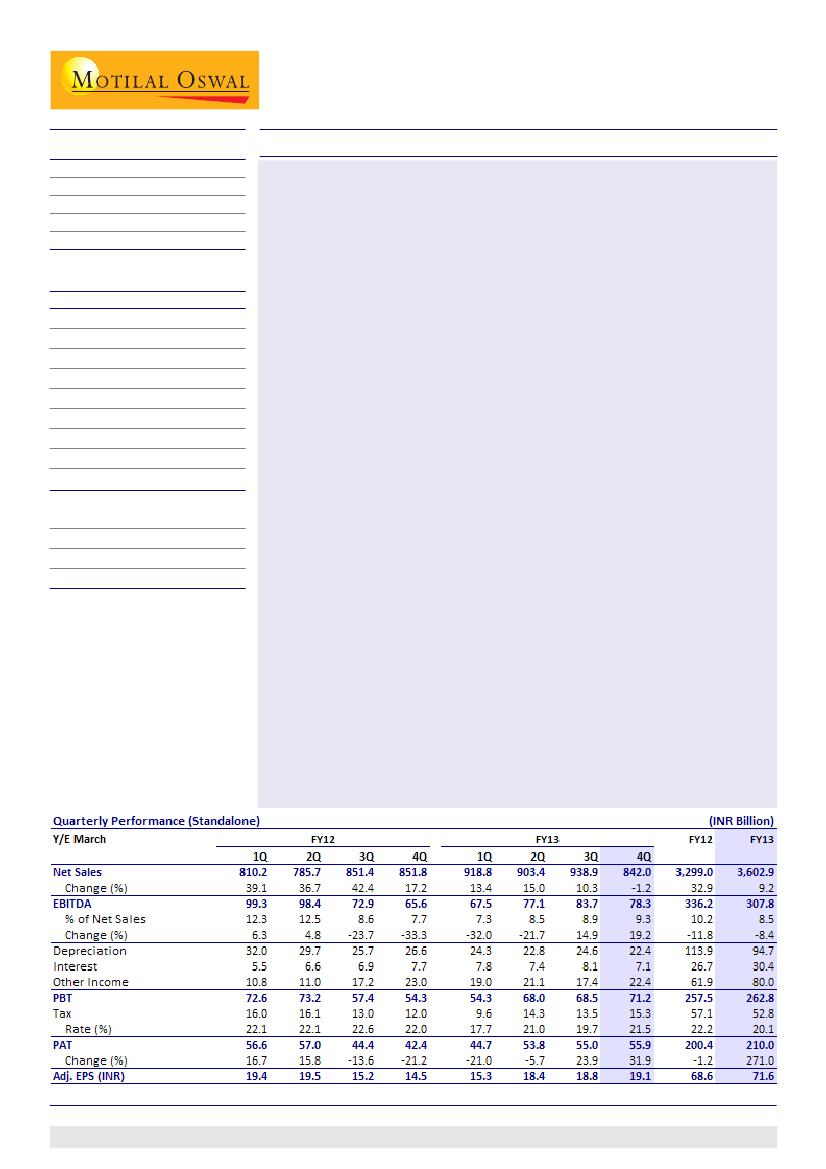

Reliance Industries' (RIL) EBIT for 4QFY13 was INR59.2b (+23% YoY, -5% QoQ),

lower than our estimate of INR65.8b, primarily due to lower than expected

petchem EBIT. However, PAT was in-line at INR55.9b (+32% YoY, +2% QoQ; our

estimate was INR55b), led by lower depreciation at INR22.4b (v/s our estimate

of INR23.4b) and higher other income at INR22.4b (v/s our estimate of INR18.8b).

Refining - GRM in-line; EBIT impacted by higher opex/lower throughput:

GRM was USD10.1/bbl (+33% YoY, +5% QoQ; v/s estimate of USD10/bbl).

Refining EBIT at INR35.2b (v/s estimate of INR37.7b) was impacted by 8%

QoQ decline in throughput to 16.1mmt, led by CDU maintenance shutdown

and higher opex.

Petchem - Below estimates led by lower volumes:

Petchem EBIT was INR19b,

down 13% YoY and 2% QoQ, despite higher QoQ individual product spreads.

EBIT margin was 8.6% against 8.8% in 3QFY13. The management indicated

that lower petchem EBIT is due to lower volumes. We believe it could also be

due to adverse sales mix.

E&P - meaningful upside 3-4 years away:

KG-D6 production averaged

19.2mmscmd (v/s 24mmscmd in 3QFY13) and production is expected to

stabilize post the workover well drilling / booster compressors, expected in

early FY15. RIL, along with BP has proposed development of additional 4tcf of

gas with an investment of USD5b. If government approvals are received on

time, these new development projects (R-series, satellite fields, etc) will

start production in 3-4 years. Further, NEC- 25 production start is now expected

in mid-2019.

Valuation and view:

In FY14/FY15, we model (a) GRM at USD9/bbl, (b) KG-D6 gas

price at USD4.2/7/mmbtu, and (c) KG-D6 gas volumes at 13/15mmscmd. While

turnaround in the Retail business (EBITDA of INR780m in FY13 v/s loss of INR3.4b

in FY12) is positive, any meaningful earnings addition is expected only in FY16/

17, when its large projects (pet coke gasification/off-gas cracker) commission.

Core business outlook (90% of earnings) remains subdued and we expect RoE to

hover at ~12%. The stock trades at 11.2x FY15E adjusted EPS and at an EV of 8.1x

FY15E EBITDA. Our SOTP-based target price is INR867. Maintain

Neutral.

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Kunal Gupta

(Kunal.Gupta@MotilalOswal.com); +91 22 3982 5445

Investors are advised to refer through disclosures made at the end of the Research Report.