23 April 2013

4QFY13 Results Update |

Sector: Real Estate

Mahindra Lifespaces

BSE Sensex

S&P CNX

19,170

5,834

Bloomberg

MLIFE IN

Equity Shares (m)

40.8

M.Cap. (INR b)/(USD b) 15.4/0.3

52-Week Range (INR)

452/284

1,6,12 Rel. Perf. (%)

-2/-9/6

CMP: INR378

TP: INR480

Buy

Financials & Valuation (INR b)

Y/E March

Net Sales

EBITDA

Adj PAT

Adj EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

10.9

1.2

9.8

1.3

10.6

1.1

9.3

1.3

10.2

1.0

8.0

1.3

2013 2014E 2015E

7.4

2.4

1.4

34.6

18.7

317

10.9

11.4

18.4

7.9

2.7

1.5

35.6

2.7

349

10.2

12.3

17.9

9.0

2.9

1.5

37.2

4.5

385

9.7

12.3

16.6

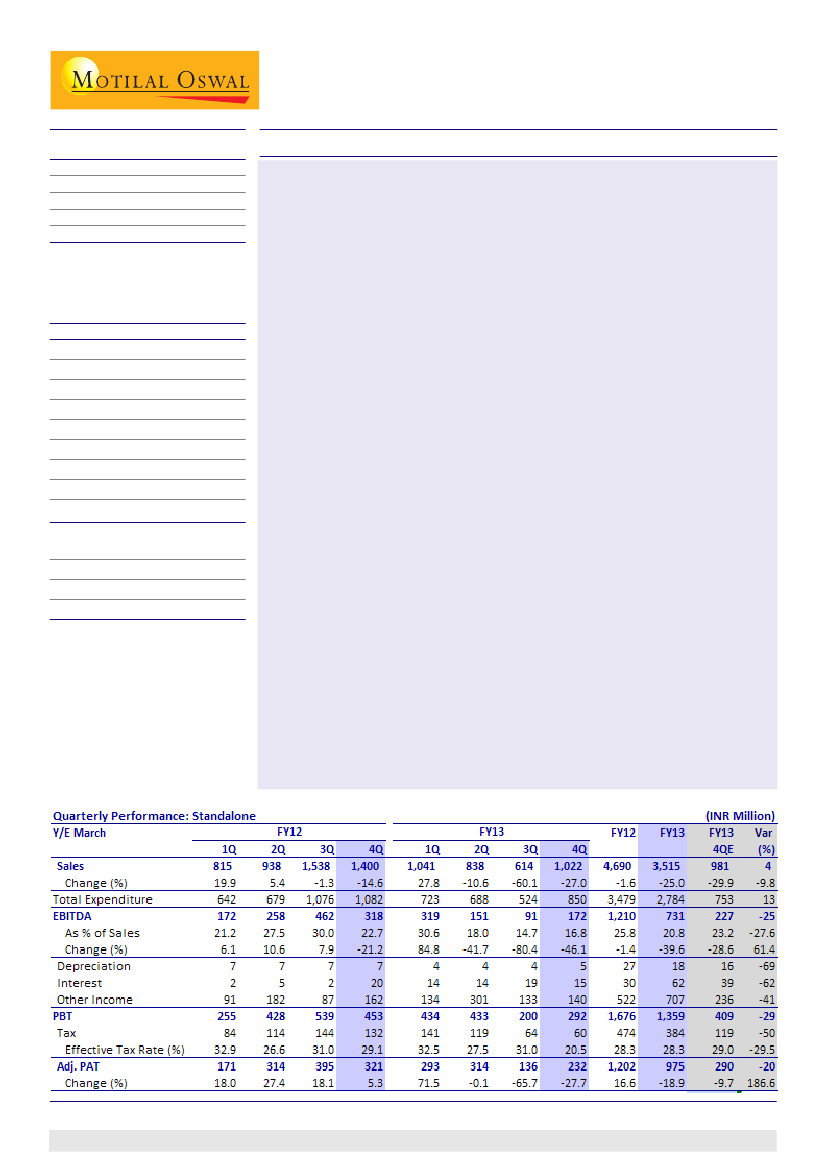

Mahindra Lifespaces (MLIFE) reported 4QFY13 standalone results below our

estimate, while consolidated numbers surprised positively.

MLIFE's standalone revenue for 4QFY13 stood at INR1b (-27% YoY, v/s est. of

INR981m), while EBITDA declined 46% YoY to INR172m (est. of INR227m).

EBITDA margin improved 2.1pp QoQ to 16.8%, but fell below our estimate

due to weaker progress in Splendor II . PAT declined 28% YoY to INR232m (est.

of INR290m), further impacted by lower other income, but offset by lower

effective tax rate as well.

4QFY13 consolidated revenue stood at INR3.3b, +25% YoY, while PAT (pre

minority) was at INR925m, +166% YoY. FY13 consolidated revenue stood at

INR7.4b (+5% YoY, v/s est. of INR6.1b), EBITDA at INR2.4b (+26% YoY, v/s est. of

INR1.5b) and PAT at INR1.4b (+19% YoY, v/s est of INR929m).

Sharp increase in consolidated revenue in 4QFY13 is attributable to (1)

multiple projects crossing 25% threshold: (a) three phases of Bloomdale

(Nagpur), (b) Iris 2/3 (Chennai) and (c) Ashvita (Hyderabad, in standalone

entity), and (2) uptick in new leasing at MWC Jaipur: leased out 73 acres

(~INR1b) in 4QFY13, of a total 75 acres in FY13.

MLIFE sold 0.38msf (INR1.5b) in 4QFY13, a stable run-rate against (0.39msf)

INR1.5b in 3QFY13 and 0.2msf (INR0.5b) in 4QFY12. FY13 pre-sales stood at

1.1msf (INR4.4b) v/s our estimate of 1.3msf (INR4.8b) and FY12 sales of 1.2msf

(INR5.9b). 4QFY13 pre-sales were driven by (1) Ashvita (Hyderabad) - 0.21msf

and (2) MWC Chennai projects (Iris and Aqualily) 0.14msf. Incremental pre-

sales have been weak in Aura (Gurgaon) and phase I/II of Bloomdale (Nagpur).

It acquired five projects (~2msf, with guided revenue potential of INR10b) in

FY13, along with one more affordable housing project in Boisar, Mumbai

(0.55msf) in Apr-13. 4QFY13 acquisitions include (1) a premium project in

Andheri (0.37msf) and (2) Bangalore (0.67msf). Consolidated net debt

increased by INR3.2b QoQ to INR7.1b (net DER of 0.55x).

The stock trades at 1x FY15E BV, 10.2x FY15E EPS and 27% discount to our

FY15E SOTP value of INR520/share. Maintain

Buy

with a target price of INR480.

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +9122 3982 5436

Investors are advised to refer through disclosures made at the end of the Research Report.

1