23 April 2013

4QFY13 Results Update | Sector:

Technology

Persistent Systems

BSE Sensex

19,170

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

S&P CNX

5,834

PSYS IN

40.0

21.8/0.4

590/326

3/14/52

CMP: INR545

TP: INR554

Neutral

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

Adj. PAT

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

2013 2014E 2015E

12.9

3.4

1.9

46.9

32.4

262.1

20.2

15.2

19.2

11.6

2.1

5.2

1.7

15.0

3.6

2.2

54.2

15.5

310.9

19.5

16.7

22.2

10.1

1.8

4.5

2.2

17.0

3.9

2.5

61.6

13.7

365.0

18.8

16.4

22.7

8.8

1.5

3.7

2.6

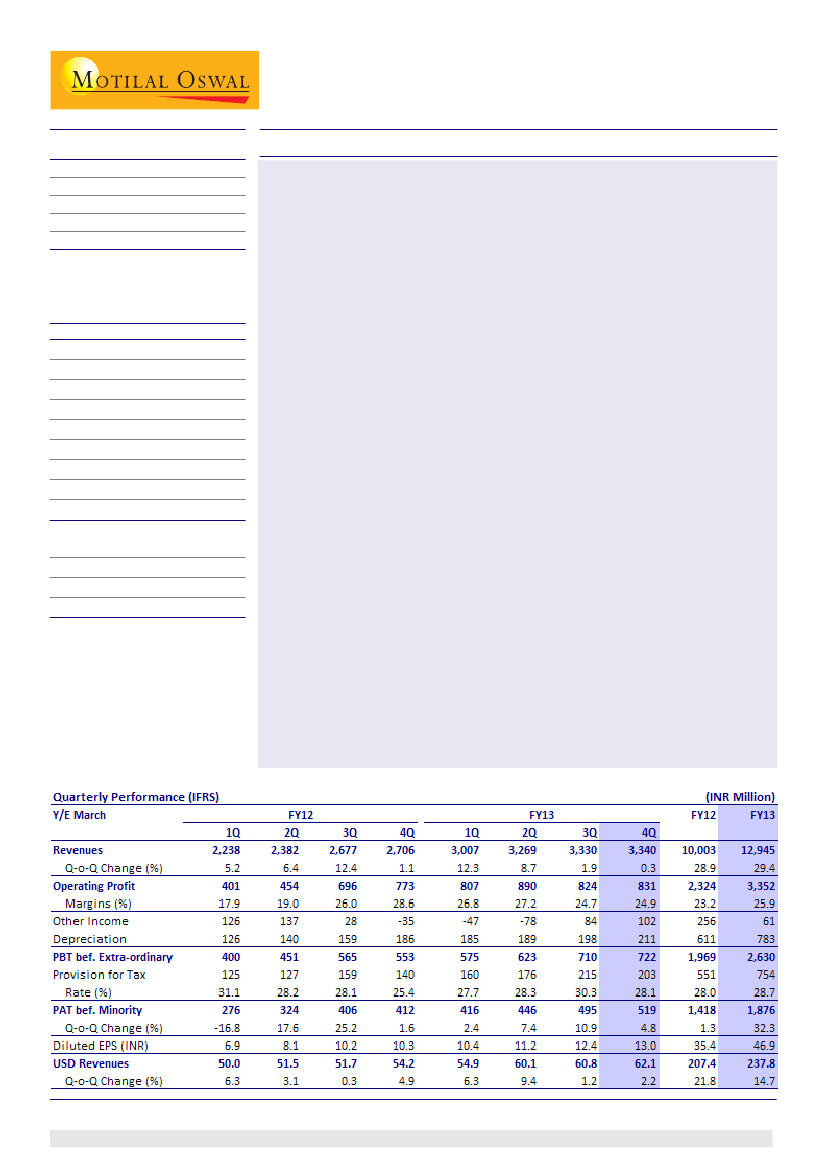

Persistent Systems' (PSYS) 4QFY13 revenue at USD62.1m grew 2.2% QoQ,

below our estimate of USD63.3m (4.1% QoQ growth). EBITDA margin for the

quarter was 24.9%, +20bp QoQ, and marginally above our estimate of 24.5%,

on account of lower SGA and some reversal in bad debt provisioning. PAT

was INR519m, +4.8% QoQ, higher than our estimate of INR477m, driven by a

forex gain of INR41.5m, v/s our estimate of a loss of INR36.5m.

Linear revenue at USD51.2m was in line with our estimate, while the

disappointment was driven by IP-led revenue, which declined 1.7% QoQ to

USD10.9m, v/s our estimate of USD12m (growth of 8.7% QoQ).

Performance in IP-led revenue was even more disappointing considering

the fact that 4Q is a seasonally strong one for the connectors PSYS writes for

its top client, and that inclusion of NovaQuest added ~10% revenue on 3QFY13

base (~USD1.1m of USD1.8m from NovaQuest was IP-led).

While deal sizes have reduced, number of opportunities in the market place

has considerably increased. Commentary on pricing remains positive, with

expectation of continued gradual improvement from a change in business

mix and better rates in new deals.

On the back of lackluster IP-led revenue performance in 4Q and expectation

of revenue uptick from HPCA licensing agreement only in 2HFY14, we have

lowered FY14E revenue estimate by 1.6%. We expect USD revenue growth of

16.7%/15.5% in FY14E/FY15E. Our profitability expectations are largely similar

post results. A lower revenue estimate drives 5.1%/4.1% downward revision

in our EPS estimates for FY14E/FY15E.

PSYS' operations in the fast growing segments like Cloud, Mobility, Big Data

and Analytics keep us sanguine on its growth prospects. However, the

performance in IP-led revenue remains volatile, and on an organic basis,

growth remained tepid in both Linear and IP-driven revenue. Given the weak

growth in organic revenue and continued volatility in IP segment, we value

PSYS at 9x FY15E EPS, implying a target price of INR554. Maintain

Neutral.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Investors are advised to refer through disclosures made at the end of the Research Report.

1