29 April 2013

4QFY13 Results Update | Sector:

Utilities

Jaiprakash Power

BSE Sensex

19,287

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

S&P CNX

5,871

JPVL IN

2,938.0

78/1.4

46/26

4/-36/-46

CMP: INR26

TP: INR40

Buy

Financials & Valuation (INR b)

Y/E March

2013 2014E 2015E

34.4

27.3

6.9

2.3

95.2

24.0

10.2

7.4

11.3

1.1

11.9

74.6

49.2

11.3

3.8

64.6

25.7

15.5

11.3

6.9

1.0

6.8

Sales

24.6

EBITDA

19.3

NP

3.5

EPS (INR)

1.2

EPS Gr. (%)

(12.4)

BV/Sh. (INR)

22.0

RoE (%)

5.9

RoCE (%)

6.3

Valuations

P/E (x)

22.1

P/BV (x)

1.2

EV/EBITDA (x) 14.4

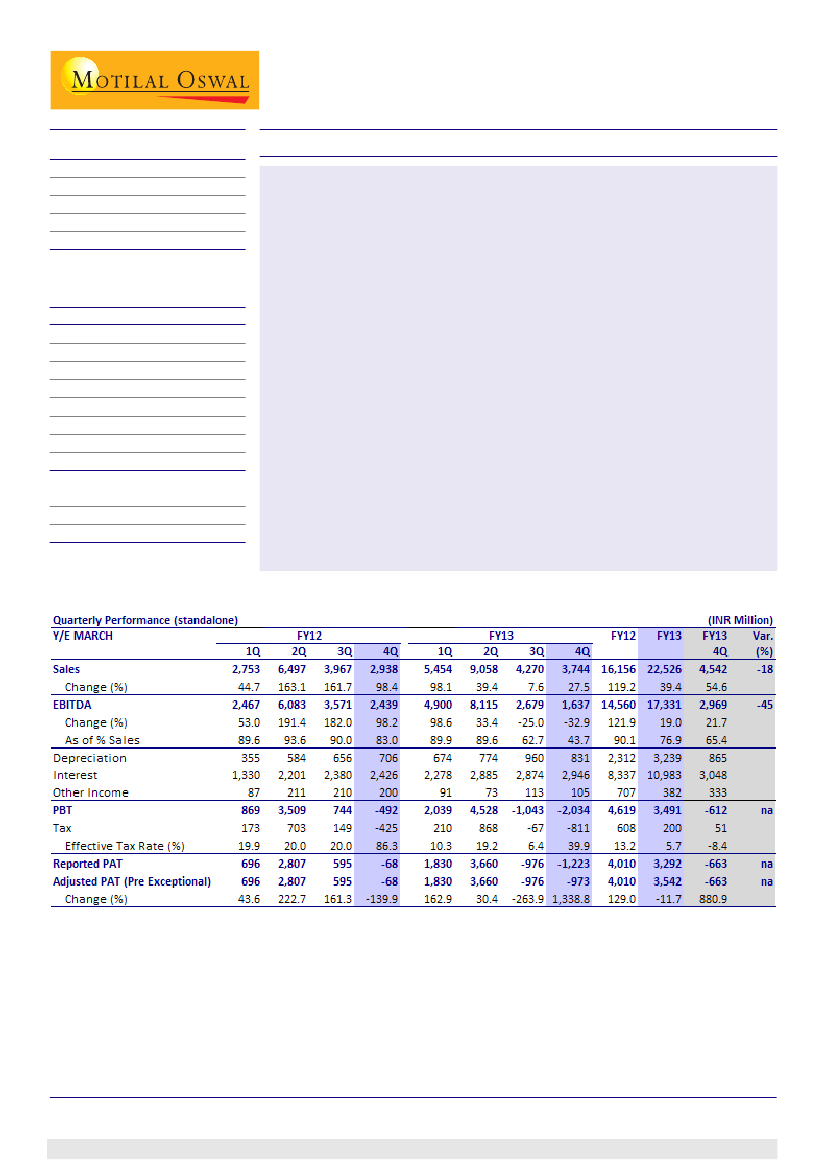

Loss higher than estimated:

On a standalone basis, Jaiprakash Power Ventures

(JPVL) reported a loss of INR1.2b, higher than our estimate of a loss of

INR663m. The reported number includes INR250m of arrears paid towards

transmission charges. Adjusted for this, the loss was INR973m. The higher

than estimated loss was due to lower generation from hydropower projects,

lower merchant realization for Karcham Wangtoo and mismatch in revenue

recognition for the Bina project.

During the quarter, the PLF of Bina was on the lower side due to lower demand

from the MP DISCOM, though PAF remained strong.

Project execution on track:

Project execution is on track, with Unit-1 of the

Nigrie project expected by November 2013 and Unit-1 of the Bara project by

April 2014. Also, coal production at Amelia mine (Nigrie project) is likely to

start by May 2013. For Dongri Tal mine, land acquisition is in progress and the

management expects coal production to commence from 3QFY14.

Cutting estimates; reiterate Buy:

We lower our PLF/generation assumption

for hydropower projects and build in 10% cost increase for the Bara project.

Our FY14E/15E earnings are, therefore, cut 13%/8% and we reduce our target

price to INR40 (from INR44 earlier). Reiterate

Buy,

as JPVL is best placed on

the PPA/FSA front.

Nalin Bhatt

(NalinBhatt@MotilalOswal.com); +91 22 39825429

Aditya Bahety

(Aditya.Bahety@MotilalOswal.com); +91 22 39825417

Investors are advised to refer through disclosures made at the end of the Research Report.

1