2 May 2013

4QFY13 Results Update | Sector: Consumer

Godrej Consumer Products

BSE Sensex

19,504

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

S&P CNX

5,930

GCPL IN

340.3

284.6/5.3

936/465

4/10/42

CMP: INR836

TP: INR800

Neutral

Financials & Valuation (INR b)

Y/E March

2013 2014E 2015E

Sales

63.9

78.3

90.9

EBITDA

10.0

13.6

16.1

Adj. PAT

6.7

8.9

11.1

Adj. EPS (INR) 19.6

26.3

32.5

EPS Gr. (%)

26.7

33.9

23.8

BV/Sh.(INR)

93.7 108.2 129.1

RoE (%)

20.9

24.3

25.2

RoCE (%)

24.8

30.1

31.5

Payout (%)

40.8

38.1

30.8

Valuations

P/E (x)

36.1

27.0

21.8

P/BV (x)

7.6

6.5

5.5

EV/EBITDA (x) 25.4

18.5

15.5

Div. Yield (%)

1.1

1.4

1.4

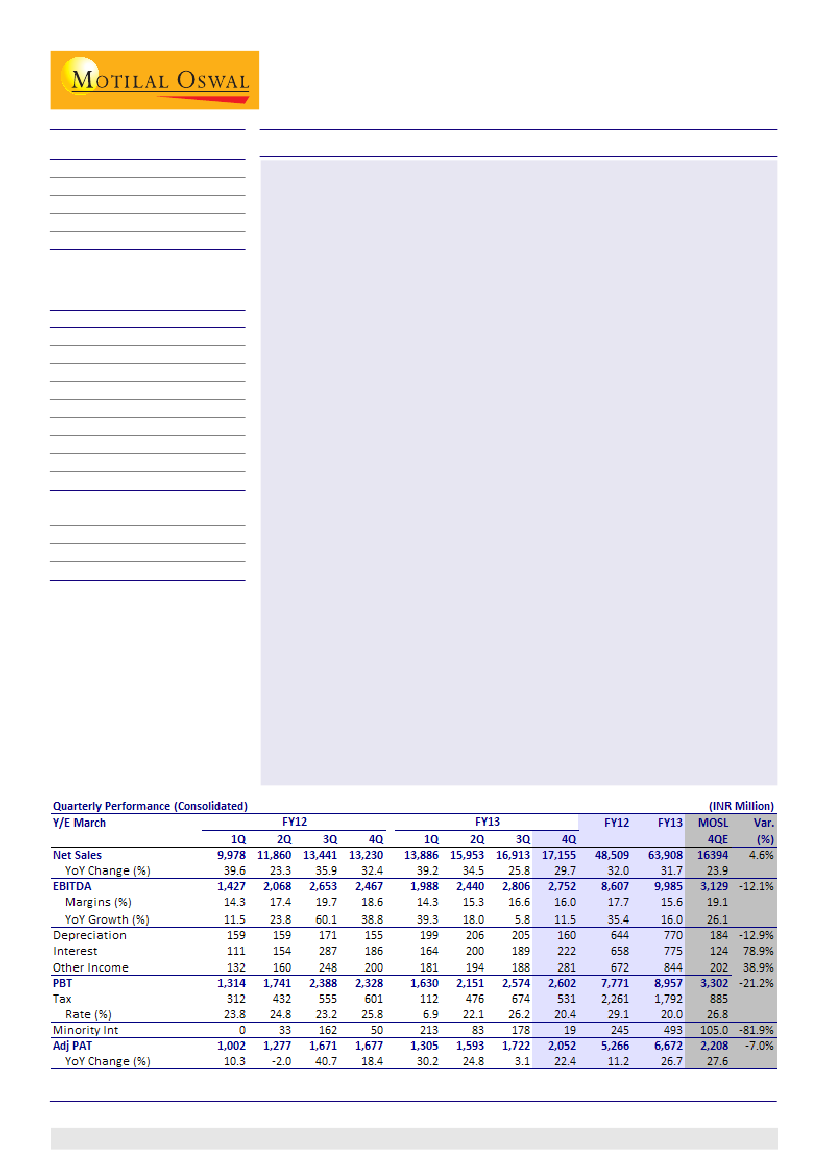

Godrej Consumer's (GCPL) 4QFY13 consolidated results are below estimates

due to sharp margin contraction in international and domestic business. Sales

grew 30% to INR17.15b (est INR16.39b), while EBITDA margin declined 260bp

to 16% (est 19.1%) and adj PAT grew 22.4% to INR2.05b (est INR2.2b).

Consolidated sales growth of 30% to INR17.15b (est INR16.39b) was led by

19% organic sales growth; 18% growth in Indian subcontinent business and

23% growth in international business.

Gross margin was up 150bp to 55.1%; 120bp increase in ad spends to 9.5% and

280bp increase in other expenditure to 19.6% dragged EBITDA margin down

by 260bp to 16% (est 19.1%).

India business reported sales of INR9.2b, up 18% YoY, driven by Home

Insecticide (up 26%) and Hair Care (up 27%), while Soaps posted 17% sales

growth (volume growth of 4%). Hair Colors performance has shown significant

improvement post the relaunch of

Expert.

Hair Colors has posted 2x category

growth and outperformed the category after many quarters.

Stand-alone gross margin expanded 340bp to 54.5% on account of correction

in palm oil prices and significant mix improvement due to strong growth in

Hair Colors and Home Insecticides. However, EBITDA margin declined 115bp

YoY at 18.3%, led by higher ad spends (up 120bp) and other exp (up 500bp).

International sales grew 49% to INR7.7b (23% organic growth) led by Megasari

and acquisitions. EBITDA grew 8%; margin declined 250bp to 16.2% due to

contraction in profitability across the geographies on country specific issues.

Valuation and view:

Despite the margin miss v/s our expectations, we retain

estimates as we expect advertising spends to normalize in FY14E. The stock

trades at 27x FY14E EPS of INR26.3 and 21.8x FY15E EPS of INR32.5. We like

GCPL's sustained share gains in HI category in India, turnaround in its Hair

Colors performance and continued robust performance in Indonesia (45% of

international business). Decline in PFAD prices is a tailwind. Valuations at

lifetime high factor the positives, in our view. Maintain

Neutral

with a target

price of INR800 (25x FY15E EPS).

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +9122 3982 5404

Sreekanth P V S

(Sreekanth.P@MotilalOswal.com); +9122 3029 5120

Investors are advised to refer through disclosures made at the end of the Research Report.

1