13 May 2013

4QFY13 Results Update | Sector: Financials

Punjab National Bank

BSE Sensex

20,083

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

S&P CNX

6,095

PNB IN

339.2

265.7/4.9

922/659

0/-7/-20

CMP: INR771

TP: INR1,130

Buy

Financials & Valuation (INR b)

Y/E March

2013 2014E 2015E

NII

149

166

196

OP

109

117

140

NP

47

52

62

NIM (%)

3.4

3.5

3.6

EPS (INR)

134

148

176

EPS Gr. (%)

-6.7

10.0

19.2

BV/Sh. (INR)

884

997 1,133

ABV/Sh. (INR) 751

850

984

ROE (%)

16.5

15.7

16.5

ROA (%)

1.0

1.0

1.1

Div. Payout (%) 23.3

23.2

23.2

Valuations

P/E(X)

5.7

5.2

4.4

P/BV (X)

0.9

0.8

0.7

P/ABV (X)

1.0

0.9

0.8

Div. Yield (%)

3.5

3.8

4.6

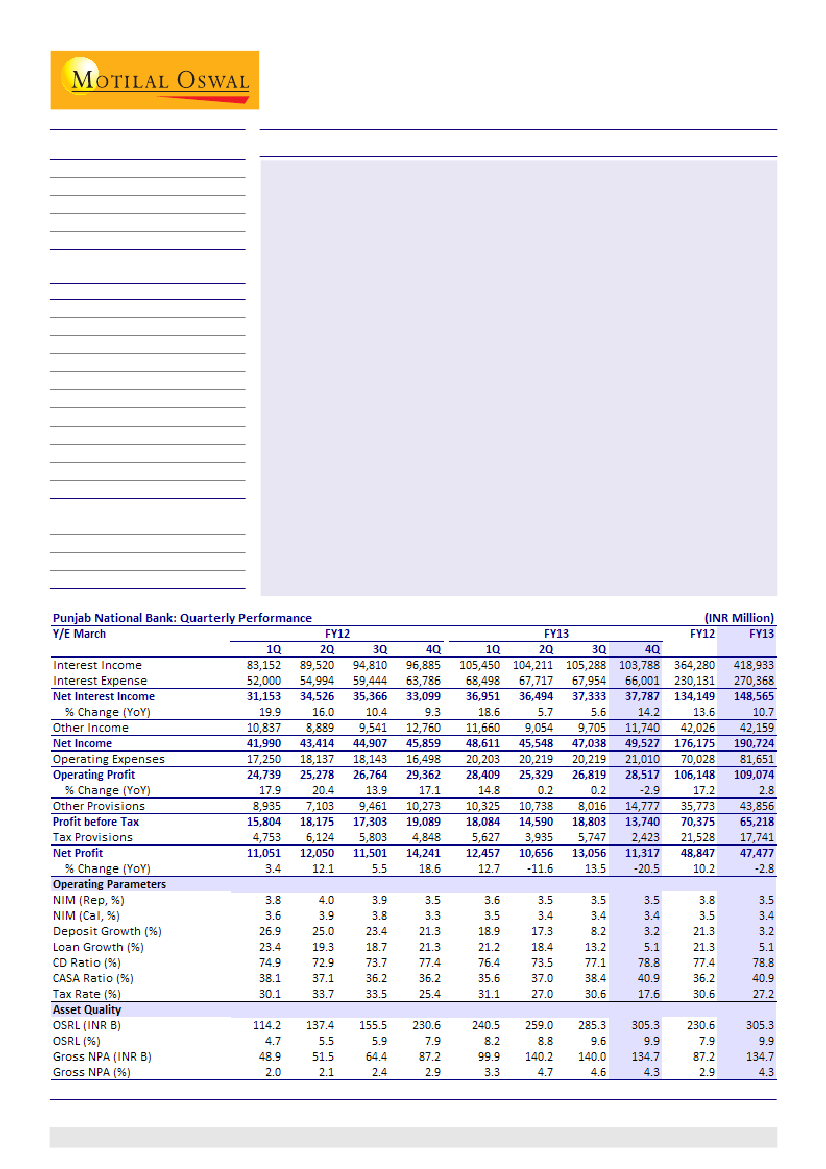

PNB's 4QFY13 PAT declined 21% YoY to INR11.3b, 19% below est (INR13.4b), led

by higher-than-expected provisions of INR11b on stressed assets. Lower tax rate

of 17.6% v/s est of 30.7% helped PAT. NIM was stable QoQ at 3.5%.

Key highlights:

While net slippages in 1HFY13 were significantly higher at INR53.5b (4%

annualized), balance sheet consolidation, aggressive recovery drive and

higher follow-up with borrowers are leading to sharp reversal in reported

NPL movement. In 3QFY13, net slippages were almost nil, while in 4QFY13

they were just INR3.7b (annualized 50bp).

Additions to standard restructured loans stood at INR64b (2.1% of loans), of

which ~INR20b belonged to SEBs. Outstanding standard restructured loan

(OSRL) portfolio stood at INR305.3b (9.9% of loans).

Bank continues to de-bulk and consolidate its balance sheet, resulting in

with (a) fall in bulk deposits to 12.5% v/s 24% a year ago and (b) increase in

CASA deposits (reported) to 40.9% v/s 38.4% QoQ and 36.2% a year ago.

Valuation and view:

PNB remains highly levered to macro-economic scenario

and any improvement in the same can provide significant upside in earnings (led

by asset quality). Lower balance sheet and fee income growth and higher credit

cost led to 7/15% downgrade in PPP/PAT estimates. Top management continuity

till October 2014, improvement in liability profile, strategically placed treasury

book for decline in interest rates, relatively better pension related assumption

than peers, healthy RoA of 1%+ are some of the comforting factors.

Buy.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com) + 91 22 3982 5415

Sohail Halai

(Sohail.Halai@MotilalOswal.com)+ 9122 3982 5430

Investors are advised to refer through disclosures made at the end of the Research Report.

1