14 May 2013

1QCY13 Results Update | Sector:

Metals

Rain Commodities

BSE Sensex

19,692

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

S&P CNX

5,980

RCOL IN

341.7

16.4/0.3

51/31

-8/19/8

CMP: INR48

TP: INR57

Buy

Financials & Valuation (INR b)

Y/E Dec

Sales

EBITDA

NP

Adj. EPS (INR)

EPS Gr(%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

Payout (%)

Valuation

P/E (x)

P/BV

EV/EBITDA (x)

Div. Yield (%)

2.9

0.6

3.5

2.3

4.3

0.6

5.5

2.3

3.2

0.5

4.8

2.3

2012 2013E 2014E

53.6

11.1

5.7

16.7

-12.2

74.7

22.3

10.0

9.5

111.1

13.8

3.8

11.1

-33.5

82.9

13.4

9.7

11.5

116.9

15.2

5.2

15.2

37.0

96.8

15.7

11.5

8.4

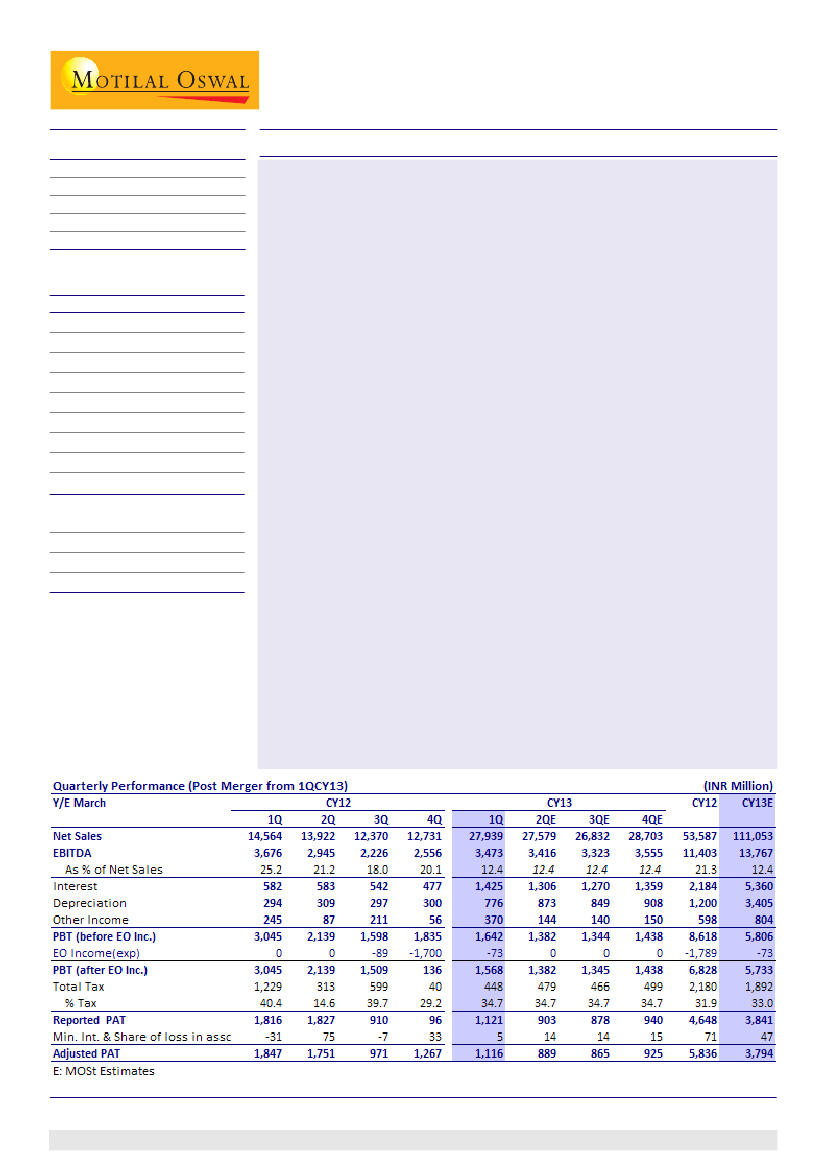

Rain Commodities' (RCOL) 1QCY13 consolidated EBITDA was INR3.5b (below

est.). Consolidated EBITDA was boosted by insurance proceeds of INR343m

for damage of CPC storage at Gramercy facility of RCC, which was damaged by

a lightning strike in 2QCY12. Prior period results are not comparable as current

quarter numbers contained financials from Rutgers operations too.

All three major business segments (CPC, CT Pitch and Cement) witnessed

margin pressure in the current quarter. CPC realizations declined by USD30-

35/ton, while major raw material GPC prices remained firm due to tightness

in the market. Aluminum prices are at their three-year low levels, which is

exerting pressure on CPC realizations. CPC volumes declined 11% YoY to 457kt.

Total carbon sales (CPC, pet coke and Coal Tar derivatives) were at 794kt. Coal

Tar Pitch (CTP) business was affected due to lower realization on account of

lower crude oil prices and subdued aluminum market. CTP and derivatives

sales were at 259kt, while chemical sales were 75kt.

Cement realization was down by INR8/bag to INR184/bag. However, EBITDA/

ton for cement business improved by INR50/t QoQ to INR173/t, below its long

term average of ~INR800/t. RCOL is looking to market its products in neighboring

Odisha market where prices are 25-30% higher than Andhra Pradesh.

Net debt as on March 31, 2013 was USD1,173m, while gross debt was USD1.33b.

Cash and cash equivalent was USD161m as the debt raised for Rutgers

acquisition was deployed in January.

Management stated that they will return ~10% of profits every year to

shareholders either through buyback or dividend route.

US listing of Carbon business is not expected soon as there is no immediate

requirement for funds. It may look for listing in the next one to two years after

operations are stabilized, with more clarity on financials, post acquisition.

We estimate lower margins for both CPC and CT Pitch business. Thus, we cut

CY14E EPS by 21% to INR15.2/share. The stock trades at 4.8x CY14E EV/EBITDA,

post Rutgers acquisition basis. Maintain

Buy.

Pavas Pethia

(Pavas.Pethia@MotilalOswal.com); +9122 39825413

Sanjay Jain

(SanjayJain@MotilalOswal.com); +9122 39825412

Investors are advised to refer through disclosures made at the end of the Research Report.

1