11 April 2013

Update |Sector: Automobiles

Tata Motors

CMP: INR268

TP: INR 323

BUY

TATA MOTORS: JLR Mar‐13 retails grew 16% YoY (+100% MoM)

to 53,772 units – highest ever retails; China retails grew 22% YoY

(TTMT IN, CMP INR268, Mkt cap USD16.3b, TP INR323, 21% upside, Buy)

‐

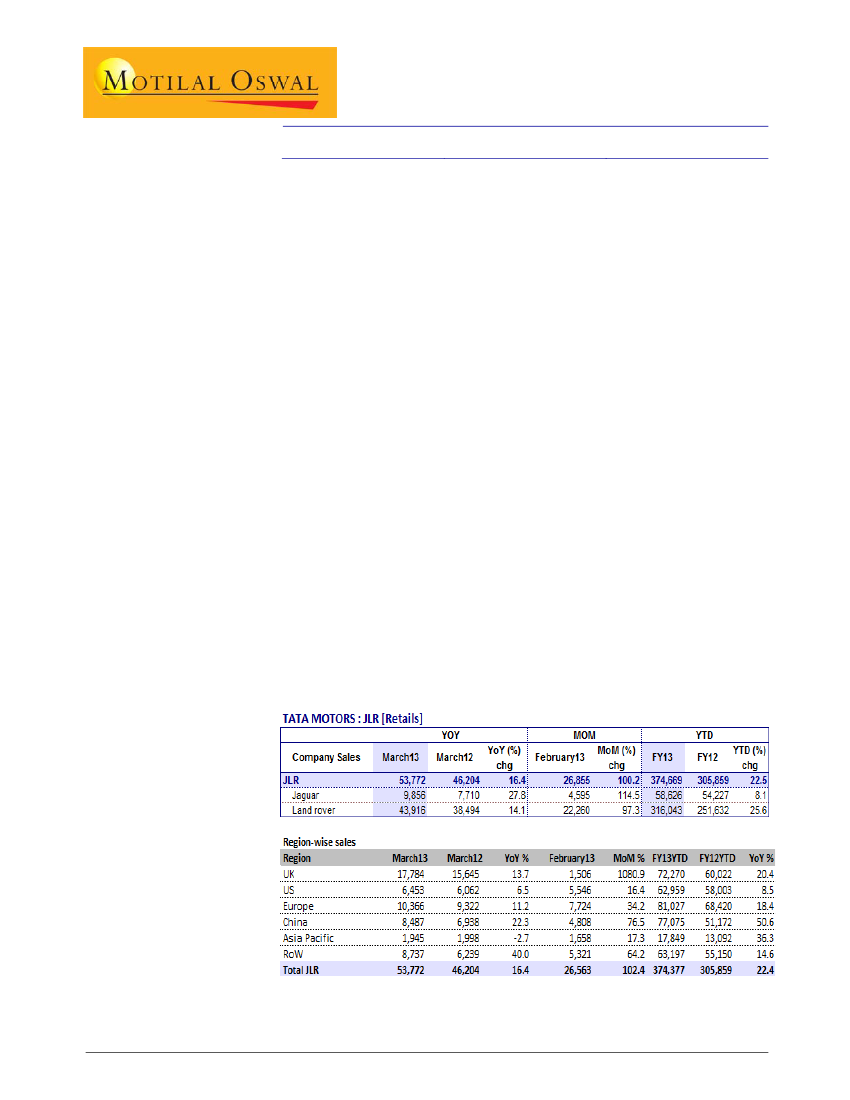

JLR’s Mar‐13 retail volumes grew 16% YoY (+100% MoM) to 53,772 units. Sales

in Mar‐13 were up in every major market: +22% in China, +6.5% in North

America, +14% in the UK, +11% in Europe and +40% in RoW markets. These are

highest ever retails for JLR.

‐

For FY13, retail volumes grew by 22.5% to 374,669 units.

‐

Jaguar sold 9,856 units in March (+28% YoY), with increased sales of the XF

(+42% YoY) and the XJ (+4% YoY), reflecting new smaller engines and all‐wheel

drive options as well as the XF Sportbrake. However, XK volumes declined 17%

YoY.

‐

Land Rover sold 43,916 units in March (+14% YoY). Freelander, Evoque and

Range Rover sales increased by 46%, 21.5% and 36% respectively.

‐

Phil Popham, Group Sales Operations Director for Jaguar Land Rover said:

"Jaguar Land Rover has had a record breaking start to the year reflecting the

continued interest in our two great brands and our commitment to delivering

desirable products that resonate with customers across the globe. Jaguar Land

Rover is seeing continued year on year growth following the introduction of new

models, engines and drivetrains with the Jaguar XF Sportbrake, new Range

Rover and Range Rover Evoque amongst our top selling models.”

‐

Wholesale dispatches for Mar‐13 are expected at ~40,915 units (+12% YoY,

+15% MoM).

‐

We model JLR volume growth of 11.0%/16.3% at 411,372/479,569 units and

EBITDA margins at 14.9%/14.8% for FY14/FY15 respectively.

‐

Tata Motor’s ordinary stock is trading at 7.8x FY14 consol EPS of INR34.3 and

~6.7x FY15 consol EPS of ~INR40.2, whereas DVR trades at 4.6x/3.9x FY14/FY15.

‐

Maintain Buy with target price of INR323/INR197 for Ordinary/DVR share.

1