17 April 2013

Update |Sector: Media

Zee Entertainment

CMP: INR200

TP: INR 232

Neutral

Concerns on Essel Group PE fund investments unfounded; cash

utilization a focus area

(Z IN, CMP INR200, Mkt cap USD3.5b, TP INR232, 16% upside, Neutral)

‐

Zee Entertainment has issued a clarification relating to a media article which

claimed that it is the principal sponsor and anchor investor in a INR10b real

estate private equity fund

‐

Zee Entertainment has clarified that it it not the sponsor or investor of “India

Asset Growth Fund” registered by the Essel Group

‐

However, the board of direcotors have given an in‐principle approval to invest in

high‐yield debt securities of unrelated real estate entities, with adequate

security cover, upto a maximum of INR1b. As on date, INR290m has been

committed for the same.

‐

Cash utilization remains in focus for Zee given strong balance sheet and FCF

generation. As of September 2012 Zee had cash and current investments of

~INR10b (INR10.5/sh).

‐

While dividend pay‐out is currently at ~25%, share buy‐back program has

achieved limited success as stock price remained above the ceiling of INR140/sh

during past three quarters. Out of maximum outlay of INR2.8b for the share

buy‐back commenced on April 23

rd

2012, Zee has been able to utilize only

INR0.6b (during 1QFY13).

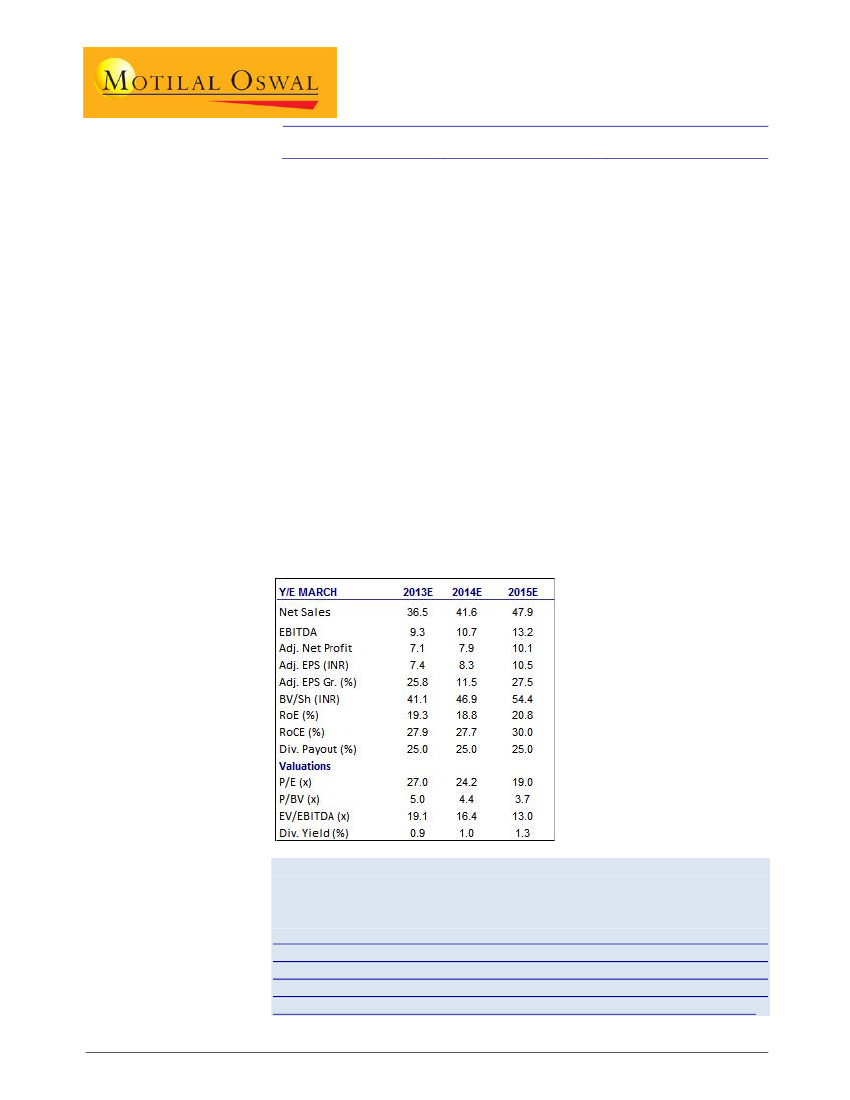

ZEE: Financial and valuation summary (INR b)

Extract from media article

The $4‐billion Essel Group has launched a Rs 1,000‐crore real estate private equity

(PE) fund as part of its asset management foray. The fund will have a corpus of Rs

500 crore, with an option to have an additional Rs 500 crore.

Subhash Chandra‐promoted media company Zee Entertainment is the principal

sponsor and anchor investor in the PE fund. Zee has put in Rs 100 crore and

Chandra’s family office trust gave Rs 100 crore as part of the initial closure of the

fund, which took place last week, said Amit Goenka, managing director and chief

executive of Essel Financial Services, the new financial services arm of Essel Group.

1