30 May 2013

4QFY13 Results Update | Sector: Oil & Gas

ONGC

BSE Sensex

20,148

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

S&P CNX

6,104

ONGC IN

8,555.5

2,858/51.5

354/244

-2/27/8

CMP: INR334

TP: INR442

Buy

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

Adj. PAT

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

Payout (%)

Valuation

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

11.8

1.9

4.8

2.8

9.5

1.7

3.9

3.3

6.6

1.4

2.7

4.8

2013 2014E 2015E

1,614 1,814 2,075

540

240

28.3

(8.8)

177

16.8

15.6

39.2

654

304

35.3

26.7

199

18.8

17.9

36.4

861

436

50.6

43.5

231

23.5

22.3

37.0

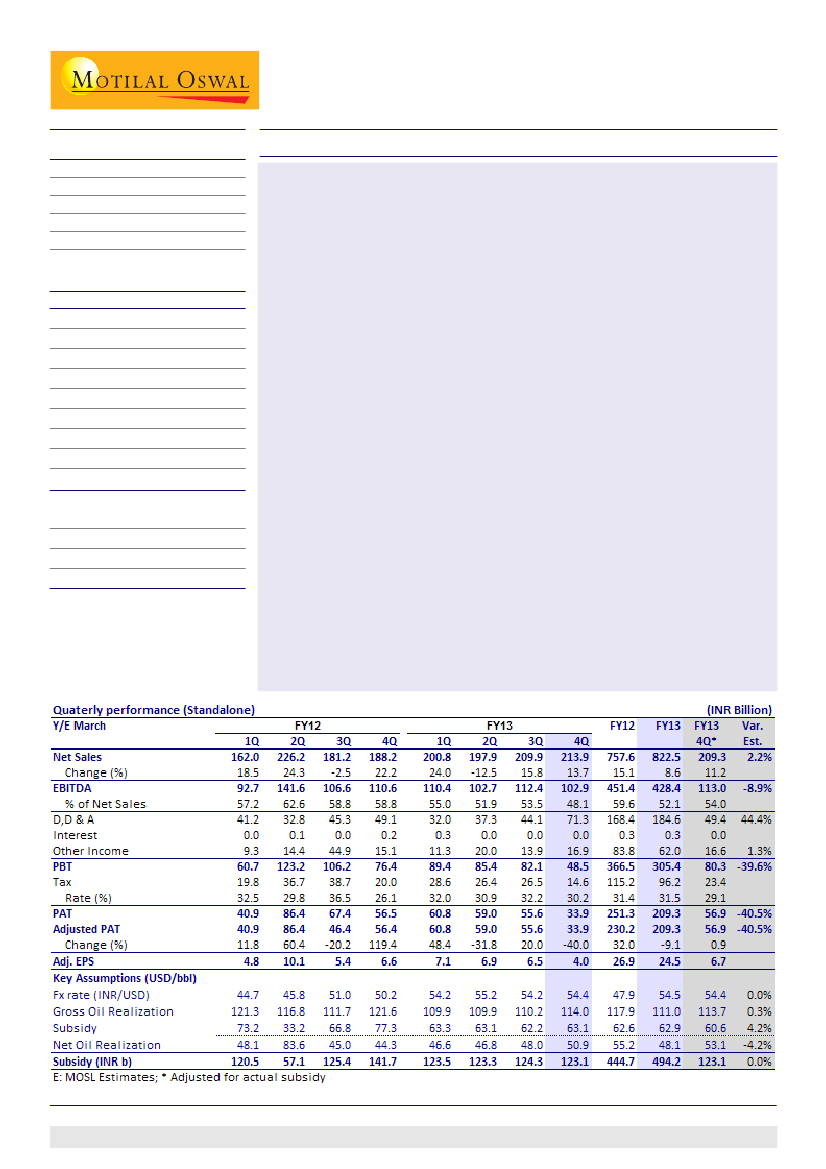

Exploration write-offs, employee cost provision impacts profitability:

ONGC's

reported 4QFY13 EBITDA at INR103b (v/s est of INR113b, adj. for actual subsidy)

was impacted by INR20b superannuation benefits provision, the impact of

which was partly negated by higher VAP revenue. PAT was impacted by

significantly higher D,D&A at INR71.3b v/s our estimate of INR49.4b, led by

dry well write-offs.

4QFY13 net realization at USD50.9/bbl:

Gross realization for 4QFY13 declined

6% YoY (but grew 3% QoQ) to USD114/bbl. Post subsidy of USD63.1/bbl (v/s

our revised estimate of USD60.6/bbl, USD62.2/bbl in 3QFY13 and USD77.3/

bbl in 4QFY12), net realization was USD50.9/bbl. Absolute subsidy sharing

for the quarter was INR123.1b (down 13% YoY and 1% QoQ).

Quarterly production lower:

Oil production (including JV) for 4Q declined 2%

YoY and QoQ to 6.47mmt while gas production declined 5% YoY and 2% QoQ

to 6.22bcm due to shutdown at PMT fields.

Upstream sharing at 38% in FY13; model 40% for FY14/FY15:

ONGC's 4QFY13

subsidy was INR123b and its share in upstream contribution was 82.8%. We

model upstream sharing at 40% for FY14/FY15.

Key things to watch:

(1) Gas price hike, (2) Implementation of diesel reforms,

(3) Clarity on Sudan and Syria production for OVL, (4) Subsidy sharing, and (5)

Visibility on production growth.

Maintain Buy:

We currently model Brent oil price of USD105/bbl (v/s USD110/

bbl earlier) in FY14/FY15 and USD95/bbl in long term. Timely execution of

diesel reforms and gas price hike could lead to stock re-rating. Implied

dividend yield for FY13 stands at ~3%. The stock trades at 8.6x FY14E EPS of

INR35.3. Our SOTP-based target price for ONGC is INR442.

Buy.

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Kunal Gupta

(Kunal.Gupta@MotilalOswal.com); +91 22 3982 5445

Investors are advised to refer through disclosures made at the end of the Research Report.