30 May 2013

4QFY13 Results Update | Sector:

Utilities

Power Grid Corporation

BSE Sensex

20,148

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

S&P CNX

6,104

PWGR IN

4,629.7

523.2/9.3

124/101

-2/-9/-17

CMP: INR113

TP:INR127

Buy

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

NP

EPS (INR)

EPS Gr. (%)

BV/Sh. (INR )

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

2013 2014E 2015E

127.1

108.9

41.4

8.9

24.6

56.7

16.6

9.3

34.1

12.6

2.0

10.6

2.4

157.8

137.7

49.4

10.7

19.4

63.6

17.7

9.5

35.0

10.6

1.8

9.2

2.8

191.9

168.8

59.4

12.8

20.3

72.0

18.9

10.1

35.0

8.8

1.6

8.1

3.4

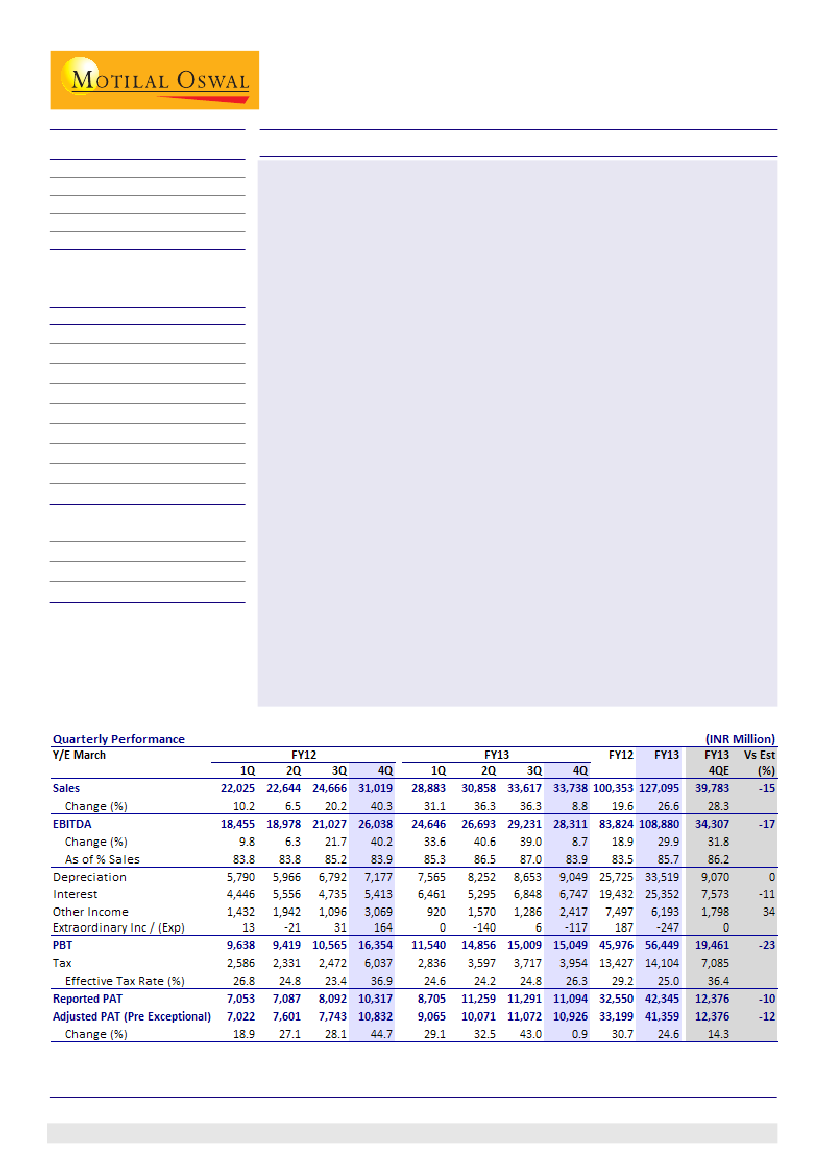

Adjusted PAT below estimate:

Power Grid Corporation's (PGCIL) adjusted

PAT for 4QFY13 was INR10.4b (INR700m of interest on DESU period dues and

other exceptional items), 16% below our estimate, primarily led by

disappointments on performance of core business and Consultancy/Telecom

divisions. Transmission PBT was INR20b, almost at the level of 2QFY13, despite

capitalization of INR104b in 2HFY13. This could be partly due to lower equity

contribution. Short-term open access (STOA) charges were INR1b, lower than

our estimate of INR1.3b.

Consultancy profits dip sharply:

Consultancy division revenue grew 28% YoY

to INR1,225m (our estimate: INR923m), as PGCIL has begun trading activity

for products, while Telecom business revenue was up 9% YoY at INR640m

(our estimate: INR503m). Consultancy PBT dipped 58% YoY to INR237m (our

estimate: INR458), while Telecom PBT was INR179m (our estimate: INR220m)

v/s INR209m in 4QFY12.

Robust capex/capitalization in FY13 but equity contribution dips:

Capitalization for FY13 stood at INR172b, entailing capitalization of INR78b in

4Q. Capitalization for 4Q/FY13 was higher than our estimate of INR65b/

INR159b. The management has not given any definitive guidance for FY14/

15; we assume capitalization of INR185b/INR200b. PGCIL is hopeful of

maintaining equity contribution at 26-28% without any dilution in the near

term.

Cutting earnings estimates; maintain Buy:

We cut our earnings estimates for

FY14/FY15 by 6% to factor in the disappointments on core business and

Consultancy/Telecom division performance. We now expect PGCIL to report

EPS of INR10.7/INR12.8 for FY14/FY15. The stock trades at 8.8x FY15E EPS and

1.6x FY15E BV. Maintain

Buy.

Nalin Bhatt

(NalinBhatt@MotilalOswal.com); +91 22 39825429

Aditya Bahety

(Aditya.Bahety@MotilalOswal.com); +91 22 39825417

Investors are advised to refer through disclosures made at the end of the Research Report.

1