30 May 2013

4QFY13 Results Update | Sector: Oil & Gas

BPCL

BSE Sensex

20,148

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

S&P CNX

6,104

BPCL IN

723.0

274/4.9

449/316

-13/7/-15

CMP: INR378

TP: INR485

Buy

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

Adj. PAT

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

Payout* (%)

Valuation

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

14.6

1.6

8.2

2.9

12.2

1.5

7.4

2.2

10.6

1.4

6.5

2.5

2013 2014E 2015E

2,422

67

19

26.0

140.9

233

11.5

8.9

35.2

2,438

68

22

30.9

18.9

254

12.7

9.3

35.2

2,568

69

26

35.7

15.4

279

13.4

9.5

35.1

*Based on standalone

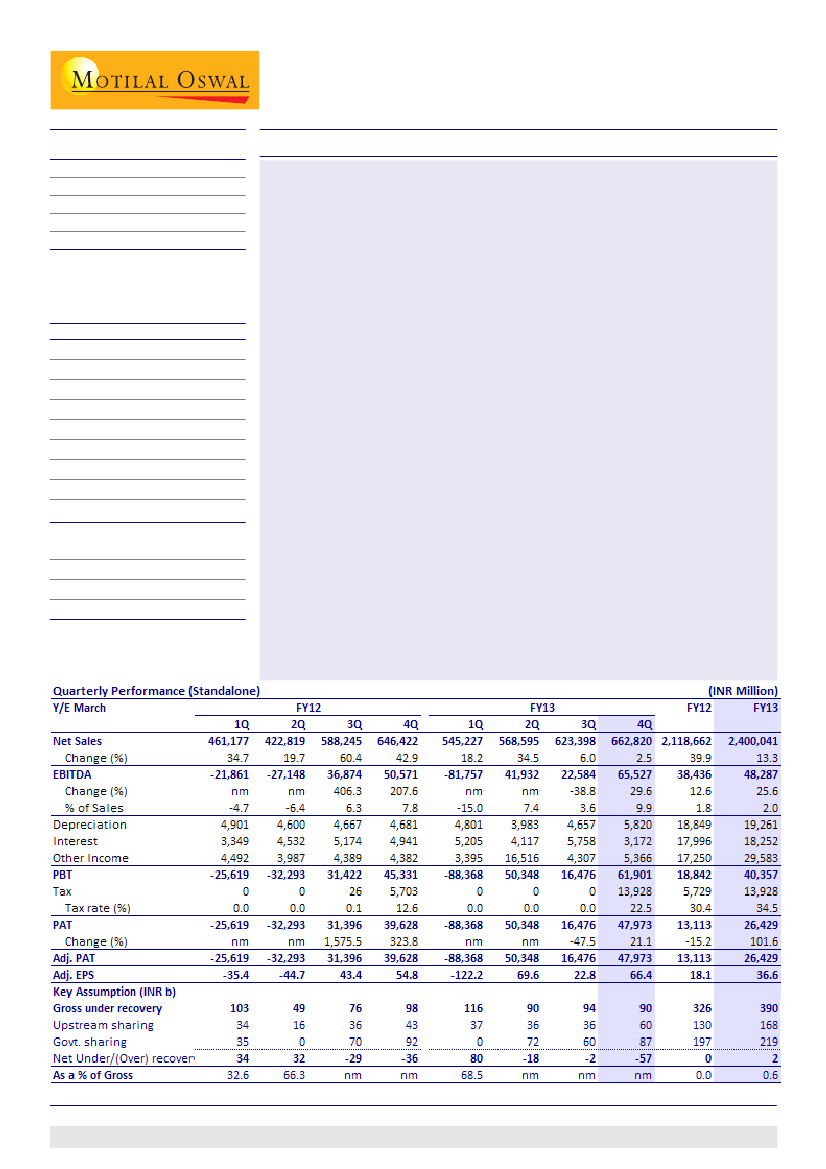

4QFY13 EBITDA lower than estimate:

BPCL reported EBITDA of INR65.5b for

4QFY13, lower than our est. of INR71.9b, led by (a) higher staff cost to the

tune of INR2.1b, (b) inventory loss of INR3.3b, and (c) under-recovery sharing

of INR2.5b v/s our estimate of nil. This was partially negated by (a) higher

GRM of USD6/bbl v/s our estimate of USD5.4/bbl, and (b) forex gain of INR0.7b.

FY13 PAT doubles:

PAT for 4QFY13 was INR48b against our estimate of INR51.5b,

INR39.6b in 4QFY12 and INR16.5b in 3QFY13. Full-year PAT doubled to INR26b.

FY13 subsidy sharing at 0.6% v/s expectation of nil:

While upstream companies

compensated BPCL INR168b in FY13, the government provided INR219b,

implying a marginal INR2.5b (0.6%) sharing for BPCL. This compensation helped

BPCL to report PAT of INR26b for FY13. For FY14, we model subsidy sharing as:

60% by government, 40% by upstream.

GRM at USD6/bbl in 4QFY13, shift to export parity difficult:

Reported GRM for

4QFY13 was USD6/bbl against USD4.2/bbl in 4QFY12 and USD4.8/bbl in 3QFY13.

Given the difficult GRM scenario and unviability of many domestic refineries

under export parity, we believe it will be difficult for the government to change

the petroleum pricing methodology from trade parity to export parity. Our

analysis indicates GRM impact of ~USD2/bbl for simple refiners.

Maintain Buy:

Our positive stance on the stock is driven by the ongoing diesel

reforms, which are likely to reduce gross under-recoveries by ~55% by FY15.

For OMCs, in the initial period of reforms, the stock performance will be

largely through re-rating, and the earnings benefit will be limited, as we

already assume nil subsidy sharing in FY14/FY15. The stock trades at 12.2x

FY14E EPS of INR31 and 0.7x FY14E BV, adjusted for investments. Maintain

Buy.

BPCL is our top pick among OMCs.

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Kunal Gupta

(Kunal.Gupta@MotilalOswal.com); +91 22 3982 5445

Investors are advised to refer through disclosures made at the end of the Research Report.

1