31 May 2013

4QFY13 Results Update |

Sector: Real Estate

Unitech

BSE Sensex

S&P CNX

20,215

6,124

Bloomberg

UT IN

Equity Shares (m)

2,438.8

M.Cap. (INR b)/(USD b)

58.4/1.0

52-Week Range (INR)

41/18

1,6,12 Rel. Perf. (%)

-15/-29/-9

CMP: INR24

TP: INR40

Buy

Financials & Valuation (INR b)

Y/E March

Net Sales

EBITDA

Adj PAT

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

29.9

0.7

36.4

0.0

18.3

0.7

23.9

0.6

15.1

0.5

19.4

0.6

2013 2014E 2015E

24.4

3.3

2.1

0.8

-11.7

35.2

1.8

2.7

0.0

29.3

5.0

3.4

1.3

63.5

36.1

2.9

3.1

11.6

31.6

6.1

4.1

1.6

20.7

45.7

3.5

3.7

9.6

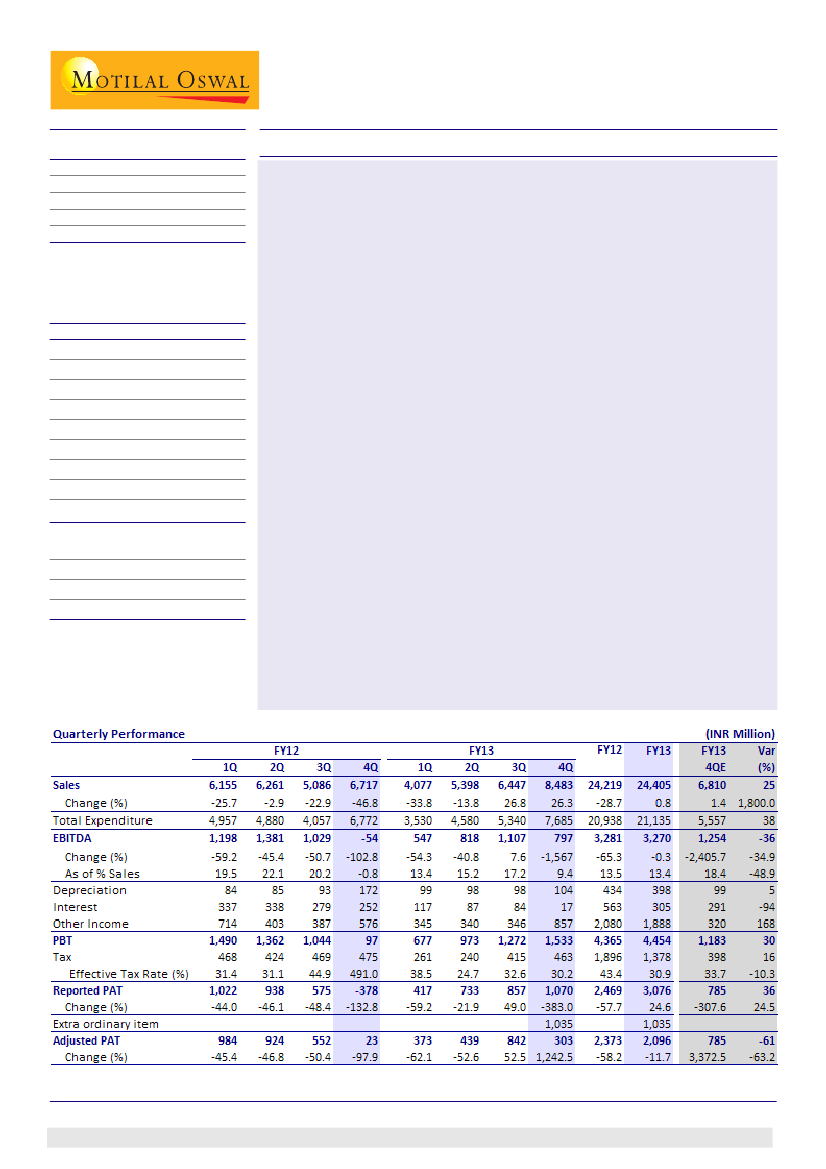

4QFY13 revenue grew 26% YoY (32% QoQ) to INR8.5b v/s our estimate of

INR6.8b. FY13 revenue was flat at INR24.4b. Higher revenue booking is

attributable to gradual pick-up in execution and revenue commencement

from phase II of Uniworld Resort's villas (accounted for ~INR1b of additional

revenue on total presales of INR3.5b-4b).

EBITDA was INR797m v/s our estimate of INR1.2b. EBITDA margin was 9.4%

v/s 17.2% in 3QFY13. The sharp margin deterioration was due to write-off of

INR500m of bad debtors (included in other expense). Adjusting for this,

EBITDA margin would have been 15.5%.

PAT was INR303m v/s our estimate of INR785m, impacted by INR1.04b

provisioning pertaining to Telecom business post cancellation of license.

The company has another INR8b of provisioning due to this, which would be

accounted over 1HFY14 (based on certain settlement milestone).

Margins in the core real estate business have posted strong improvement,

partly due to higher revenue booking. EBIT margin was 25.5% v/s 18.1% in

3QFY13. This was also due to revenue commencement from Gurgaon project,

profitability of which is higher.

With higher focus on execution, the company launched only 4msf in FY13

v/s 7.8msf in FY12. Lower launches led to weaker presales of INR28b v/s our

estimate of INR29b and INR38b in FY12. Presales run rate declined QoQ in

4QFY13; the management cited lowering of broker commission in Noida

market as one of the possible reasons.

Net worth declined by INR8b due to restatement of a subsidiary's financials.

We await further details.

The stock trades at 0.5x FY15E BV, 15.1x FY15E EPS and 48% discount to our

NAV of INR50. Maintain

Buy,

with a TP of INR40 (20% discount to NAV).

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Investors are advised to refer through disclosures made at the end of the Research Report.