Tuesday, June 04, 2013

Market Overview

Oilseeds futures bounced back due to renewed

buying in CBT and monsoon factor discounted by

markets. Immediate focus of market is availability of

soybean. Farmers and stockiest are hoarding

inventory and it takes something game changer

event like real monsoon or large scale sell off in CBT

can change market psychology.

Castor market attracted bargain hunting on dips.

Availability of castor in physical market is very poor

and export is very strong. We think tail end risk in

castor market is skewed to the upside. Tentative

range is 3100-3500. Bias is moderately bullish.

Spices complex ruled erratic to weak. Turmeric

futures extended losses on fresh bouts of selling as

monsoon is expected to commence in southern

states in coming few days. Turmeric may form a

bottom when actual rains start. It’s a buy on rumors

sell on facts kind of scenario. Market is well supplied

but current prices are not friendly for farmers

Dhania market is capped in 6500-7000 range. June

dhania settled marginally higher at 6595, up Rs.50 a

100 kgs. Jeera market regained lost gains and

closed with decent gains. Undercurrent looks

buoyant. Expected range is 12700-13300 basis

June. NCDEX Jun Jeera settled at Rs.13150, up 140

a 100 kgs

Cotton complex posted solid bounce. NY cotton

posted powerful rebound amid broader rebound in

commodities. Mills were selective buyers in quality

Sanaker cotton. Kapas futures ruled firm on active

trade buying. MCX June cotton traded firm at

18770, up Rs 170 a bale

Cotton cake futures also recovered on firm demand

from cash market. Ready availability is tight hence

FED material is also in good demand. MCX cotton

cake remained strongly bullish as several end users

are taking deliveries from MCX cotton. June NCDEX

cotton cake settled at Rs 1557, up Rs 11 a 100 kgs.

Expected range is 1539-1589

Chana market ruled firm on active trade buying.

Wheat futures also ruled steady to mild bullish. Guar

market ruled steady. NCDEX Jun chana settled at Rs

3188, up Rs 32 a 100 kgs. Expected range is 3140-

3280. Guar market ruled steady. Short term bottom

may be placed in guar

Commodity

Chana

Chilli

Turmeric

Jeera

Soyabean

Soyoil

R M Seed

CPO

Sugar

Wheat

Mentha Oil

Castor Seed

Potato

Exchange

NCDEX

NCDEX

NCDEX

NCDEX

NCDEX

NCDEX

NCDEX

MCX

NCDEX

NCDEX

MCX

NCDEX

MCX

Expiry

June

June

June

June

June

June

June

June

June

June

June

June

June

Price

3188

5660

5652

13150

3793

708.8

3483

484.1

3040

1601

957

3209

921.6

%

Change

1.24%

-0.25%

-1.84%

1.08%

2.15%

0.21%

0.40%

0.77%

0.66%

0.19%

-4.30%

0.79%

-0.36%

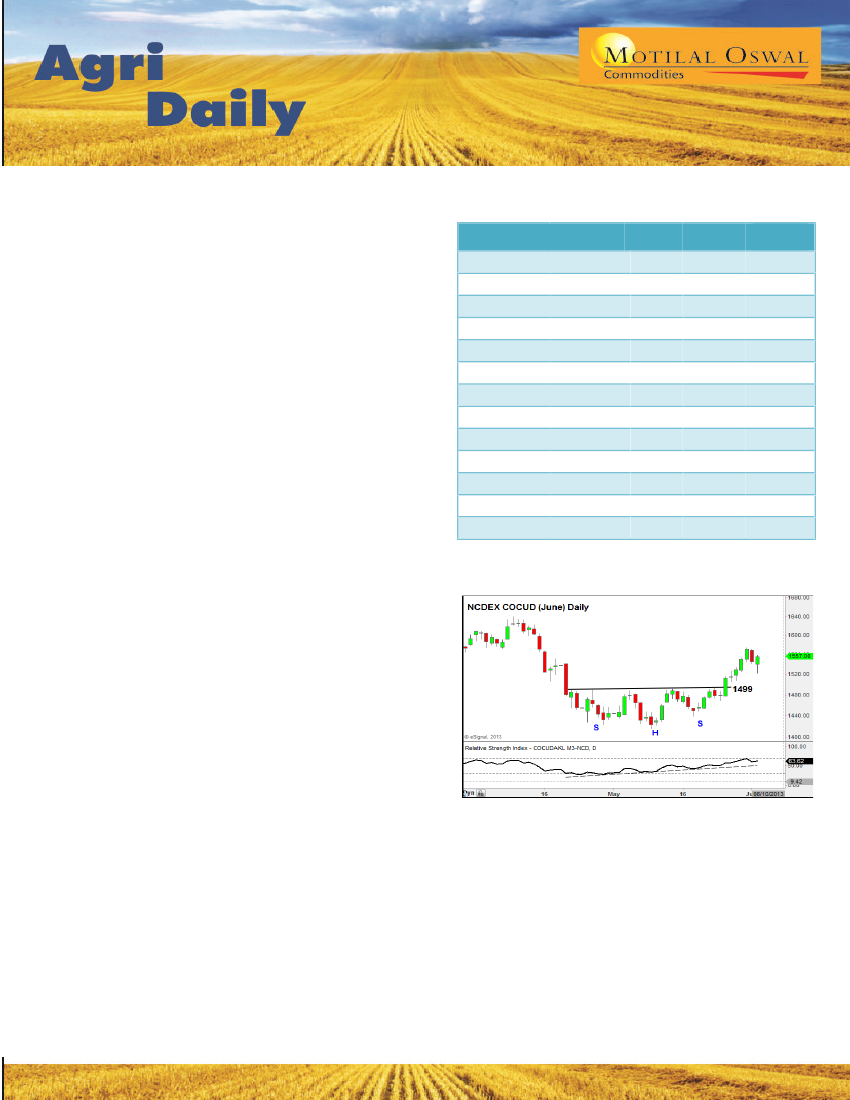

Chart of the Day – Cocud

NCDEX COCUD continues to make higher highs

and higher lows. As long as price sustains above

1500, buying on dips is advisable for the target

of 1611

1

Please refer to disclaimer at the end of the report.