7 June 2013

Annual Report Update | Sector: Financials

HDFC Bank

BSE SENSEX

S&P CNX

19,519

5,921

CMP: INR683

TP: INR755

Neutral

The best keeps getting better

Growth mantra – branch expansion, deeper product penetration

We went through HDFC Bank’s (HDFCB) annual report for FY13. Our key takeaways:

Retail franchise continues to deliver excellent results. Retail loans and deposits grew

27% and 24% respectively. The proportion of retail business increased from 60% in

FY11 to 65% in FY12 and 67% in FY13.

For FY13, slippage ratio and credit cost were at decadal lows of 1% and 0.6%,

respectively. Including general and floating provisions, coverage ratio was 203%.

Outstanding floating provisions stood at INR18.35b (INR7.7/share, 5.1% of net worth).

The bank is focusing on India’s hinterland – 88% of its branch openings during the year

were in semi-urban and rural areas.

We believe operating leverage will provide strong cushion to earnings. While visibility

on core operating parameters and growth is high, valuations are rich. Maintain Neutral.

Bloomberg

HDFCB IN

Equity Shares (m)

2346.7

M.Cap. (INR b)/(USD b) 1615/28.6

52-Week Range (INR)

727/499

1,6,12 Rel. Perf. (%)

2/-1/15

Financials & Valuation (INR b)

Y/E March

NII

OP

NP

NIM (%)

EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

ABV/Sh. (INR)

RoE (%)

RoA (%)

Payout (%)

Valuations

P/E(X)

P/BV (X)

P/ABV (X)

Div. Yield (%)

2013 2014E 2015E

158.1 193.9 237.1

114.3 147.6 187.3

67.3

88.0 110.4

4.8

4.8

4.9

28.3

37.0

46.4

28.4

30.9

25.5

152.1 180.5 216.1

150.7 177.4 210.7

20.3

22.2

23.4

1.8

2.0

2.0

22.8

23.4

23.4

24.3

4.5

4.6

0.8

18.6

3.8

3.9

1.1

14.8

3.2

3.3

1.3

Focused retail strategy; liability profile improved further

Liability customer acquisition followed by exploitation of cross-selling

opportunities remains HDFCB’s key business strength. During the year, retail

loans grew 27% and retail deposits grew 24%. As at March 2013, retail deposits

constituted 75% of overall deposits, up from 72% a year ago (67% in FY11), led by

28% growth in retail term deposits (partially cannibalizing savings deposits, which

grew 19%). Fees earned from cross-selling third-party products grew 6% and

accounted for 15% of overall fees (stable YoY), down from 24% in FY11.

Aggressive franchise expansion – banking on India’s hinterland

During the year, the number of branches grew 20% to 3,062 (now just 40 branches

behind ICICIBC) and ATMs grew 21% to 10,743 (almost equal to AXSB and ICICIBC).

Presence in terms of number of cities in India increased 32% during FY13 and

5.6x over FY08. Of the 518 new branches in FY13, 193 were micro branches (2-3

member branches). 88% of the branches opened during the year were in rural

and semi-urban areas. Total customer base increased by 2.7m (10% growth) to

~28.7m in FY13 and has more than doubled in the last five years. Nevertheless,

customer acquisition has slowed from ~5m in FY12. The number of debit cards

increased ~12% in FY13 (15% CAGR over FY09-13) to 15.8m and the number of

credit card customers grew ~10% to 6.4m.

Shareholding pattern %

As on

Mar-13 Dec-12 Mar-12

Promoter

22.9

23.0

23.2

Dom. Inst

8.6

8.9

10.5

Foreign

51.7

51.4

48.8

Others

16.9

16.8

17.5

A third of HDFCB’s branches are less than 24 months old and a large part of its

branch expansion has happened in rural and semi-urban areas, where breakeven

period is 24-30 months. Strong expansion in the hinterland will not only help in

customer acquisition and product penetration, but also to meet priority sector

targets (already achieved 40%, overall). Deeper product penetration in mature

branches will lead to higher growth. While credit cost and slippages are at cyclical

lows, higher base on account of floating provisions provides strong cushion to

earnings. Visibility on core operating parameters and growth remains high;

however, this is adequately discounted in the rich valuations. Maintain

Neutral.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com) +91 22 3982 5415

1

Sohail Halai

(Sohail.Halai@motilaloswal.com) +91 22 3982 5430

Investors are advised to refer through disclosures made at the end of the Research Report.

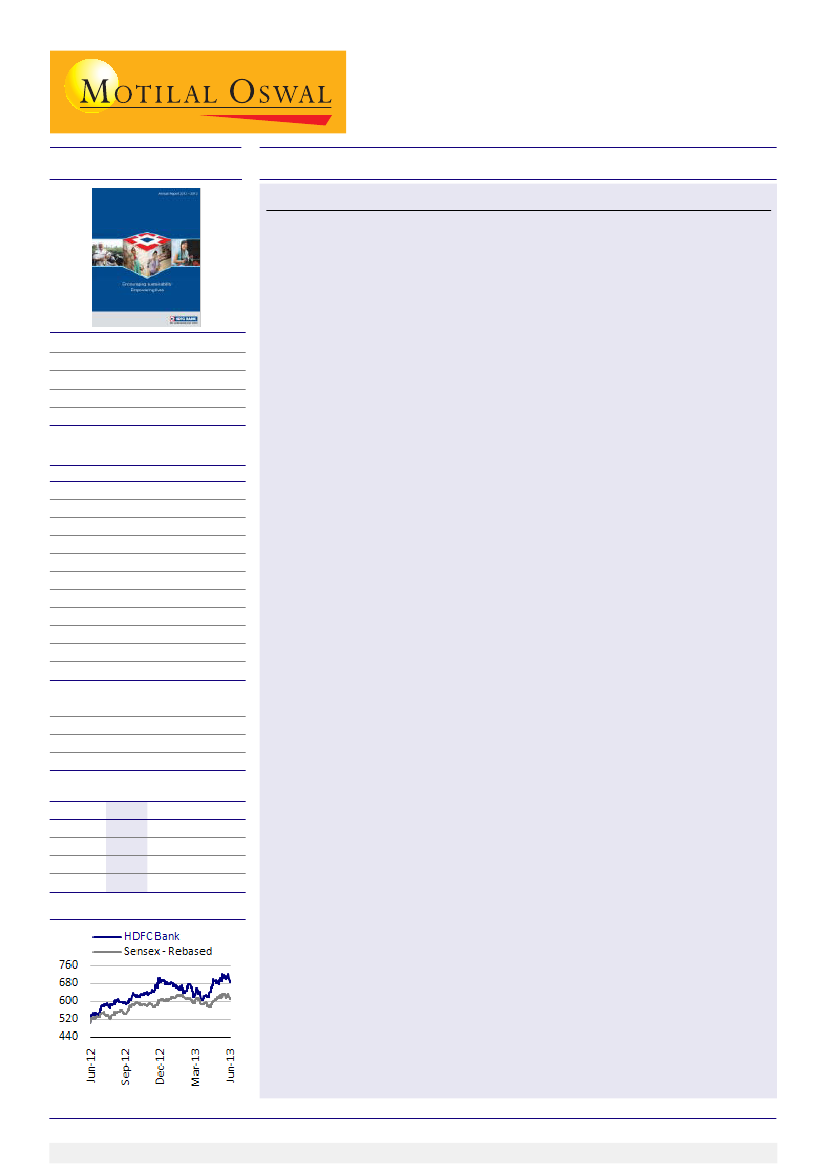

Stock performance (1 year)

Operating leverage, mix change to drive earnings growth