Wednesday, June 26, 2013

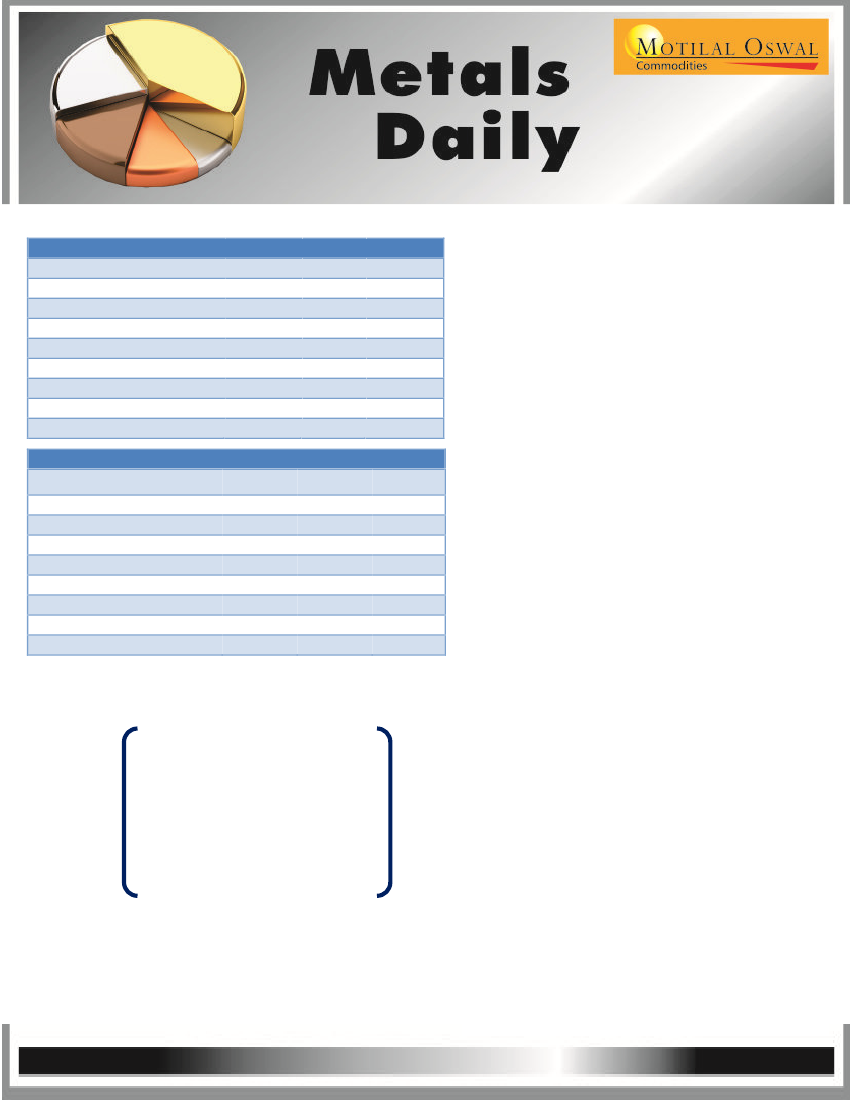

Commodity

Gold / USD Spot

Silver / USD Spot

Crude oil $ Spot

COMEX Copper $

LME Copper (3M)

LME Aluminum (3M)

LME Nickel (3M)

LME Lead (3M)

LME Zinc (3M)

Last

1276.74

19.58

95.25

343.5

6723

1775

13761

2040.75

1839

Chg

-4.55

-0.07

0.18

-1.9

-44.5

-3

-139

-9.25

-7.25

% Chg

-0.36%

-0.36%

0.19%

-0.55%

-0.66%

-0.17%

-1.02%

-0.46%

-0.40%

Market Overview (Economy)

Asian markets are positive in early trade

after better economic data yesterday and

precious metals continue to selloff as safe

haven demand wanes

Durable goods orders jumped 3.6% in

May, home prices jumped 12.1% year-

over-year and Consumer confidence in the

U.S. surged to 81.4

The People’s Bank of China said it will use

tools to ensure money-market stability

and this has helped reduce concerns over

the cash crunch in China

Equity

BSE Sensex Index

S&P CNX NIFTY

Hang Seng Index

Shanghai Index

Nikkei 225 Index

DAX Index

CAC 40 Index

Dow Jones

NASDAQ 100 Index

Last

18629.2

5609.1

19855.7

1959.5

12969.3

7811.3

3649.8

14760.3

2866.5

Chg

88.3

18.9

41.7

-3.7

-93.4

118.9

54.2

100.8

18.3

% Chg

0.5%

0.3%

0.2%

-0.2%

-0.7%

1.5%

1.5%

0.7%

0.6%

Precious Metals

Gold and silver plunged to their lowest in

almost 3 years as U.S. economic data beat

estimates, backing the case for reduced

stimulus

The dollar strengthened and Treasuries

fell, pushing 10-year yields toward the

highest since 2011 as safe haven appeal

keeps diminishing

Assets in the SPDR Gold Trust, fell by

16.23 tons to 969.5 metric tons yesterday,

and are 28% lower this year. Holdings of

the world's largest silver-backed ETP’s

have fallen their most in a year

In its latest move to discourage gold

buying, the RBI restricted rural regional

banks from giving loans against gold

jewellery and coins and this will continue

to hit gold demand

The precious metals selloff has gained

momentum yet again after all economic

data in the U.S. beat estimates and the

rout will continue as ETP holdings

continue to fall and physical demand

shows no signs of improvement. The next

major support for gold could come around

$1200-1185 level and silver could find

support in the $18.5-17.3 range

1

Please refer to disclaimer at the end of the report.