12 July 2013

1QFY14 Results Update | Sector: Diversified

Sintex Industries

BSE Sensex

S&P CNX

19,958

6,009

Bloomberg

SINT IN

Equity shares (m)

324.1

M. Cap. (INR b)/(USD b)

13.0/0.2

52-Week Range (INR)

76/37

1, 6, 12 Rel. Perf. (%)

-19/-45/-53

CMP: INR40

TP: INR49

Buy

Financials & Valuation (INR b)

Y/E March

Net sales

EBITDA

Adj. PAT

Adj EPS (INR)

EPS Gr. (%)

BV/sh. (INR)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

2013 2014E 2015E

51.1

7.7

4.1

13.3

2.1

100.4

14.3

10.3

7.8

3.0

0.4

5.1

1.8

53.0

8.2

3.5

10.9

-17.9

108.0

10.7

9.4

7.9

3.7

0.4

4.7

1.8

59.1

9.5

4.4

12.6

15.5

121.1

11.0

9.7

5.9

3.2

0.3

3.9

1.8

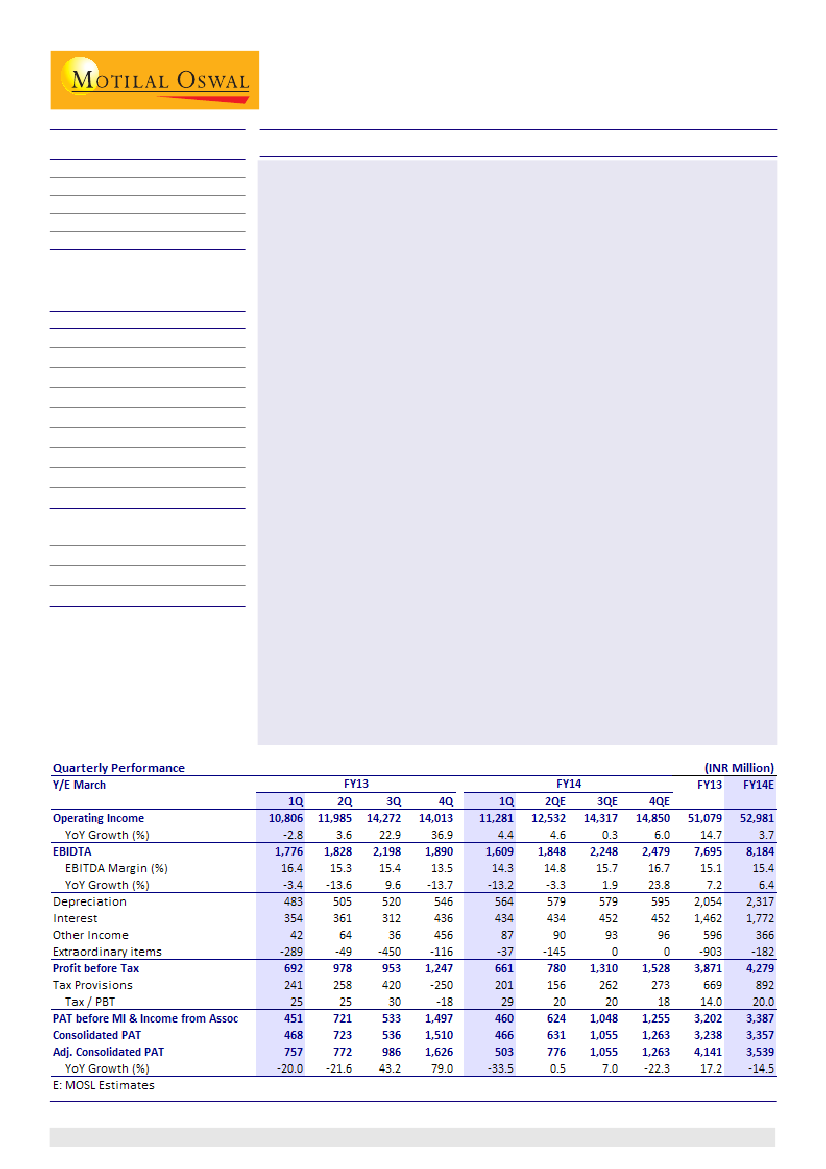

Sintex Industries' (SINT) 1QFY14 revenue was up 4.4% YoY (-19% QoQ) to

INR11.3b (v/s est of INR13b), led by 16% and 13% YoY decline in domestic

composites (largely Bright) and Monolithic respectively. EBITDA margin was

down by 2.1pp YoY (0.8pp QoQ) to 14.3% (v/s est of 15.5%), which translates

into an EBITDA decline of 13% YoY (-15% QoQ) to INR1.6b (v/s est of INR2b).

Margins shrunk across segments (barring Prefab), with a sharp decline in

Monolithic (-5.3pp YoY) and domestic composites (-6.1pp YoY). Adjusted PAT

was down 34% YoY to INR503m.

SINT witnessed a sharp decline (-13% YoY, -21% QoQ) in sales and 5.3pp fall in

operating margin in the monolithic segment, with problems of less

remunerative sites continuing. Management guidance is likely to translate

into almost 25%+ decline in FY14E monolithic revenue to INR7-7.5b.

Prefab vertical continues to remain the bright spot, with 19% YoY (-30% QoQ)

growth in sales and 3.4pp QoQ expansion in margin to 23.4%. Declining

contribution from telecom shelter segment (a lower margin business) has

been a key to margin improvement.

It plans to set up a new spinning unit (320,000 spindle) for the textile division

(likely capex of ~INR17b over 24-30 months) in Gujarat on the back of

favorable state government policy and tax exemption.

Despite possible long term benefits of overseas acquisitions and plan textile

capex, we believe any deterioration in balance sheet strength would create

near term stock overhang and restrict immediate re-rating of the stock.

We downgrade SINT's adjusted EPS by 14%/22% to INR10.9/INR12.6 for FY14E/

15E led by (a) 34%/11% reduction in Monolithic/Domestic composites FY14

revenue and (b) 1%/3% reduction in FY14E margins to 15%/15.1%. It translates

into FY14E and FY15E based target price of INR49/share (4.5x EPS) and INR55/

share (4x) respectively. The stock trades at 3.7x FY14E and 3.2x FY15E EPS. We

remain cautiously optimistic and maintain a

Buy.

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Investors are advised to refer through disclosures made at the end of the Research Report.

1