24 July 2013

Annual Report Update | Sector: Real Estate

DLF

BSE SENSEX

S&P CNX

19,958

6,009

CMP: INR177

TP: INR246

Buy

Behemoth moves… but hits roadblocks

Strategy and risk management framework in place, but headwinds likely

to make recovery long drawn

Bloomberg

DLFUIN

Equity Shares (m)

1,714.4

M.Cap. (INR b)/(USD b) 301.9/5.1

52-Week Range (INR)

289/161

1,6,12 Rel. Perf. (%)

-11/-25/-31

Financials & Valuation (INR b)

Y/E March

2013 2014E 2015E

Net Sales

77.7

90.1

98.6

EBITDA

26.3

34.1

39.6

Adj PAT

7.1

7.4

12.7

EPS (INR)

4.2

4.2

7.1

EPS Gr. (%)

-40.8

-0.8

71.6

BV/Sh. (INR) 152.9 158.2 155.2

RoE (%)

2.6

2.6

4.2

RoCE (%)

6.0

5.8

6.9

Payout (%)

55.8

56.3

32.8

Valuations

P/E (x)

40.5

40.8

23.8

P/BV (x)

1.1

1.1

1.1

EV/EBITDA (x) 19.2

14.4

12.3

Div. Yield (%)

1.2

1.2

1.2

DLF's annual report highlights various operational and regulatory challenges creating

hurdles for immediate fruition of its recently adopted business strategies targeted at

consolidation of core operations, balance sheet, cash flow maximization and propel

long term growth.

Continuation of weak operations (lower launches, pre-sales, margin contraction),

partially ameliorated by improvement in execution resulted in core FCFE of negative

INR17.4b (v/s negative INR21.6b in FY12). Hence, the net debt decline of INR8.3b YoY

looks meager compared to divestments of INR31.6b.

Dev Co revenue declined sharply due to changes in accounting practice and operational

slippages, leading to further weakening in capital efficiencies.

Recovery contingent on various operational improvements and deleveraging. We

maintain a cautious Buy, with a reduced target price of INR246 (10% discount to NAV).

Operational slippages and accounting adjustments wane P&L

Dissecting DLF's P&L among asset classes, we estimate Dev Co revenue fell 36%

YoY to INR39b (CAGR of -18% over FY09-13) along with 8.3pp YoY reduction in

operating margins. Rent Co revenue growth moderated sharply to 7% YoY (21% in

FY12, CAGR of 34% over FY09-13). Disappointment in Dev Co was driven by (a)

weak recent operations (pre-sales fell 28%/20% YoY in FY13/12) and (b) changes

in POCM accounting practice, which delayed revenue recognition from recent

launches. Rent Co weakness was attributable to muted leasing (coupled with

cancellations) and few divestments concluded in 2HFY12 (IT Park Pune, Noida).

Capital efficiency (RoCE calculated on segmental EBITDA) of Rent Co remains

subdued (albeit improves 0.6pp YoY to ~6.5%) due to higher CWIP and DAL assets

being carried at high book value. RoCE for Dev Co plunged sharply by 3.5pp YoY to

8.5%, impacted by lower asset turn (slippages in launch target, change in

accounting) and margin contraction.

Shareholding pattern %

As on

Mar-13 Dec-12 Mar-12

Promoter

78.6

78.6

78.6

Dom. Inst

0.3

1.0

0.3

Foreign

16.7

15.0

15.6

Others

4.4

5.5

5.5

Core FCFE at high negative, divestment success fails to bring down leverage

Slippages in launches (4.3msf v/s target of 8msf) translated into a sharp decline

in pre-sales (-28% YoY) and procrastinated revival in operating cash flow (OCF);

albeit construction outsourcing drove execution improvement and better

customer collections (~INR63b v/s INR50b in FY12). We estimate FY13 core OCF at

INR31b (28% YoY) and core FCFE of negative INR17.4b (-INR21.6b in FY12), further

impacted by (1) higher capex (~INR10b v/s INR5b in FY12), (2) interest outgo

(INR32b v/s INR30b in FY12) and (3) tax payment of INR9.4b (much higher than

P&L provision of INR1.3b). Thus, the net debt decline of INR8.3b YoY looks meager

compared to divestments of INR31.6b (v/s INR17.7b in FY12). Dev Co net leverage

of INR125b (adjusted for 6x Rent Co EBITDA) continues to stand at discomforting

level of 6.25x P&L EBITDA (or 4.7x cash EBITDA) - the recovery hinges on

operational break-even (expected by FY15) and success in deleveraging (QIP,

wind deals and clarity on Aman Resort transaction).

1

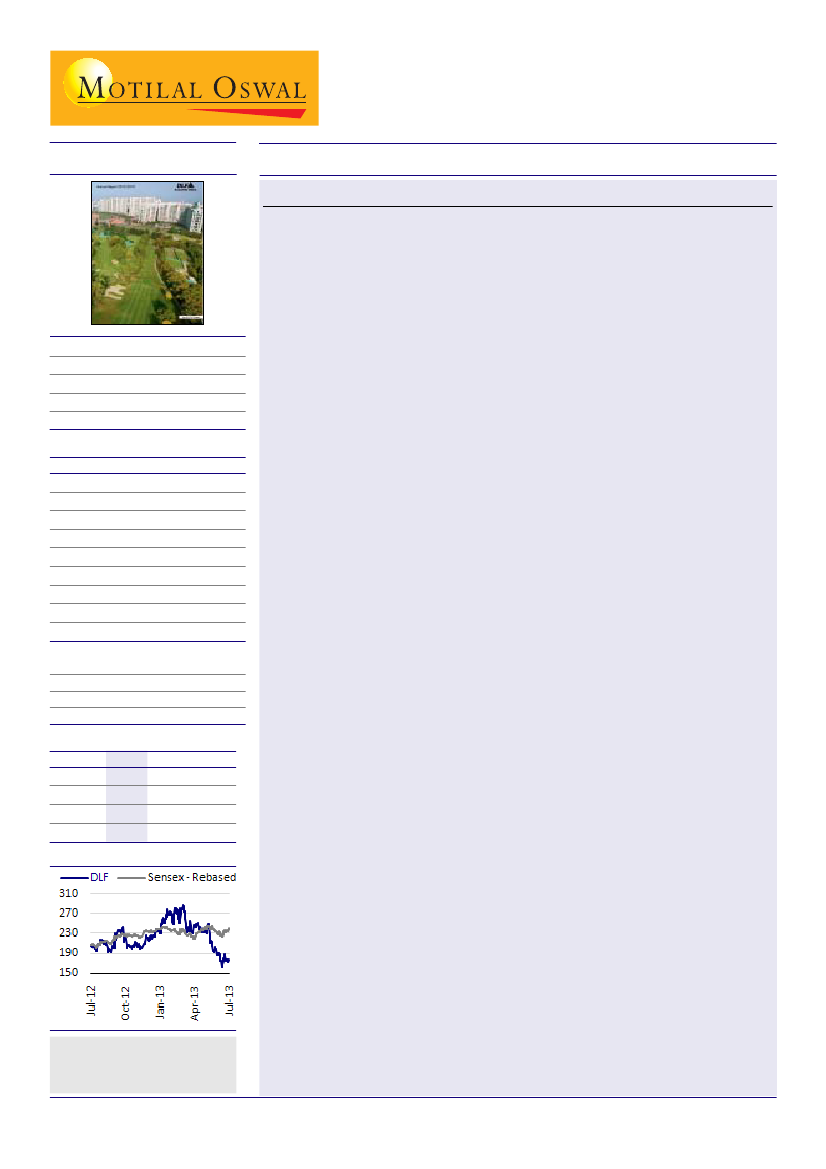

Stock performance (1 year)

Investors are advised to refer

through disclosures made at the end

of the Research Report.

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436