30 July 2013

1QFY14Results Update | Sector:

Healthcare

Torrent Pharmaceuticals

BSE SENSEX

19,593

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel.Per (%)

S&P CNX

5,832

TRP IN

169.2

71.2/1.2

459/304

2/19/11

CMP: INR421

TP: INR477

Buy

Financials & Valuation (INR m)

Y/E MAR

Net Sales

EBITDA

Adj PAT

2013 2014E 2015E

30,540 37,329 42,307

6,930 7,336 8,358

4,330 5,031 5,772

29.7

7

108

30.7

29.6

14.2

3.9

34.1

15

133

28.3

28.7

12.3

3.2

Adj.EPS (INR) 27.8

Growth (%) 43

BV/Share

85

(INR)

RoE (%)

35.8

RoCE (%)

P/E (x)

P/BV (X)

33.5

15.1

5.0

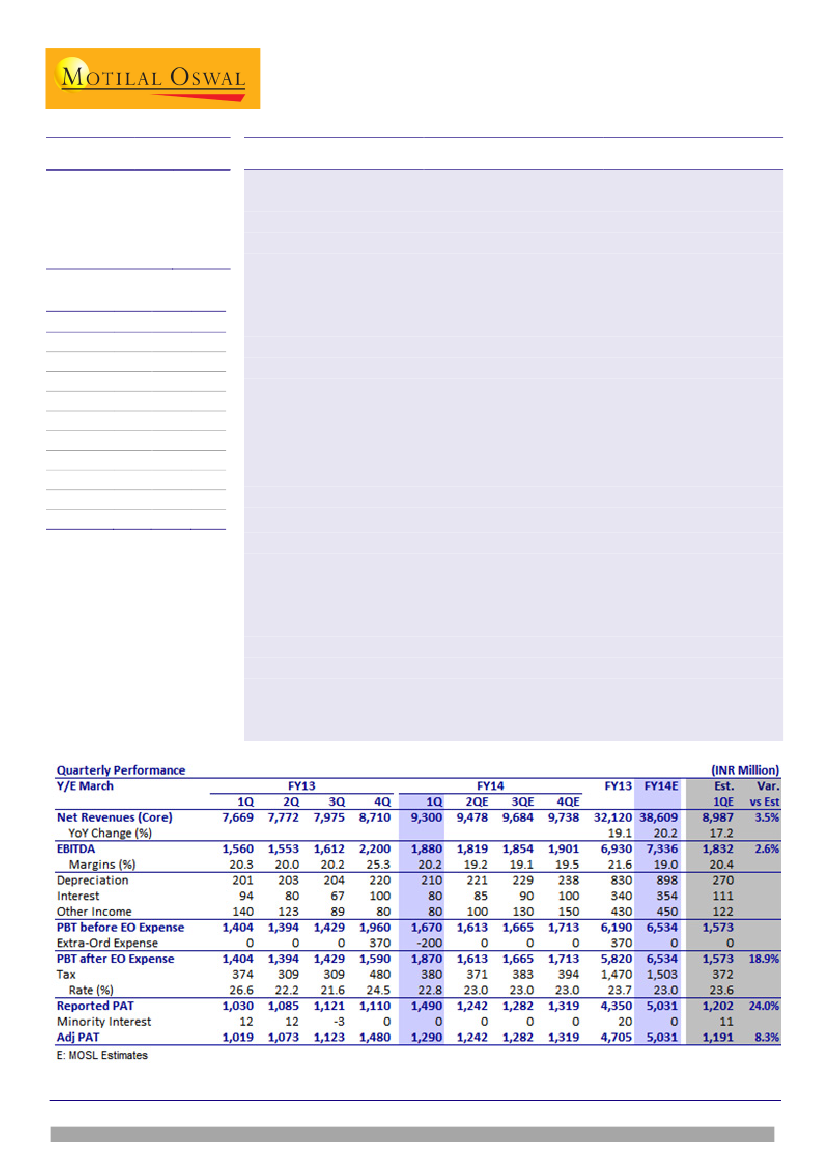

Torrent Pharma’s (TRP) revenue, adjusted for one-time income of INR420m, grew

21.3% YoY to INR9.3b (v/s est. INR8.99b). Adjusted EBITDA grew 20.5% YoY to

INR1.88b (v/s est. of INR1.83b), with EBITDA margin at 20.2% (est. 20.4%).

Adjusted PAT grew 26.7% to INR1.29b (above est. INR1.19b).

Sales growth was driven by stronger-than-expected growth in Europe, while the

US grew 40% YoY as expected. Brazil continued to report a decline of 2% YoY (as

expected), while RoW, Russia and CIS markets posted a healthy 23% YoY growth.

Domestic formulations growth was also in line with expectation at 13% YoY.

EBITDA growth was impacted by adverse sales mix, with higher contribution from

Europe (low margin business) and price pressures in Brazil. Other factors were (1)

forex loss of INR130m and (2) inventory write-down of INR220m.

Concall highlights: (1) India: Revival of growth in acute segment continues; see

signs of improving MR productivity. (2) Brazil: Price reduction in two key products

due to increasing competition; increasing focus on generic. (3) US: High growth to

sustain driven by five to six launches in FY14. (4) Europe: High growth to sustain

due to contribution from new markets of the UK and Romania.

Based on 1QFY14 performance, we increase EPS estimates for FY14E/15E by 4%/3%

mainly to reflect the higher growth in Europe. Over the last six years, TRP delivered

30% EPS CAGR, even as capital employed CAGR was just 17.6%. It consistently

improved profitability, with RoCE increasing from 14.5% in FY05 to 35.7% in FY13.

Based on revised estimates, we expect 20% EPS CAGR over FY12-15E, led by 17%

revenue CAGR. Its high return ratios are likely to sustain, despite large capex and

growing cash on the books. We believe current valuations do not reflect the

improvement in business profitability (exl. Europe), scale-up of international

operations and TRP’s strong positioning in domestic formulations, particularly in

chronic therapeutic segments. The stock trades at 14.2x FY14E and 12.3x FY15E EPS.

Maintain

Buy

with a target price of INR477 (14x FY15E EPS).

Alok Dalal(Alok.Dalal@MotilalOswal.com);+91

22 39825584

Hardick Bora(Hardick.Bora@MotilalOswal.com);+91

22 3982 5423

Investors are advised to refer through disclosures made at the end of the Research Report.