30 July 2013

1QFY14 Results Update | Sector:

Consumer

Colgate

BSE SENSEX

19,593

Bloomberg

S&P CNX

5,832

CLGT IN

CMP: INR1,408

TP: INR1,400

Neutral

Equity Shares (m)

136.0

M.Cap. (INR b) / (USD

191.5/3.2

b)

52-Week Range (INR) 1,580/1,116

1, 6, 12 Rel. Per (%)

0/1/6

Financials & Valuation (INR b)

Y/E MAR

2013 2014 2015E

Net Sales

30.8

35.4

41.0

EBITDA

Adj PAT

Adj.EPS INR

Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

6.6

5.0

36.5

11.3

38.1

108.4

108.5

39.4

37.8

7.9

5.9

43.1

18.1

46.0

102.6

102.7

33.4

31.3

9.2

6.9

50.6

17.4

55.3

99.9

100.0

28.4

26.0

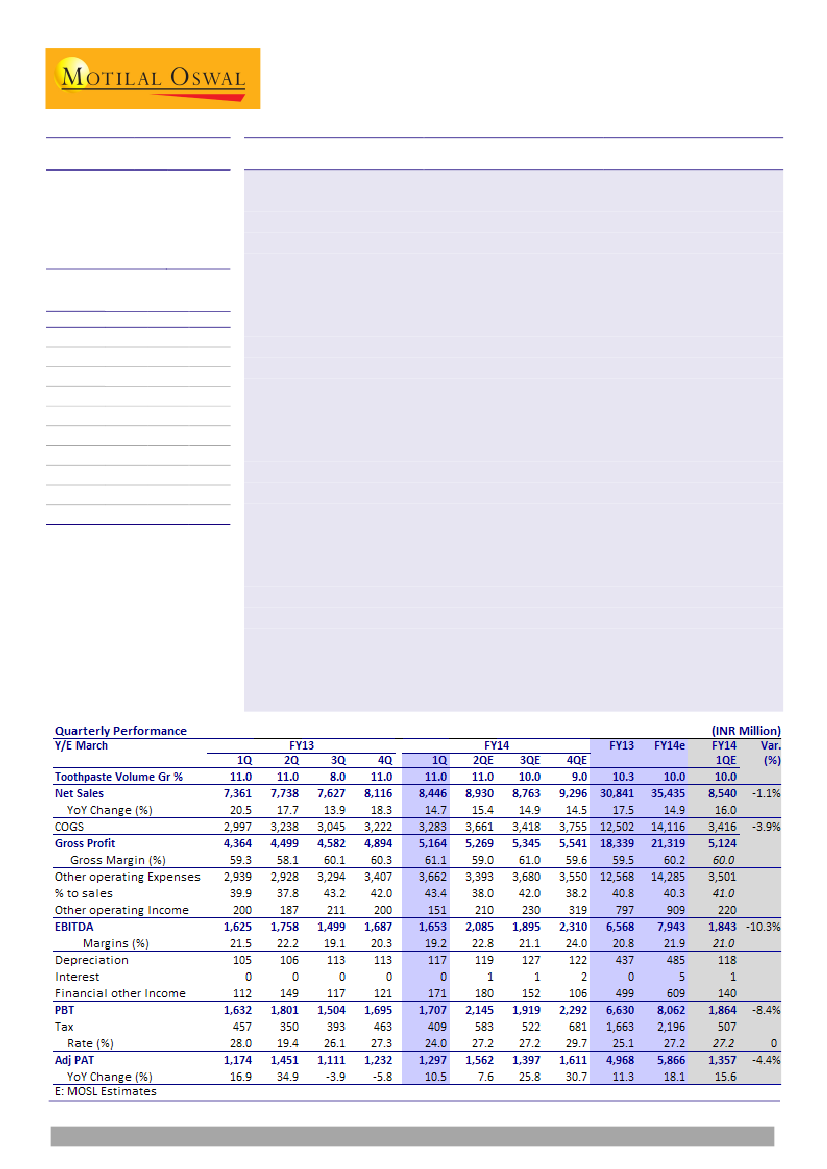

1QFY14 performance mixed:

Colgate Palmolive (CLGT) posted mixed

performance for 1QFY14. While volume growth was strong and market share

increased, profitability was weak. Sales grew 14.7% to INR8.45b (our estimate:

INR8.54b), EBITDA margin declined 230bp to 19.2% (our estimate: 21%) and

adjusted PAT grew 10.5% to INR1.29b (our estimate: INR1.36b).

Market share up:

Toothpaste volumes grew 11% (on a base of 11% growth in

1QFY13 and 14% in 1QFY12). CLGT’s market share in Toothpastes increased 120bp

YoY to 55.9% for the period January - June 2013. Overall volume growth was 9%.

EBITDA margin contracts:

Gross margin expanded 110bp to 61.1% (our estimate:

60%). However, 70bp increase in ad spends and 400bp rise in other expenditure

dragged EBITDA margin by 230bp to 19.2% (our estimate: 21%). EBITDA remained

flat YoY at INR1.65b (our estimate: INR1.84b). Financial other income grew 53%.

Adjusted PAT grew 10.5% to INR1.29b (our estimate: INR1.36b). Adjusting for

exceptional items net of tax, core tax rate was 24%, down 400bp.

Focusing on market share:

After P&G’s entry into Toothpastes, we note a

significant step-up in advertising and promotion activity (alternate day front page

print advertising, aggressive TV slots, consumer offers, saver packs, etc). We

believe CLGT is prioritizing market share and volume gains over profitability, and

rightly so. We like the aggression with which it is fighting for market share,

despite the short term impact on its margins and profitability.

Maintain Neutral:

Notwithstanding the miss on margins, we believe CLGT’s

success in defending market share will have an overbearing impact on valuations.

Contrary to the street, we do not expect significant impact of P&G’s entry on

CLGT’s market share. Maintain

Neutral

with a target price of INR1,400 (28x FY15E

EPS). The stock trades at 33.4x FY14E and 28.4x FY15E EPS. Slowdown in rural

consumption and internecine price war in the Toothpaste category are key risks.

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Investors are advised to refer through disclosures made at the end of the Research Report.