12 August 2013

1QFY14Results Update | Sector:

Healthcare

Cipla

BSE SENSEX

18,947

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel.Per (%)

S&P CNX

5,612

CIPLA IN

802.9

435/347

8/9/11

CMP: INR415

TP: INR425

Neutral

M.Cap. (INR b) / (USD b) 333.2/5.5

Financials & Valuation (INR b)

Y/E MAR

Sales

EBITDA

Net Profit

Adj. EPS

BV/Sh.

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2013

82.8

22.0

13.1

16.4

112.2

14.6

20.4

25.3

3.7

2014E 2015E

100.6

23.0

15.1

18.8

14.6

127.5

14.7

18.5

22.1

3.3

115.5

25.9

17.0

21.2

13.1

144.0

14.7

19.1

19.5

2.9

EPS Gr. (%) 16.9

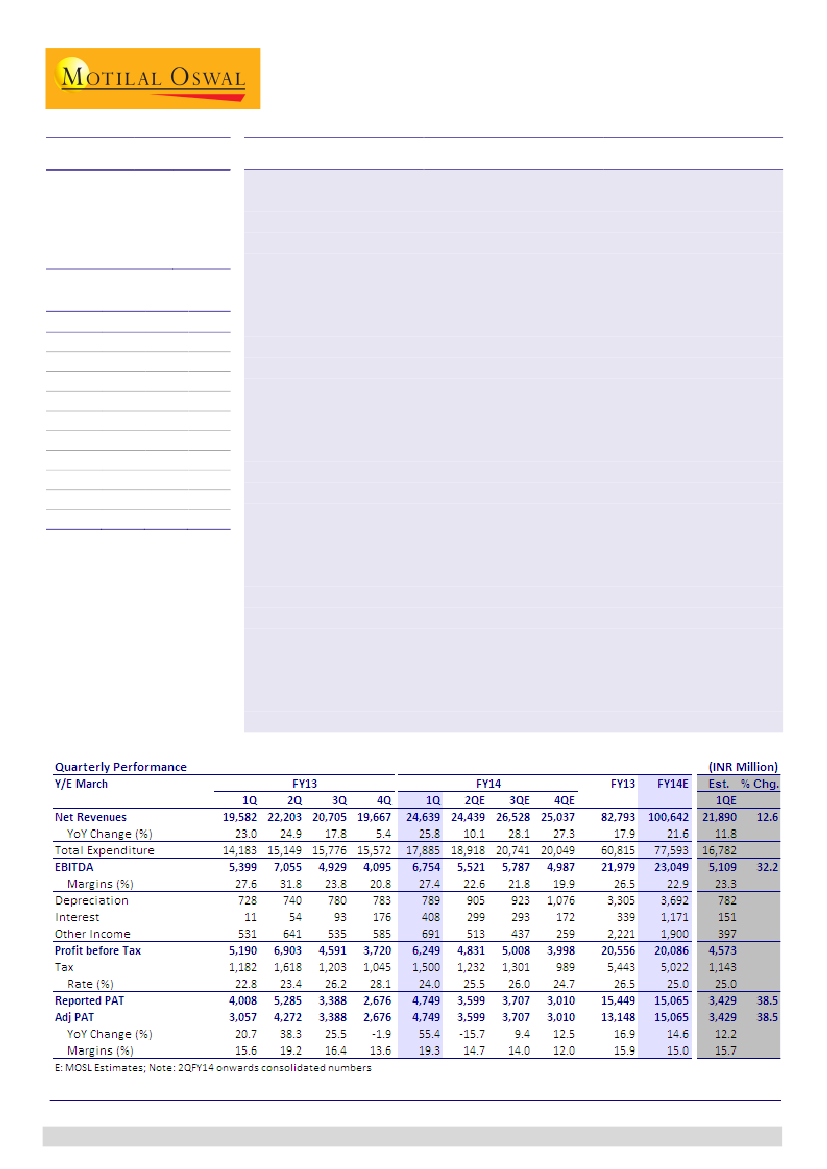

Reported revenue grew 26% YoY to INR24.6b (v/s est. of INR21.9b), reported

EBITDA grew 25% YoY to INR6.75b (v/s est. of INR5.1b) and reported PAT grew

18% to INR4.75b (v/s est. of INR3.4b).

Growth was driven by domestic sales, up 18% YoY (v/s est. of flat growth), and 4x

growth YoY in other operating income (v/s est. of 26%), which included a one-

time milestone payment from Meda for Dymista (not quantified, but we estimate

it at ~USD20-22m).

Reported EBITDA margin was down mere 20bp YoY to 27.4% (v/s est. 23.3%) due

to the licensing income, adjusted for which margins are in line with estimates.

Adjusted for one-off sales in 1QFY13 and the licensing income this quarter, we

estimate that core sales grew 34% YoY (v/s est. 25%), core EBITDA grew 32% YoY

(v/s est. of 23%) and adjusted PAT grew 24% YoY (v/s est. of 12%).

FY14 guidance:

Management has guided for 14-15% sales growth (organic) for

FY14, driven by export formulations. Domestic formulations’ growth is pegged at

12-14% after considering 2-3% impact of the new drug policy. Without giving any

specific guidance on the EBITDA margin, management indicated that profitability

may be impacted by higher R&D expenses (guided at 4-5% of sales) and higher

staff costs. Tax rate is guided at 25%, while capex will be INR4b (apart from the

addition of INR1.5-2b from CWIP).

Post 1QFY14 earnings, we upgrade EPS estimates for FY14E/15E by 4% to reflect the

benefit from Cipla Medpro acquisition, which is partially offset by expected negative

impact of DPCO 2013. Factors driving performance in 1QFY14 are also non-recurring

in nature. The coming quarters will be challenging for Cipla due to the impact from

new pricing policy and increasing pressure on profitability due to rising manpower,

R&D and interest costs. We estimate core EPS of INR18.8 for FY14E (up 15% YoY) and

INR21.2 for FY15E (up 13% YoY). The stock trades at 22.1x FY14E and 19.5x FY15E

earnings. We maintain

Neutral

with a revised target price of INR425 (20x FY15E EPS).

Alok Dalal(Alok.Dalal@MotilalOswal.com);+91

22 3982 5584

Hardick Bora(Hardick.Bora@MotilalOswal.com);+91

22 3982 5423

Investors are advised to refer through disclosures made at the end of the Research Report.