17 August 2013

1QFY14 Results Update | Sector:

Financials

LIC Housing Finance

BSE SENSEX

19,368

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

5,742

LICHF IN

504.7

91.4/1.5

300/154

-20/-28/-38

Financials & Valuation (INR b)

Y/E MAR

NII

PPP

Adj. PAT

Adj. EPS

(INR)

EPS Gr. (%)

RoAA (%)

RoE (%)

P/E (x)

P/BV (x)

2013 2014E 2015E

15.3

14.5

10.2

20.3

2.2

1.5

16.8

8.9

1.4

18.9

17.8

12.2

24.2

19.4

1.5

17.4

7.5

1.2

23.2

21.8

14.9

29.6

22.3

1.4

18.4

6.1

1.0

CMP: INR181

TP: INR260

Buy

BV/Sh (INR) 128.3 149.3 173.1

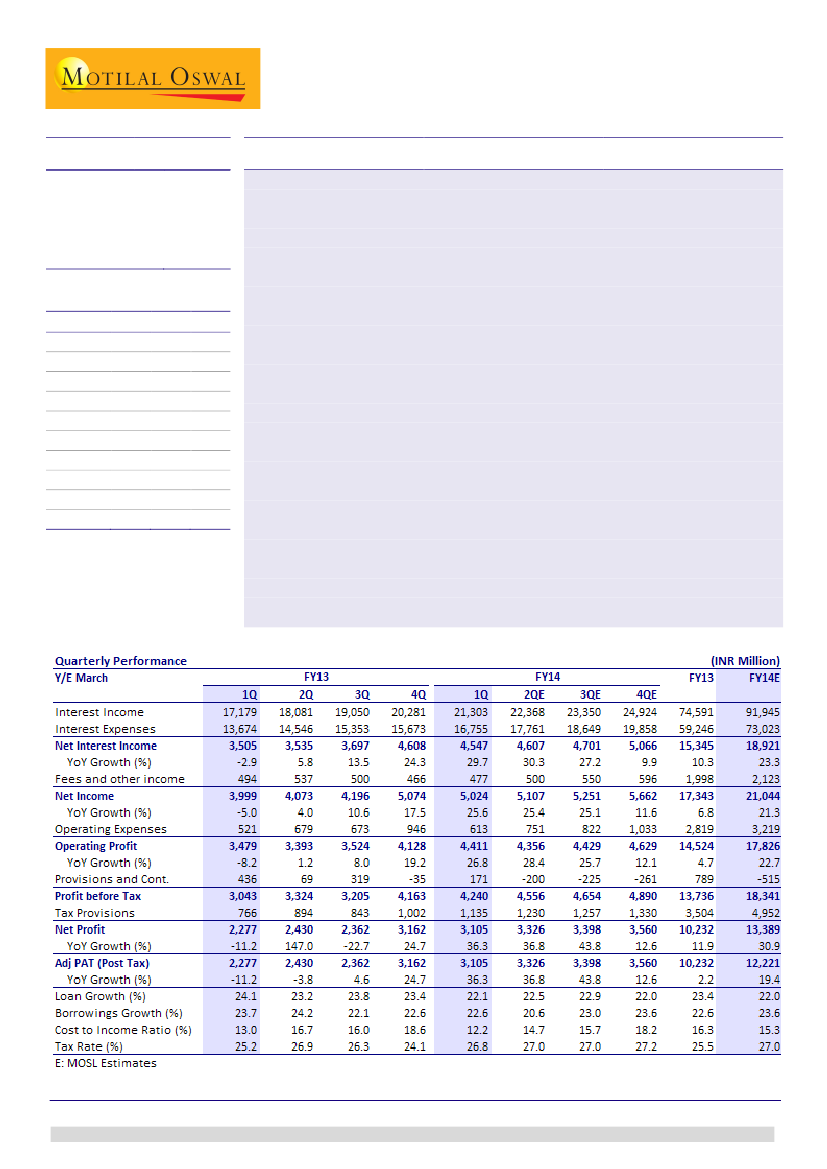

LIC Housing Finance’s (LICHF) 1QFY14 PAT stood at INR3.1b, up 36% YoY and down

2% QoQ (in line with our est. of INR3.1b). Strong loan growth of 22% YoY and 3%

QoQ, led to marginally higher-than-expected NII growth of 30% YoY and flat QoQ

to INR4.54b (3% above est). Seasonal deterioration in asset quality (GNPAs up 38%

QoQ) led to higher-than-expected provisioning of INR171m (v/s est. of INR100m).

Loan growth remained strong (up 22% YoY and 3% QoQ) driven by a robust 24%

YoY and 3.5% QoQ increase in individual loans. Builder loans continued to contract

for the 11

th

consecutive quarter (down 21% YoY and 9.6% QoQ) and now

constitute 3% of overall loans, against 3.4% in 4QFY13 and 4.6% in 1QFY13.

NII grew by 30% YoY and remained largely flat QoQ at ~INR4.54b, led by 12bp YoY

margin expansion to 2.3%. While reported yields increased 10bp YoY to 10.79%,

reported cost of funds remained same at 9.58%.

Asset quality witnessed seasonal deterioration, with absolute GNPAs/NNPAs

increasing 37%/112% sequentially, while GNPAs/NNPAs percentage stood

0.80%/0.52, a decline of 19/16bp sequentially.

Valuation and view:

Despite high interest rates and property prices, volume

growth in the individual loan segment remains fairly strong. Meanwhile,

disbursements in the builder segment continue to remain sluggish. We expect

RoAs to remain healthy at ~1.5% and RoEs at ~18%, after falling sharply in FY13,

and estimate adjusted earnings growth of 20% over FY14E-15E. We believe loan

growth will remain healthy, with asset quality intact in the ensuing quarters. At a

valuation of 1x FY15E BV, the stock is attractively valued and largely discounts the

concerns. Maintain

Buy

with a target price of INR260 (1.5x FY15E BV).

Sunesh Khanna

(Sunesh.Khanna@MotilalOswal.com); +91 22 3982 5521

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Investors are advised to refer through disclosures made at the end of the Research Report.