Monday, September 23, 2013

Market Overview

Commodity

Exchange

NCDEX

NCDEX

NCDEX

NCDEX

NCDEX

NCDEX

NCDEX

MCX

NCDEX

NCDEX

MCX

NCDEX

MCX

Expiry

Oct

Nov

Oct

Oct

Oct

Oct

Oct

Sept

Oct

Nov

Sept

Oct

Oct

Price

2995

5544

4580

13082.5

3384.5

670.6

3489

529.5

2961

1572

876.9

3495

800

October soybean declined 1.5% over the weekend

to close at 3400.50. Soy oil declined over 1.5% to

close at 653.45. CPO rose 0.6% to close at 519.30.

Mustard seed declined 1.75% over the weekend to

close at 3489. Castor seed rose 0.25% over the

weekend to close at 3631.

Concerns regarding health of the standing crop in

soybean that had been driving the market

throughout August have eased considerably. Despite

that, certain sections of the market believe that

yields could be lower than average. More declines

may be seen in the medium term as arrival pressure

builds up over next month. Castor seed may remain

supported around 3560 for the time being.

October Guar seed hit 4% lower circuit limit each on

Friday as well as Saturday. Overall loss for the week

stood at 12.67% as last week’s close was at 7420.

Further declines may be seen over time as rally was

sentiment driven, not supported by fundamentals.

Besides, we are facing a large crop aided by higher

acreage.

October Chana declined another 0.4% over the

weekend to close at 3043. Chana market itself is

well supplied, but prices have been supported since

it is close to MSP (of 3000) and because it is

presently cheapest among other pulses that may be

substituted by the consumers. In the immediate

term, we expect the prices to decline to 3000. A

breach of 2990 may lead further to 2925.

October Jeera declined 1.3% over the weekend to

close at 13260. Chilli tested a high of 5654 on

Saturday, but partly declined to close at 5580,

gaining about 0.5% over the weekend. Coriander

declined 1.2% over the weekend as October

contract closed at 5684. Turmeric rose 1.7% over

the weekend as October contract closed at 4890.

%

Change

-0.03%

-0.14%

1.01%

-0.63%

-1.88%

-0.12%

0.14%

1.22%

1.13%

0.00%

-4.30%

-0.91%

-0.02%

Chana

Chilli

Turmeric

Jeera

Soyabean

Soyoil

R M Seed

CPO

Sugar

Wheat

Mentha Oil

Castor Seed

Potato

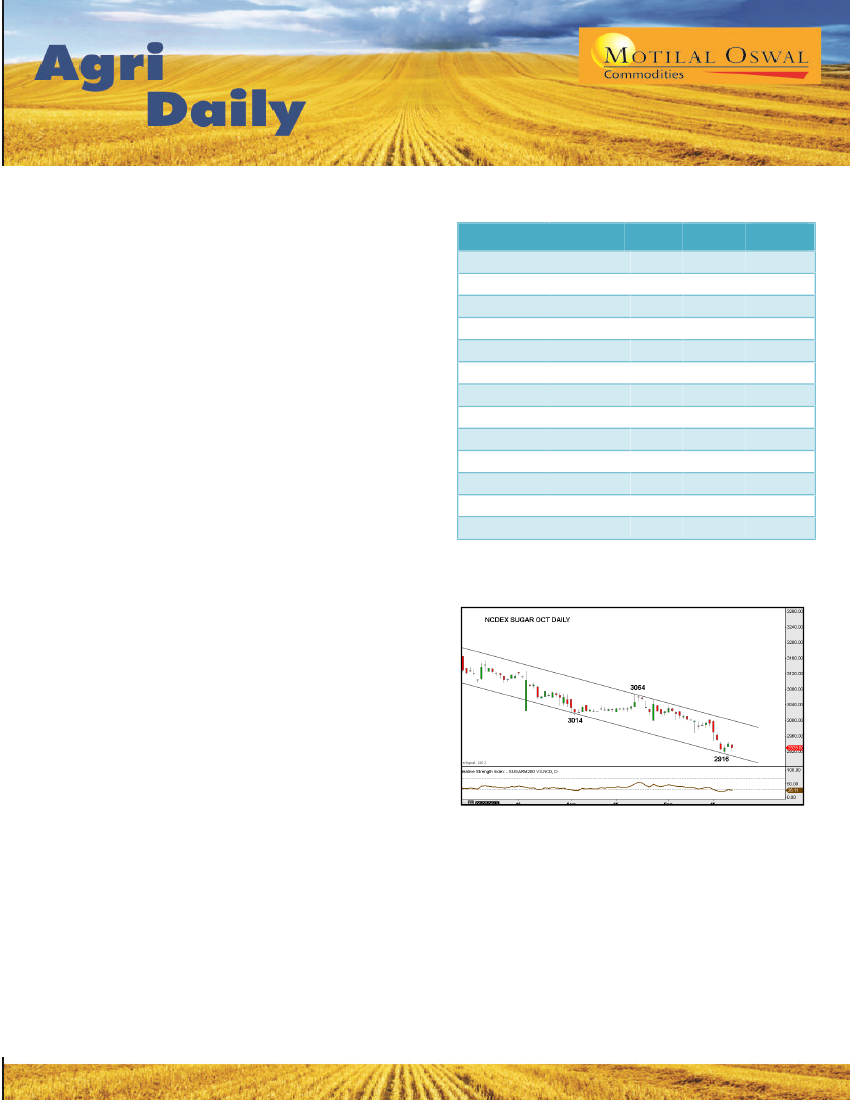

Chart of the Day – Sugar

As shown on daily chart, NCDX sugar recovered

marginally from its low of 2916 which act as strong

support. Till prices holds above the same could see

pullback towards 2970. Buy should be the strategy

with protective stop loss below 2916

1

Please refer to disclaimer at the end of the report.