Monday, October 14, 2013

RBI Reference Rate

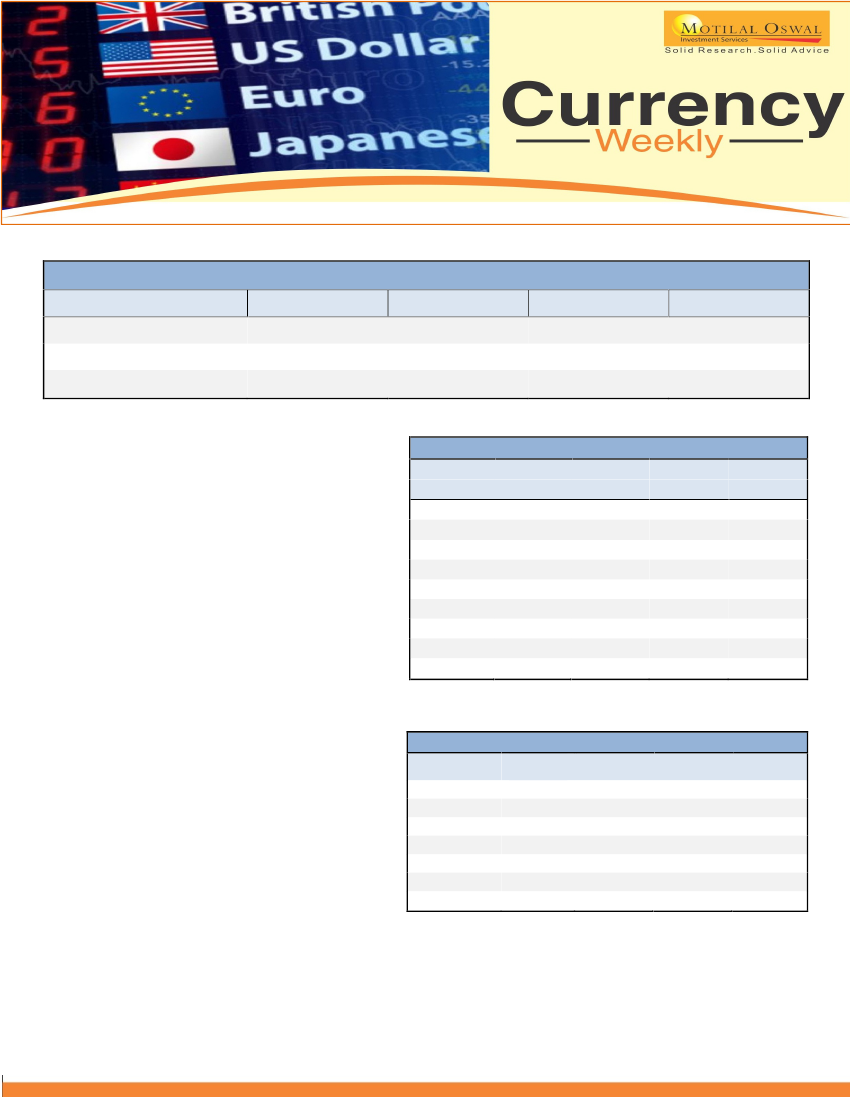

Pair

Last Closing

MTD (%)

YTD (%)

$/

61.157

-7.14%

11.54%

€/

82.7795

-4.91%

14.21%

£/

97.7656

-4.64%

9.57%

¥/

62.1500

-7.02%

-1.68%

The Indian rupee remained range bound for the

major part of the week and appreciated back to its

one month high levels after GoI announced that it

would support the bid to include Indian Bonds in

Global Bond indices. The trade balance number

released in early part of the week provided yet

another reason for home currency to surge against

all major currencies as imports declined by 18% and

exports increased 11%; across the Atlantic the debt

ceiling debate and partial shutdown took its toll on

dollar which saw hefty selling against rival

currencies, though the price action indicate that US

congress would ultimately reach a resolution to

avoid Government default. The continued shut down

in its 3

rd

week, yet again delayed releasing of

Economic data and forced traders to second guess

result outcome. The FOMC statement released on

last Wednesday indicated that most members were

in favor of tapering in current year, if economic data

turned supportive, this was instrumental in

providing stable platform to dollar but, the gains

were reversed on last trading session as Consumer

Confidence declined to its 8 month low causing

greenback to correct.

The Euro faced some selling pressure as light

economic calendar assured the 17 nation currency

swayed in tune with global fund activity, the only

significant data came out from Germany that

indicated economic slowdown. The Sterling also

declined after weak reading of Construction and

Manufacturing PMI. The sign of housing sector

slowdown prompted investors to book profit in GBP.

On Shore

Pair

Contract

Open

Close

1 Week Chg

%change

OI

OI change

Pivot

Resistance

Support

USDINR

October

62.0050

61.325

-0.68

-1.10%

455144

-3602

61.6967

62.2583

60.7633

EURINR

October

84

83.1875

-0.8125

-0.97%

41559

822

83.5367

84.5808

82.1433

GBPINR

October

99.3425

97.9475

-1.395

-1.40%

18180

-2776

98.7175

99.7825

96.8825

JPYINR

October

63.7725

62.3475

-1.425

-2.23%

6830

462

62.6758

64.0517

60.9717

Off Shore

Pair

Open

Close

1 Week Chg

%change

Pivot

Resistance

Support

Dollar

Index

80.0550

80.4120

0.357

0.45%

80.2813

80.7257

79.9677

EURUSD

1.3555

1.3541

-0.0014

-0.10%

1.3544

1.3604

1.3482

GBPUSD

1.6017

1.5954

-0.0063

-0.39%

1.5997

1.6081

1.5869

USDJPY

97.42

98.56

1.14

1.17%

97.90

99.25

97.21

Please refer to the disclaimer at the end of the report.