1 November 2013

2QFY14 Results Update | Sector:

Healthcare

Dr Reddy’s Labs

BSE SENSEX

21,165

Bloomberg

S&P CNX

6,299

DRRD IN

CMP: INR2,456

TP: INR2,883

Buy

Equity Shares (m)

170.0

M.Cap. (INR b) / (USD

417.6/6.8

b)

52-Week Range (INR) 2,545/1,712

1, 6, 12 Rel. Per (%)

-6/15/25

Financials & Valuation (INR Billion)

Y/E MAR

Sales

EBITDA

Net Profit

Adj. EPS

BV/Sh.

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2013

116.3

24.8

15.1

90.2

435.4

20.7

17.2

27.2

5.6

2014E 2015E

135.0

29.4

19.2

114.4

26.8

536.3

21.3

17.7

21.5

4.6

150.4

33.8

22.0

131.0

14.5

651.1

20.1

18.5

18.7

3.8

EPS Gr. (%) 21.9

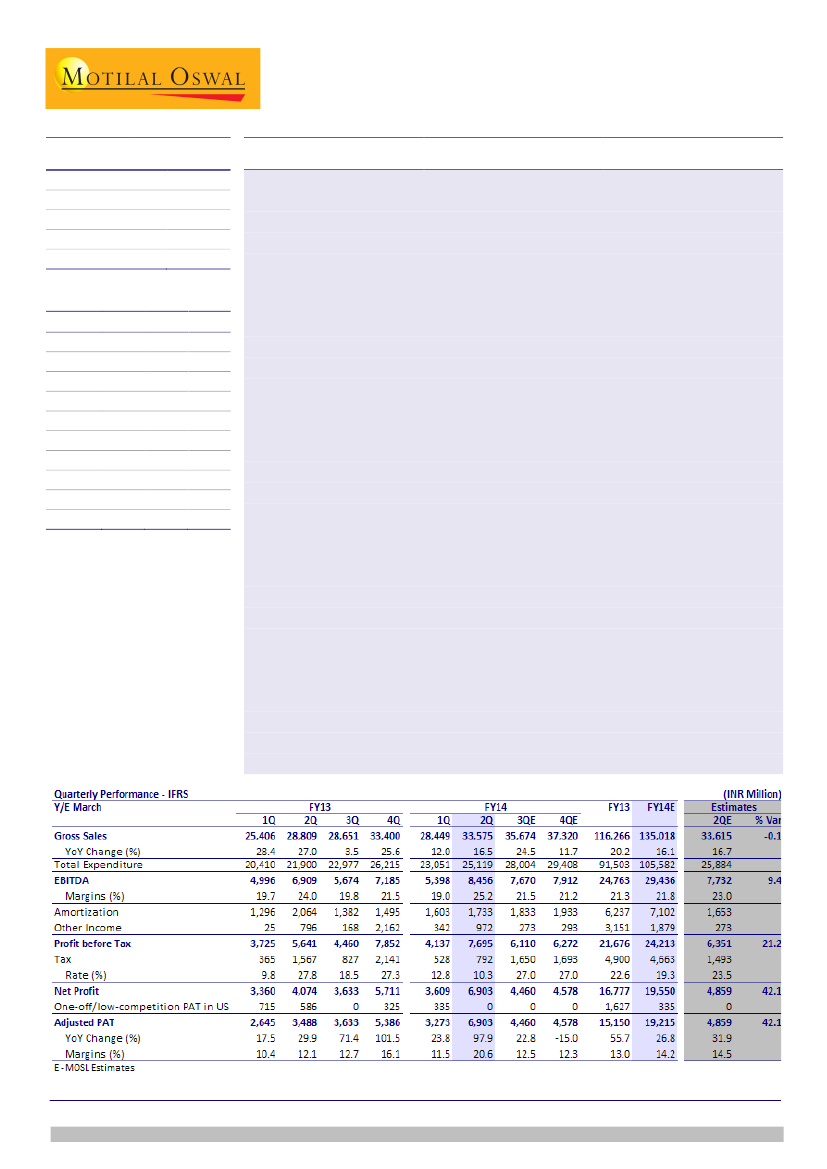

Dr Reddy’s Labs (DRRD) 2QFY14 results were above estimates. Sales growth of

16.5% YoY to INR33.5b was in line with estimates, EBITDA growth of 25% (beat

our est. by 9%), while PAT grew 98% YoY to INR6.9b (beat of 42%).

Sales growth was driven by strong traction in US/Russia (24%/40% YoY growth in

constant currency); India sales growth at 8% YoY was in line. PSAI growth declined

19% YoY to INR6.4b due to absence of new launches during the quarter.

EBITDA margin improved 120bp YoY to 25.2% led by a strong product mix. PAT

beat was led by higher other income and lower effective tax rate (10% tax rate,

lower due to reversal in tax position of INR683m for the quarter). Adjusted for

these, PAT is higher by 15%, compared to our estimates.

Company has purchased Ecologic Chemicals, which has equity interest from

owners of DRRD for a consideration of INR1.26b. Ecologic Chemicals is India’s

largest manufacturer of DL-Naproxen, an intermediate to DRRD’s key product,

Naproxen. Rationale for the acquisition is to have better control over the supply

agreement as DRRD sees strong traction in this market. Consideration has been

determined by independent evaluators. While we do not have further details, we

derive confidence from the strong corporate governance track record of the

company.

Valuation and view:

Limited competition product launches in the US continue to gain

traction and its impact would be visible over the next few quarters. Products like

gDacogen, gReclast, gVidaza injections and pipeline of 65 pending ANDAs will support

strong growth in the US over the medium term. We expect Russia to continue its

growth momentum; India business has demonstrated steady growth over the last few

quarters, which is encouraging. We expect PSAI to demonstrate muted growth over

the next few quarters and a strong performance there would be a positive surprise.

On the back of 2Q beat, we increase the FY14E/FY15E EPS by 8%/3%. The stock trades

at attractive valuations of 21.3x FY14E and 18.7x FY15E. We value DRRD at 22x FY15E

earnings to reflect the strong CAGR of 21% in core earnings expected over FY13-15E.

Maintain

Buy

with a revised target price of INR2,883, 17% upside.

Alok Dalal

(Alok.Dalal@MotilalOswal.com); +91 22 3982 5584

Hardick Bora

(Hardick.Bora@MotilalOswal.com); +91 22 3982 5423

Investors are advised to refer through disclosures made at the end of the Research Report.