1 November 2013

2QFY14 Results Update | Sector:

Healthcare

Glenmark Pharma

BSE SENSEX

21,197

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel.Per (%)

S&P CNX

6,307

GNP IN

271.0

612/418

-8/0/12

CMP: INR540

TP: INR610

Buy

M.Cap. (INR b) / (USD b) 146.4/2.4

Financials & Valuation (INR b)

Y/E MAR

Sales

EBITDA

Net Profit

Adj. EPS

(INR)

EPS Gr. (%)

BV/Sh.

(INR)

RoE (%)

RoCE (%)

Valuations

P/E (x)

29.3

23.0

4.4

13.0

0.6

17.7

3.6

11.2

0.7

P/BV (x)

5.3

EV/EBITDA 15.9

( )

Div.Yld (%) 0.4

2013 2014E 2015E

50.1

10.6

5.0

18.4

53.9

102.0

18.1

16.1

60.5

12.5

6.4

23.5

27.6

122.4

19.2

18.8

13.9

70.5

14.4

8.3

30.5

29.7

148.2

20.6

20.5

15.2

Payout (%) 10.2

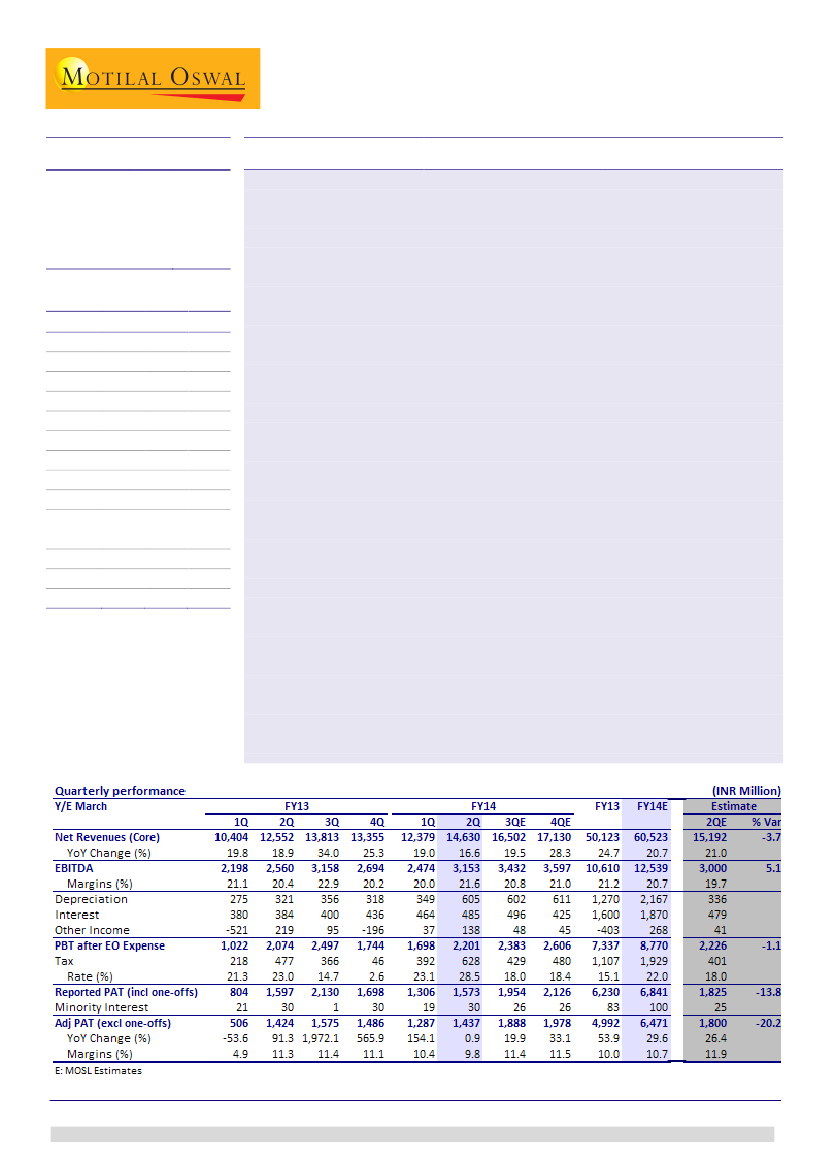

Operational performance in-line:

Glenmark (GNP) posted in-line operational

performance for 2QFY14. Core sales (excluding licensing income) grew 19% YoY to

INR14.5b (v/s our estimate of INR15.2b). Core EBITDA grew 28% YoY to INR3b (in

line) and core PAT grew 1% YoY to INR1.4b (v/s our estimate of INR1.8b). Licensing

income was INR118m (we had not anticipated any licensing income for the

quarter).

Sales growth in LatAm, semi-regulated markets slower than expected:

Sales

growth was driven by stronger than expected growth in domestic formulations (up

21% YoY) and US generics business (30% YoY, partly currency-led). In LatAm (down

3% YoY) and semi-regulated markets (down 11% YoY), sales growth was slower

than expected.

Adjusted PAT significantly below estimate:

Core EBITDA margin expanded 150bp

YoY to 20.9% (v/s 19.7%), driven by better sales mix, with increasing contribution

from recently launched products in the US. Adjusted PAT was significantly below

estimate despite strong EBITDA margin, due to higher depreciation and taxes

(effective tax rate at 28.5% v/s our estimate of 18%).

Guidance:

While GNP has maintained its 20% sales growth guidance for FY14, to

be driven by the US and India, it expects to exceed its earlier EBITDA guidance of

INR12.25b. On the negative side, GNP has raised its tax rate guidance to 22-23%

from 19%, and has indicated higher depreciation, going forward.

Cutting estimates; maintain Buy:

Post 2QFY14 results, we have cut our FY14/FY15

EPS estimates by 7%/4%, mainly due to higher depreciation and tax expense,

despite estimating higher EBITDA growth. We expect GNP to gradually reduce its

net debt over FY14-15, resulting in D/E improving from 1x in FY13 to 0.6x by FY15.

GNP has differentiated itself among Indian pharmaceutical companies through its

significant success in NCE research (resulting in licensing income of USD205m till

date). Given this success, GNP has been aggressive in adding new NCEs to its

pipeline, which will put pressure on its operations in short-to-medium term, as it

will have to fund R&D expenses for these NCEs. The stock trades at 23x FY14E and

17.7x FY15E EPS. Maintain

Buy

with a revised target price of INR610.

Alok Dalal(Alok.Dalal@MotilalOswal.com);+91

22 3982 5584

Hardick Bora(Hardick.Bora@MotilalOswal.com);+91

22 3982 5423

Investors are advised to refer through disclosures made at the end of the Research Report.