29 October 2013

2QFY14 Results Update | Sector:

Metals

JSW Steel

BSE SENSEX

20,929

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,221

JSTL IN

241.7

894/452

11/15/5

CMP: INR861

TP: INR510

Sell

Strong performance helped by exports

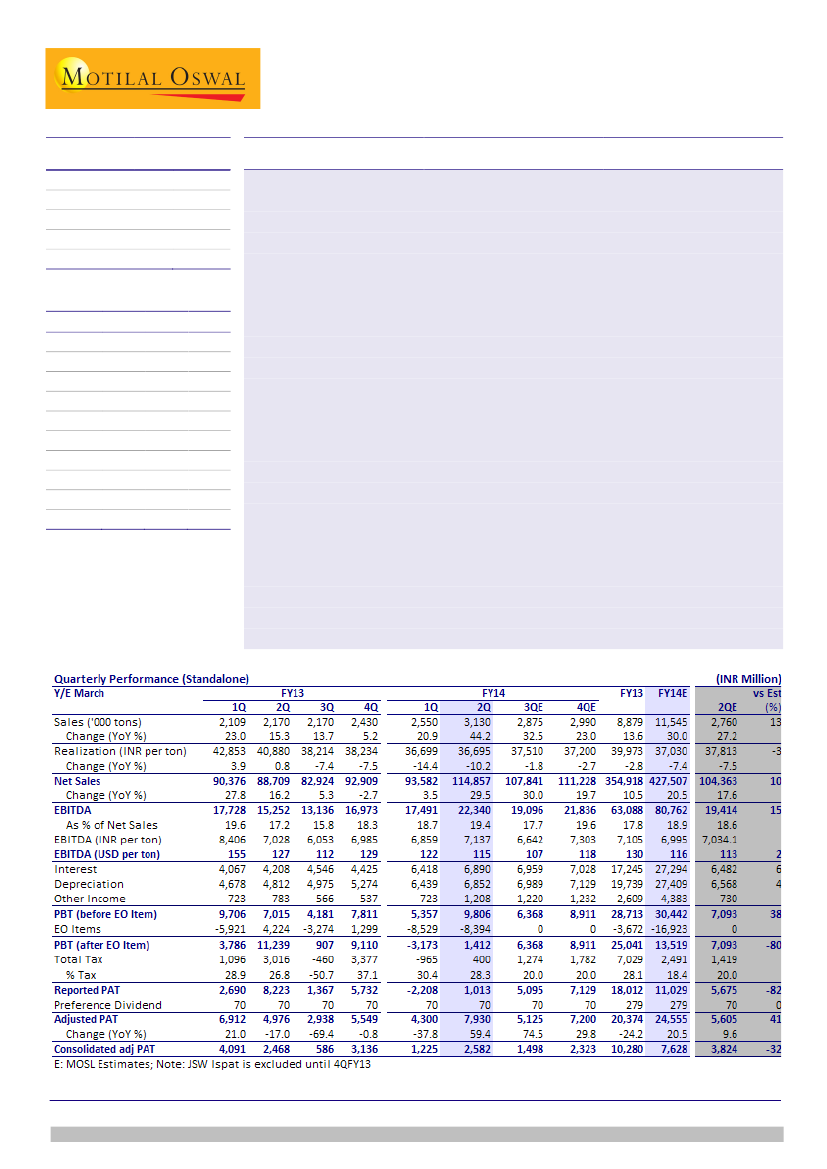

JSW Steel reported strong growth in sales volume and EBITDA driven by exports.

Margins too improved due to various improvements in operations.

Adjusted standalone PAT increased 84% QoQ to INR7.9b, i.e. 41% above est.

largely due to stronger than expected sales volumes on account of liquidation of

inventories.

Consolidated adj. PAT increased 111% QoQ to INR2.6b. Performance of

subsidiaries was still a drag. Reported consolidated PAT (post MI &asso.) of

INR1.15b included forex loss of INR8.5b.

Forex loss was aggravated due to mid quarter change in hedging strategies. JSW

steel is now fully hedging short term forex borrowing and corresponding forward

export revenues. This will better reflect actual business margins, in our view.

Net debt on balance sheet is ~INR400b (including acceptances), which is higher

than our estimate for FY14 end of INR378b. Net debt on balance sheet may

further increase despite cut in capex. Net working capital is likely to rise due to

stretching of credit period by domestic customer.

Weakening steel prices in international market and appreciation of USD/INR rate

is shrinking the export opportunity. Although Indian steel demand is expected to

improve in 2HFY14 due to seasonal factors, yet the import pressure/reducing

exports trend is likely to put pressure on domestic steel prices.

JSW steel continues to improve its operation through right strategic investments,

yet the ballooning debt keeps eroding equity value. Stock trades at FY15

EV/EBTIDA of 6.6x. We value the stock at INR510/share based on SOTP.

Sell.

M.Cap. (INR b) / (USD b) 208.1/3.4

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

Adj.EPS

(INR)

Growth

(%)

BV/Share

(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2013

382.1

65.0

8.9

49.7

-25.3

764.8

7.7

8.4

17.3

1.1

2014E 2015E

483.0

85.7

2.4

31.6

-36.5

680.5

11.5

10.1

27.3

1.3

489.8

88.5

7.1

43.8

38.8

696.0

9.2

9.5

19.7

1.2

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Pavas Pethia

(Pavas.Pethia@MotilalOswal.com); +91 22 3982 5413

Investors are advised to refer through disclosures made at the end of the Research Report.