6 November 2013

2QFY14 Results Update | Sector:

Capital Goods

BHEL

BSE SENSEX

20,895

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,215

BHEL IN

2,447.6

248/100

-9/-33/-51

CMP: INR141

TP: INR148

Neutral

M.Cap. (INR b) / (USD b) 343.8/5.5

Financials & Valuation (INR b)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS (INR)

2013

484.2

93.9

65.5

2014E 2015E

395.1

47.1

35.0

14.3

(46.5)

133.3

11.1

11.4

9.8

1.1

319.9

36.1

24.1

9.9

(31.1)

139.7

7.2

7.5

14.2

1.0

26.8

EPS Gr. (%) (4.9)

( 9)

BV/Sh.

124.4

(INR)

RoE (%)

23.5

RoCE (%)

P/E (x)

P/BV (x)

24.5

5.2

1.1

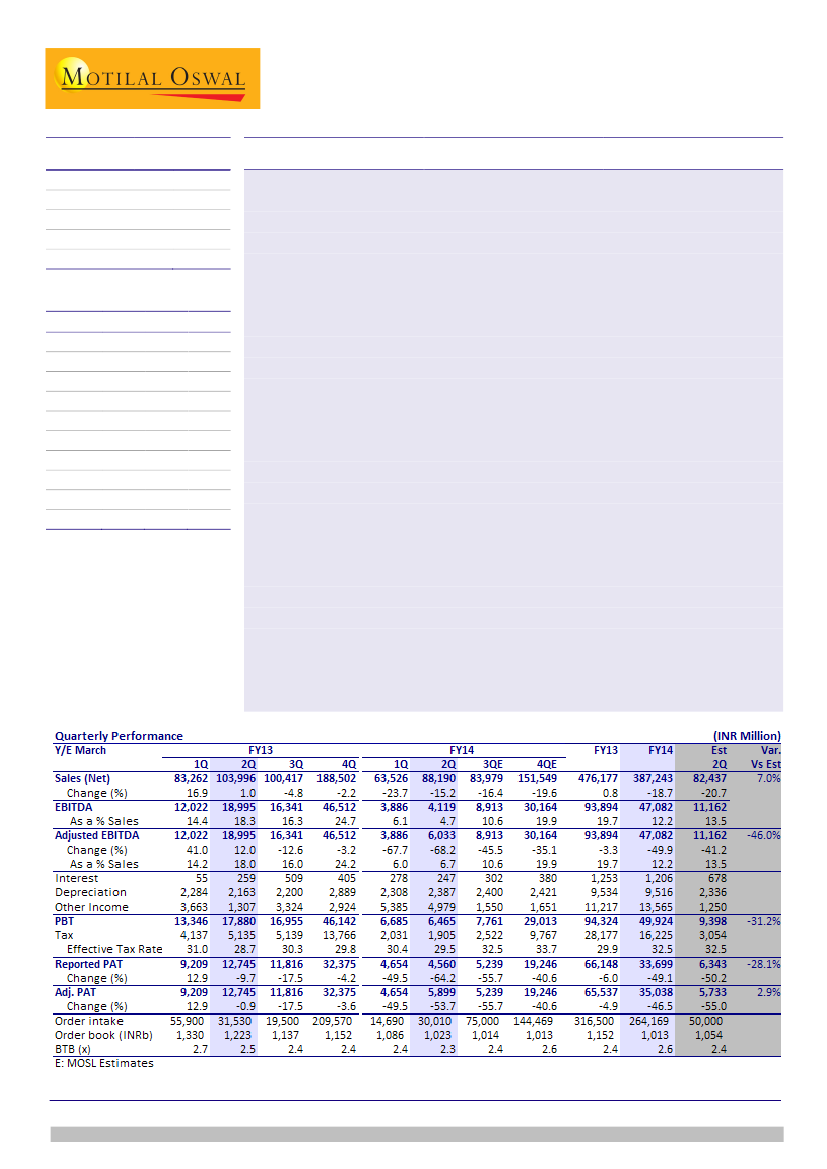

BHEL’s 2QFY14 revenues were significantly above est. at INR88.2b (down 15%

YoY) vs est. of INR82.4b (down 21% YoY) and adjusted EBIDTA margins at 6.7%

(down 1130bps). Adjusted PAT at INR5.9b (down 53.7% YoY) was in-line with

estimates of INR5.7b (down 55%) and is supported by increased other income at

INR5b (which includes INR3.7b as forex gains on receivables). Adj. to EBIDTA /

PAT pertains to PBT loss of INR1.9b on merger of BHPV, and is largely related to

readjustment of staff costs of INR1.4b (based on BHEL’s norms for actuarial

valuations, etc) and is thus one-time in nature.

Margins declined steeply in 2QFY14 given poor fixed cost absorption with

adjusted staff costs at 16.3% (up 231 bps) and SGA expenses at 18.1% (up 819

bps), while RM costs as % of revenues also increased to 59.3% (up 128bps). We

are perplexed by the sharp increase in SG&A expenses to 18.1% of revenues, and

is partly explained by provisions of INR4.3b pertaining to bad and doubtful debts /

liquidated damages, etc.

Gross order inflow was just INR30b (power sector INR8.8b, Industry INR16.5b,

international sector INR4.7b). The management stated that BHEL is favorably

positioned in ~5GW of projects to be awarded in 2HFY14.

Working capital situation continues to be stretched and debtors at the end of

2QFY14 stood at INR386b (including INR208b of retention money to be released

on project completion). Net Cash balance at the end of 2QFY14 declined to

INR54b, down 15% since March 2013.

To factor in the constrained macro environment, we are cutting FY14 / FY15

estimates by 18% and 9% respectively. We now expect BHEL to report EPS of

INR14.3/sh (down 47%) in FY14 and INR9.9/sh (down 31.1%) in FY15. At the CMP

of INR141, BHEL trades 9.8x / 14.2x its FY14E / FY15E EPS. We maintain

Neutral

rating on BHEL with a revised target of INR148 (15x FY15 EPS).

Satyam Agarwal

(AgarwalS@MotilalOswal.com); +91 22 3982 5410

Nirav Vasa

(Nirav.Vasa@MotilalOswal.com); +91 22 3982 5422

Investors are advised to refer through disclosures made at the end of the Research Report.