8 November 2013

2QFY14 Results Update | Sector:

Technology

Tech Mahindra

BSE SENSEX

20,823

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,187

TECHM IN

231.9

368.7/5.9

1,605/865

6/58/53

CMP: INR1,580

TP: INR1,84

Buy

Financials & Valuation (INR b)

Y/E MAR

Net Sales

EBITDA

Adj PAT

Adj.EPS

(INR)

Gr. (%)

2013 2014E 2015E

143

30.6

19.8

93.0

32.1

186

40.8

26.6

124.6

34.0

204

42.6

30.2

141.5

13.6

537.9

30.8

30.1

11.2

3.0

BV/Sh(INR) 321.3 408.0

RoE (%)

32.6 34.7

RoCE (%)

35.3 34.6

P/E (x)

P/BV (X)

17.1

4.9

12.8

3.9

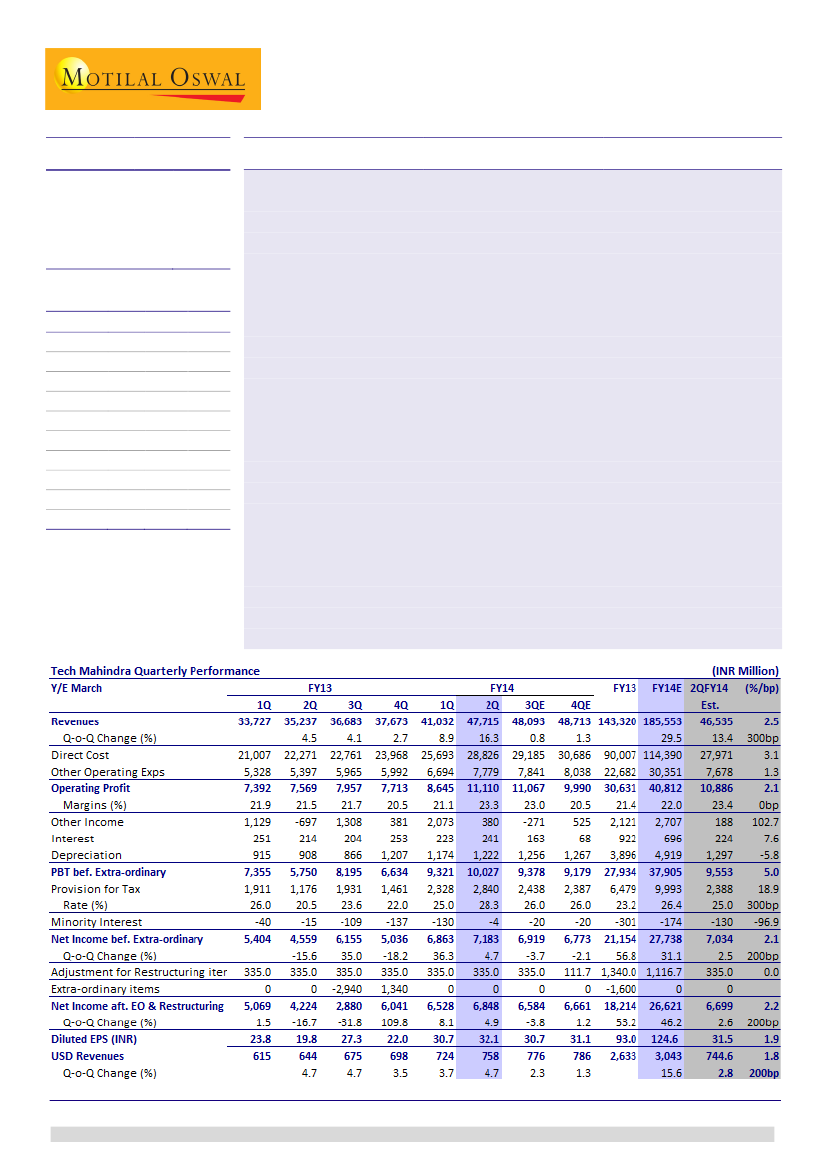

2QFY14 results beat expectations:

TECHM’s 2QFY14 revenue grew 4.7% QoQ (and

5% QoQ CC) to USD758m, above our estimate of USD745m. EBITDA margin

expanded 220bp QoQ to 23.3%, in line with our estimate. PAT after adjusting for

restructuring fees was INR6.85b, marginally ahead of our estimate of INR6.7b.

Healthy deal wins:

TECHM announced 13 significant deal wins during the quarter,

with a total TCV of ~USD500m, much higher than three large wins of USD50m-

75m TCV each announced in the previous quarter. Notably, the wins announced

are new businesses won with new clients.

Comfortable balance sheet:

TECHM continued to repay debt, which has now been

brought down to INR3.35b from INR11.6b two quarters ago. Cash position at

INR32.7b remains healthy.

Tightening in BT continues:

TECHM has discontinued disclosing top client revenue

contribution and only shares revenue contribution from top-5 client onwards.

There has been no change in gradual declining revenue trend from the account.

However, it remains a significant customer from TECHM’s perspective and its

wallet share is inching up in BT.

Revising estimates, target price:

We have raised our USD revenue estimates for

FY14/FY15 by 1.6%/2.8% on the back of multiple positives. We expect TECHM to

grow its USD revenue at a CAGR of 13.6% and EPS at a CAGR of 23.4% over FY13-

15. In 2QFY14, TECHM demonstrated improving prowess in winning deals to hive

off any impact from a weak BT account in particular, and Telecom in general. Our

revised target price of INR1,840 discounts FY15E EPS by 13x (v/s 12x earlier).

Maintain

Buy.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Siddharth Vora

(Siddharth.Vora@MotilalOswal.com); +91 22 3982 5585

Investors are advised to refer through disclosures made at the end of the Research Report.