12 November 2013

2QFY14 Results Update | Sector:

Metals

Hindalco

BSE SENSEX

20,282

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,018

HNDL IN

2,064.6

137/83

-1/2/-10

n

n

n

CMP: INR111

TP: INR154

Buy

Below estimate; copper rebounds; operational issues affected

Indian aluminum; deleveraging at Novelis has begun

n

M.Cap. (INR b) / (USD b) 229.6/3.6

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

Adj.EPS

(INR)

Growth(%)

BV/Share

(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2013

801.9

80.6

32.5

17.0

-4.4

100.7

18.0

5.8

6.6

1.1

2014E 2015E

872.6

87.5

25.3

12.2

-27.8

110.6

11.6

5.1

9.1

1.0

991.4

112.5

28.4

13.8

12.3

122.7

11.8

6.5

8.1

0.9

n

n

n

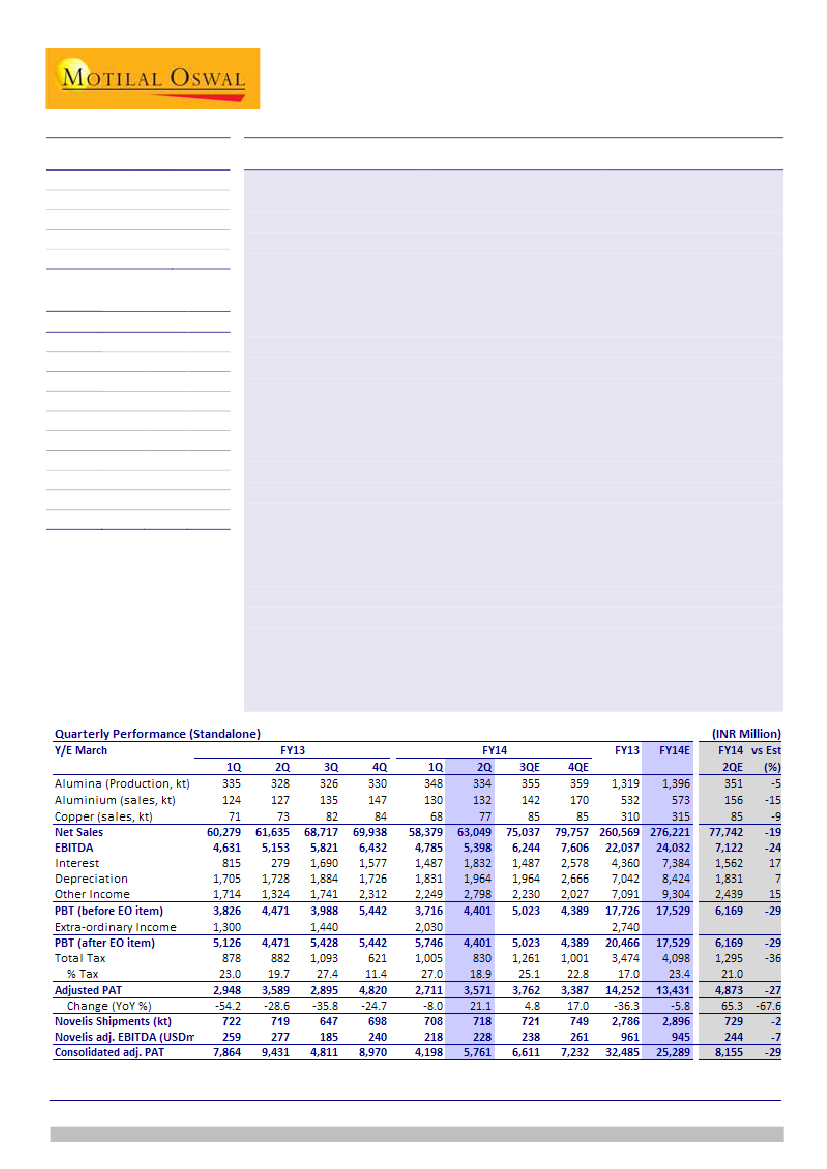

Standalone adjusted PAT flat YoY at INR3.57b (v/s est. of INR4.9b). EBITDA

increased 5% YoY (+13% QoQ) to INR5.4b (v/s est. of INR7.1b).

The operating performance of Indian aluminum business is improving slower-

than-expected due to slower growth in production and certain operational issues.

Indian copper EBIT rebounds to USDc23/lb (flat YoY) post a shutdown in 1QFY14.

Currency depreciation and 5% higher volumes led to an EBIT growth of 15%.

Novelis adj. EBITDA increased 5% QoQ to USD228m on 1% higher volumes.

EBITDA/ton was up 3% QoQ to USD318 as the benefits of expansion in S. America

have started to kick in, with strong volumes growth of 14% YoY. Although results

for the quarter are below our estimates, yet earnings are improving. Management

guided for stronger 2HFY14 (despite seasonally weak 3Q) driven by volumes and

margin expansion. We believe this is the beginning of earnings upcycle.

As Novelis is exiting the heavy investment phase, benefits of (1) volume growth,

(2) superior share of high margin auto business and (3) end of margin pressure in

N. American can business etc will drive earnings and deleveraging.

We cut LME est by USD100/t to USD1,800/t for 3Q and by USD50/t to USD1,900/t

for 4Q FY14E. LME assumptions for FY15E are kept unchanged at USD2,000/t

(INR/USD 60). Further, we increase the cost of production of aluminum to factor

certain issues highlighted in the results. Mahan smelter’s commercial production

too is pushed back to 4QFY14. Thus, FY14E/15E EPS is cut 13%/8% to

INR12.2/13.8, while SOTP-based target price is cut to INR154/share (v/s INR165).

We continue to believe that peaking of capex and improving cash flows will lead

to deleveraging, which will drive equity value. HNDL trades at attractive cons.

EV/EBITDA of 6.5x (not adj. for CWIP) and P/BV of 0.9x (BV adj. for goodwill).

Buy.

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Pavas Pethia

(Pavas.Pethia@MotilalOswal.com); +91 22 3982 5413

Investors are advised to refer through disclosures made at the end of the Research Report.