12 November 2013

2QFY14 Results Update | Sector:

Utilities

NHPC

BSE SENSEX

20,491

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,079

NHPC IN

12,300.7

29/15

-4/-14/-26

CMP: INR18

TP: INR21

Neutral

M.Cap. (INR b) / (USD b) 225.1/3.5

Financials & Valuation (INR b)

Y/E MAR

Net Sales

EBITDA

Adj PAT

Adj.EPS

(INR)

Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2013 2014E 2015E

64.0

41.8

23.6

1.7

-5.9

25

7.0

8.5

10.7

0.7

64.3

41.3

26.5

2.1

25.4

27

7.8

8.0

8.5

0.7

70.5

45.7

29.5

2.4

11.5

28

8.6

8.7

7.6

0.6

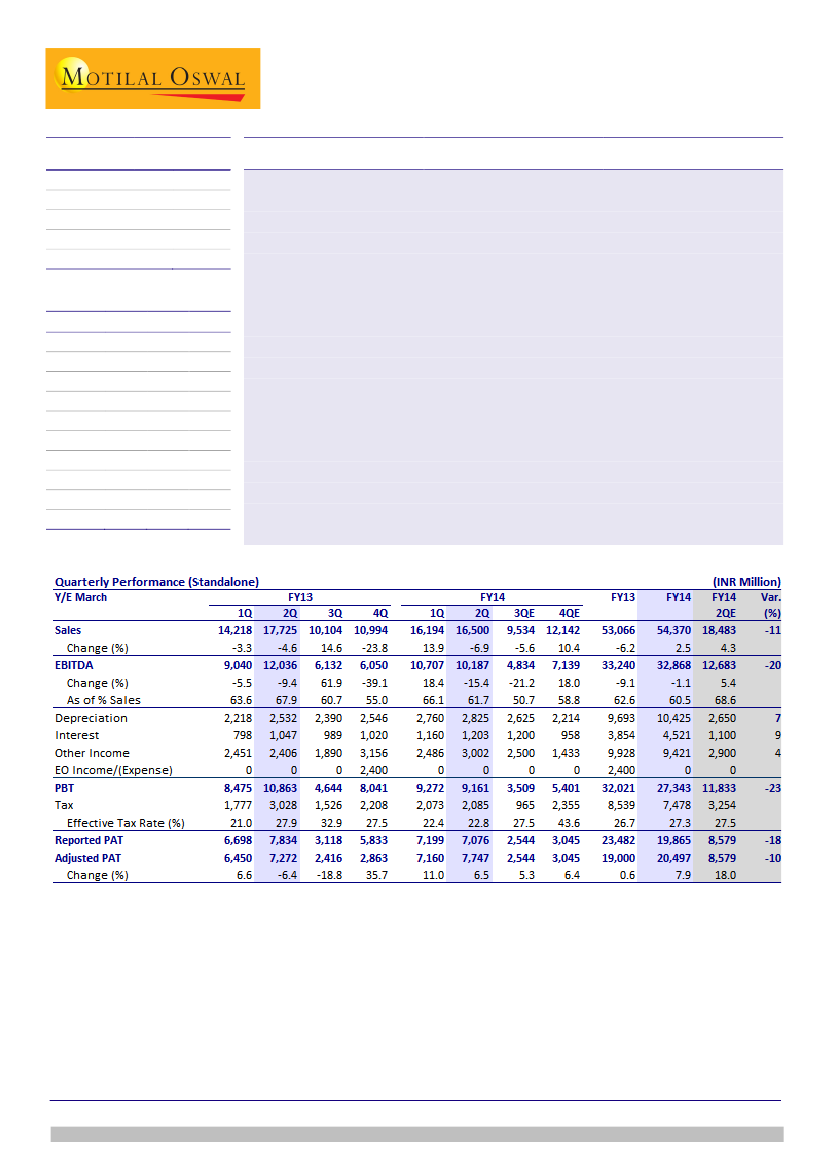

Lower generation impacts incentives:

NHPC reported PAT of INR7.1b for 2QFY14,

18% below our estimate, but adjusted PAT was INR7.7b. Reported PAT includes

INR671m (for last 5-6 years) booked in other operating expenses on account of

difference in energy cost charged by the Jammu & Kashmir government for

transfer of power from the Salal project to the Dulhasti project, as it considered

this as loss of state revenue. Adjusted PAT was 10% below our estimate, as lower

generation impacted incentives.

Generation dip due to lower availability:

NHPC’s generation declined 12% due to

zero contribution from Dhauliganga and overall lower availability. We estimate

capacity addition at 937MW in FY14 (297MW already commissioned) and 164MW

in FY15. We have been seeing consistent delays in CoDs of projects under

construction. Also, growth option beyond FY15 (for 12

th

Plan, ending FY17) is only

the Kishan Ganga (330MW) project, which is also expected in 4QFY17, meaning no

driver to earnings growth beyond FY15. Subhanshri Lower (~INR60b already spent)

and Parbati Lower II (800MW) are now delayed by 7-9 years.

Cutting estimates:

We reduce our estimates by 1.4%/3. 4% for FY14/15. We

estimate PAT at INR26.5b (up 25%) for FY14 and INR29.5b (up 12%) for FY15. The

stock trades at 7.6x FY15E consolidated EPS and 0.6x FY15E BV.

Nalin Bhatt

(NalinBhatt@MotilalOswal.com); +91 22 3982 5429

Aditya Bahety

(Aditya.Bahety@MotilalOswal.com); +91 22 3982 5417

Investors are advised to refer through disclosures made at the end of the Research Report.