13 November 2013

2QFY14 Results Update | Sector:

Metals

Nalco

BSE SENSEX

20,282

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,018

NACL IN

2,577.2

52/24

20/9/-21

CMP: INR39

TP: INR53

Buy

In line; higher alumina sales and realization boost margins; expect stronger

2HFY14

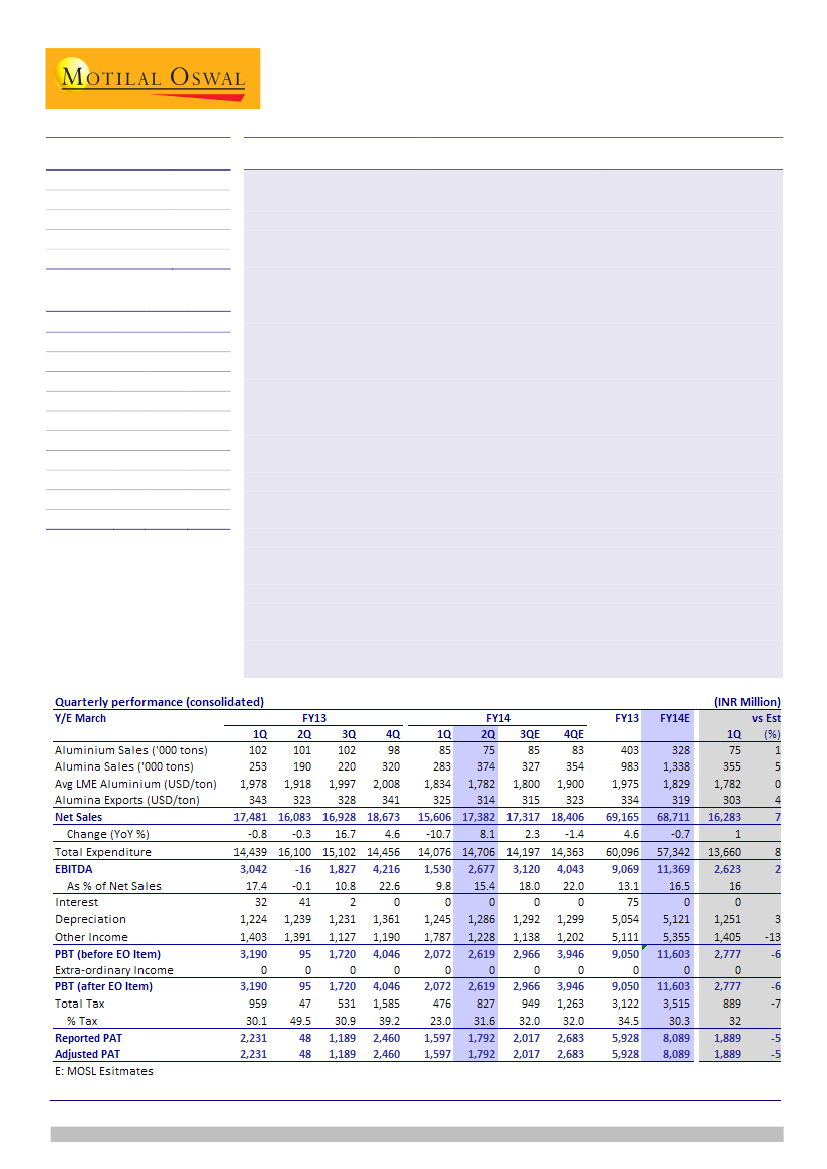

Reported EBITDA of INR2.7b (up 75% QoQ) was in line with our estimate of

INR2.6b. Higher alumina sales volume and better realization due to INR

depreciation against USD boosted margins. Adjusted PAT increased 12% QoQ to

INR1.8b.

Net sales increased 11% QoQ (+8% YoY) to INR17.4b. Alumina sales improved 32%

QoQ to 374kt. Aluminum sales declined 11% QoQ to 75kt due to restricted coal

supply from MCL. Smelter is operating at ~65-70% capacity utilization.

Aluminum realization increased 7% QoQ to INR130,019/t (USD2,080/t), while

alumina realization was up 8% QoQ to INR19,651/t (USD314/t). Product premium

dipped 1.1pp QoQ to 16.7% in 2QFY14.

According to our calculation, the cost of production (CoP) of metal increased 8%

QoQ to INR132,998 (USD2,128/t), while CoP for alumina increased by 1% QoQ to

INR14,164 (USD227/t).

Management has guided for stronger 2HFY14 performance due to improved

linkage coal availability and better realization in alumina.

Capex has been cut down to INR7-8b for FY14 as the NPCIL JV is still awaiting

regulatory approval. Management is open to the idea of increasing dividend.

Aluminum segment performance will remain volatile due to uncertain coal supply

from MCL. Alumina refineries however will continue to operate efficiently.

Commencement of mining operations at Utkal E coal block will be the key for

stock’s re-rating.

We build alumina production CAGR of 11% over FY13-15E, which will drive EPS

growth. EPS is expected to post 16% CAGR over FY13-15E to INR3.2/share. Stock

trades at FY15E PE of 12.4x and EV/EBITDA of 3.5x. We value NACL at INR53/share

based on EV/EBITDA of 5.5x FY15E (LME at USD2,000/t).

M.Cap. (INR b) / (USD b) 103.0/1.6

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

Adj.EPS(INR)

Gr. (%)

BV/Share

(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2013 2014E 2015E

69.2

9.1

5.9

2.3

-31.5

46.3

5.0

7.2

17.1

0.9

68.7

11.4

8.1

3.1

36.4

48.0

6.7

8.9

12.6

0.8

78.7

11.6

8.2

3.2

1.3

49.7

6.5

8.9

12.4

0.8

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Pavas Pethia

(Pavas.Pethia@MotilalOswal.com); +91 22 3982 5413

Investors are advised to refer through disclosures made at the end of the Research Report.