14 November 2013

2QFY14 Results Update | Sector:

Metals

Tata Steel

BSE SENSEX

20,194

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

5,990

TATA IN

971.2

448/195

21/16/-15

CMP: INR359

TP: INR312

Sell

EBITDA in-line; non-recurring items boost PAT

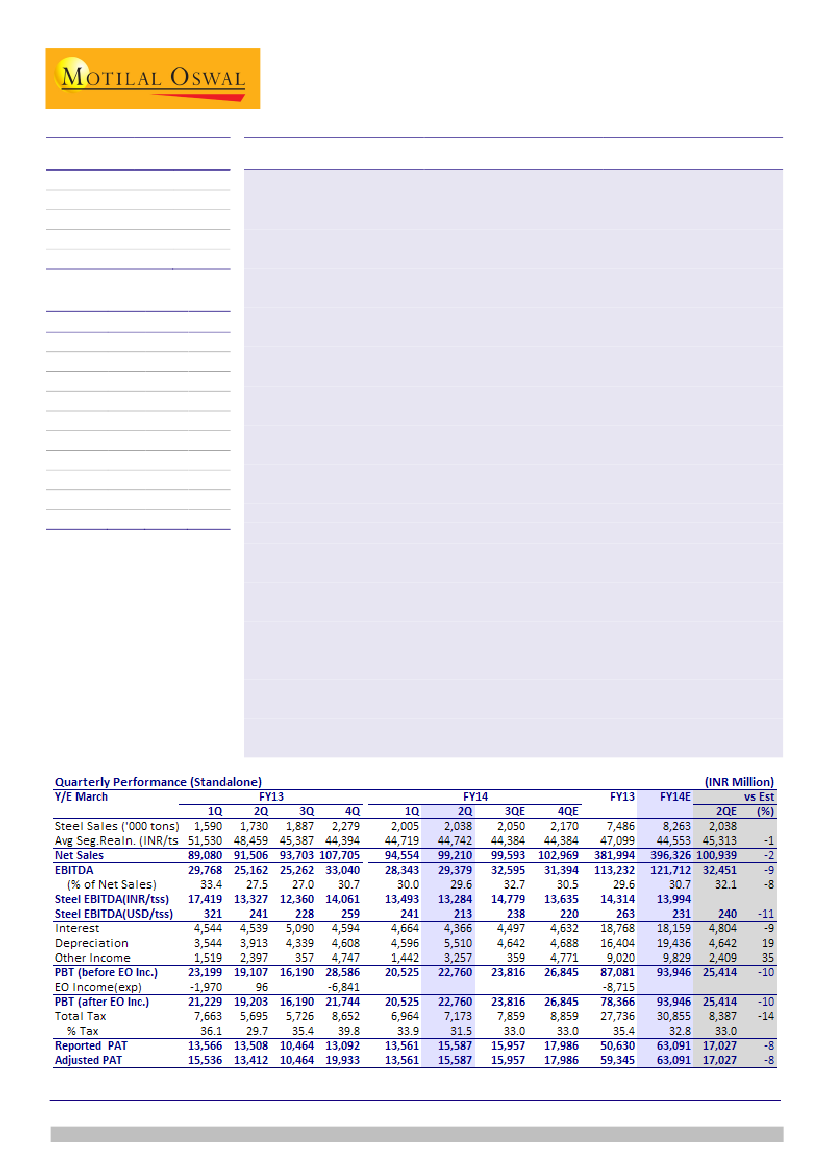

Cons. EBITDA was INR37b, flat QoQ and along expected lines. Standalone EBITDA

grew 4% QoQ, driven by better performance of FAMD; steel volumes and margins

were flat QoQ. Subsidiaries’ (TSE and others) EBITDA declined 10% QoQ to

INR7.7b.

Adj. PAT declined 18% QoQ to INR9.2b, higher than our estimate of INR3.5b due

to non-recurring items – lower interest, and D&A and deferred tax credit at TSE.

For TSE, EBITDA declined 29% QoQ to INR5.5b. EBITDA/ton declined 42% QoQ to

USD26. Excluding NRV write-back, EBITDA/ton would have been USD13.

M.Cap. (INR b) / (USD b) 348.5/5.5

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

Adj.EPS INR

Gr. (%)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2013 2014E 2015E

1,347

123.2

-70.6

1.6

1,420

163.9

42.2

41.6

243.1

9.4

9.3

8.6

1.5

1,427

169.2

42.9

42.3

1.5

277.4

16.1

9.2

8.5

1.3

Cutting FY15 volume estimate for TSI; estimate net debt at INR745b by FY15

Management cut its FY14 volume guidance for TSI to 8.3m tons (8.5m tons earlier)

due to weak domestic demand, despite 0.7m tons of extra sales in 1HFY14. TSI has

taken price hikes in Sept and Oct, but whether the prices stick needs to be

watched. We are cutting FY15 volume estimate to 9m tons (9.5m tons earlier).

Net debt increased by INR83b to INR685b in 1HFY14, largely due to forex

translation loss. Project cost estimates continue to rise, as the site is designed for

6mtpa though phase-1 will be 3mtpa. The group’s annual capex is estimated at

~USD2.5b. This is likely to increase net debt to INR745b by FY15.

-91.6 2,553.8

4.2

6.1

228.7

1.7

BV/Sh(INR) 217.3

Raising earnings estimates, target price; maintain Sell

For FY14, our cons. EBITDA estimate remains unchanged at IN164b, but lower tax

and depreciation at subsidiaries results in 26% EPS upgrade to INR41.6. For FY15,

we have raised our consolidated EBITDA estimate by INR4b to INR169b and EPS

estimate by 29% to INR42.3, to factor in higher volumes and margins for TSE.

Steel sector has got re-rated due to stabilization of steel markets. We are

increasing the target multiple from 5x to 5.5x for Indian operations. Our revised

TP is INR312 (INR210 earlier), the combined effect of re-rating and earnings

upgrade.

Balance sheet will remain stretched, given heavy investments in Indian greenfield

projects and delays. Indian steel demand is yet to bottom out. We are not sure if

the benefit of operating leverage will result in margin expansion for TSE.

Sell.

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Pavas Pethia

(Pavas.Pethia@MotilalOswal.com); +91 22 3982 5413

Investors are advised to refer through disclosures made at the end of the Research Report.