SUN PHARMACEUTICAL INDUSTRIES FY13

Sun Pharmaceuticals Industries (SUNP) released its annual report

for two years together - FY12 and FY13 due to the approval pending

for the demerger of domestic formulation business into Sun Pharma

Laboratories (SPLL). SUNP also amalgamated the erstwhile

partnership firms (post conversion into private limited companies)

with SPLL.

the

ART

of annual report analysis

Aggregate tax expense

of standalone and all

subsidiaries is lower

than consolidated tax.

Contingent liabilities

increased due to

income-tax matters in

subsidiaries.

Jump in quoted equity investments from

INR1.4b in FY12 to INR4.2b in FY13.

Stock Info

Bloomberg

CMP

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel.Perf.(%)

SUNP IN

575

2,071.2

1,191.7/19.3

650/347

-7/12/51

A

NNUAL

R

EPORT

T

HREADBARE

12 December 2013

ART #1: Accounting and auditing segment

Aggregate tax expense of standalone and all subsidiaries is

significantly lower than the consolidated tax expense (lower

by 37% of consolidated tax expense).

Consolidated tax rate rose from 9.3% in FY12 to 19.6% in FY13

(based on profits from continuing operations) primarily due to

increase in tax rate at TARO from 11.7% in CY11 to 20.2% in FY13.

Accordingly we believe that the tax rate in Indian subsidiaries is

comparatively lower.

ART #2: Key financial insights

Contingent liabilities increased from INR6.9b in FY12 to INR9.9b

in FY13, primarily due to increase in contingent liabilities on

income-tax matters in subsidiaries.

Investments made in quoted equity jumped from INR1.4b in

FY12 to INR4.2b in FY13. No further details are available on the

nature of these investments.

Financial summary (INR b)

Y/E Mar

2011

2012

2013

Sales

57.2

80.2

113.0

Sales growth (%) 42.8

40.2

40.9

EBITDA

19.7

32.0

49.0

EBITDA margin (%) 34.4

40.0

43.3

PAT*

18.2

26.6

35.7

EPS (INR)*

8.8

12.8

17.2

EPS Gr. (%)

34.9

46.3

34.3

BV/Sh. (INR)*

45.8

59.1

72.4

RoE (%)*

21.0

24.5

26.2

RoCE (%)

18.6

23.8

29.8

Payout (%)

20.0

16.6

14.5

*2013 are adjusted for provision of Wyeth claim

ART #3: Management speak/key plans

Management in 4QFY13 earnings call had guided for FY14 tax rate

of 18-20%, which was revised to 15% in 1QFY14 earnings call.

Management has increased its revenue guidance for FY14E to

25% from 18-20% earlier (guidance is in constant currency). SUNP

plans to file 25 ANDAs this year.

ART #4: Governance matters

SUNP does not have a scheme of stock options either for the

executive directors or employees.

Details of managerial remuneration paid to Mr. Israel Makov

during FY13 is not disclosed in the annual report.

Shareholding pattern (%)

As on

Promoter

Domestic Inst

Foreign

Others

Sep-13

63.7

3.2

22.8

10.3

Jun-13

63.7

3.2

22.8

10.3

Sep-12

63.7

5.2

20.4

10.7

Our pharma analyst view

Potential of SUNP's US pipeline continues to be

underappreciated. SUNP's US revenue is estimated to witness a

robust CAGR of 25% over FY13-FY15.

We value SUNP's base business at 27x FY15E to arrive at a fair

value of INR680/share. We add INR28/share for Doxil and INR10/

share for other Para IV to arrive at a target price of INR718/share.

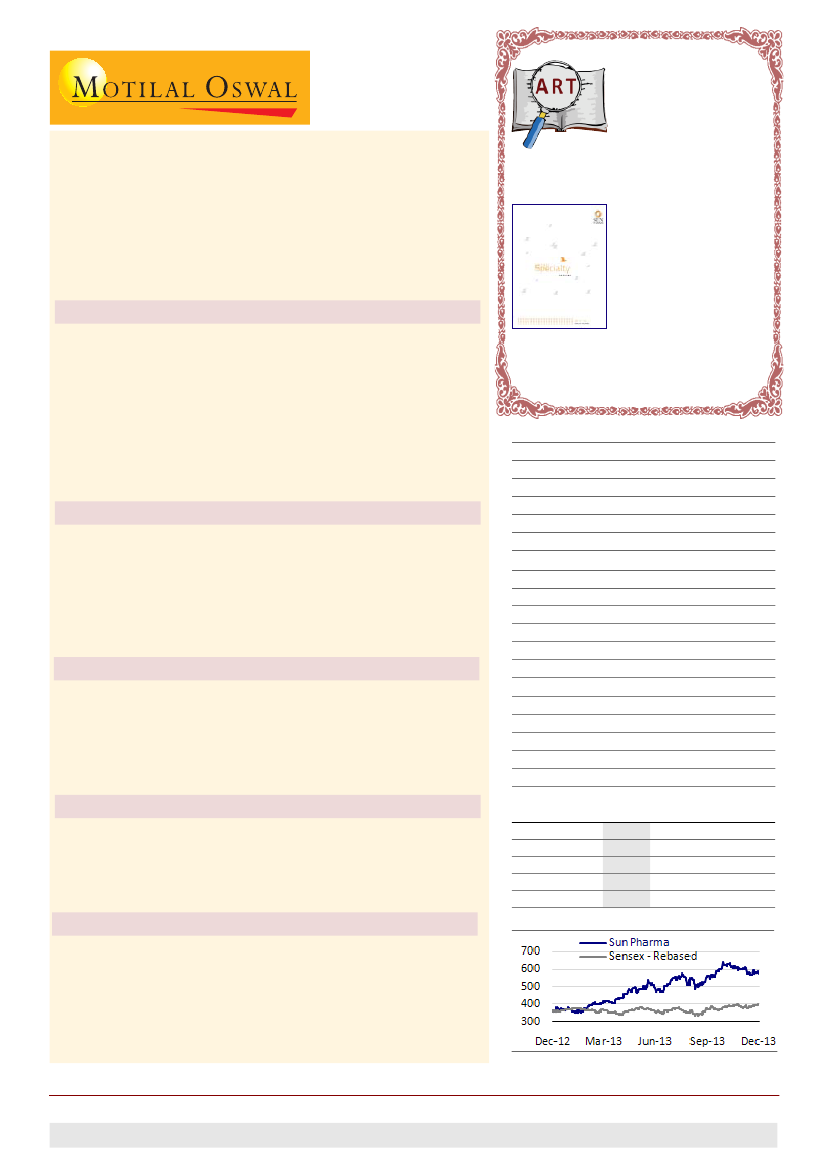

Stock performance (1 year)

ART

will present a threadbare portrait of annual reports - statistical, strategic and structured. We believe

ART's

wide canvas - from accounting and auditing issues to

operating performance to management insights to governance matters - will help readers paint a clearer picture of the stock's investment worthiness.

Ashish Gupta

(Ashish.Gupta@MotilalOswal.com); +91 22 3982 5544

Investors are advised to refer through disclosures made at the end of the Research Report.

1