15 January 2014

3QFY14 Results Update | Sector:

Automobiles

Exide Industries

BSE SENSEX

21,289

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD

b)

52-Week Range (INR)

S&P CNX

6,321

EXID IN

850.0

CMP: INR105

TP: INR110

Neutral

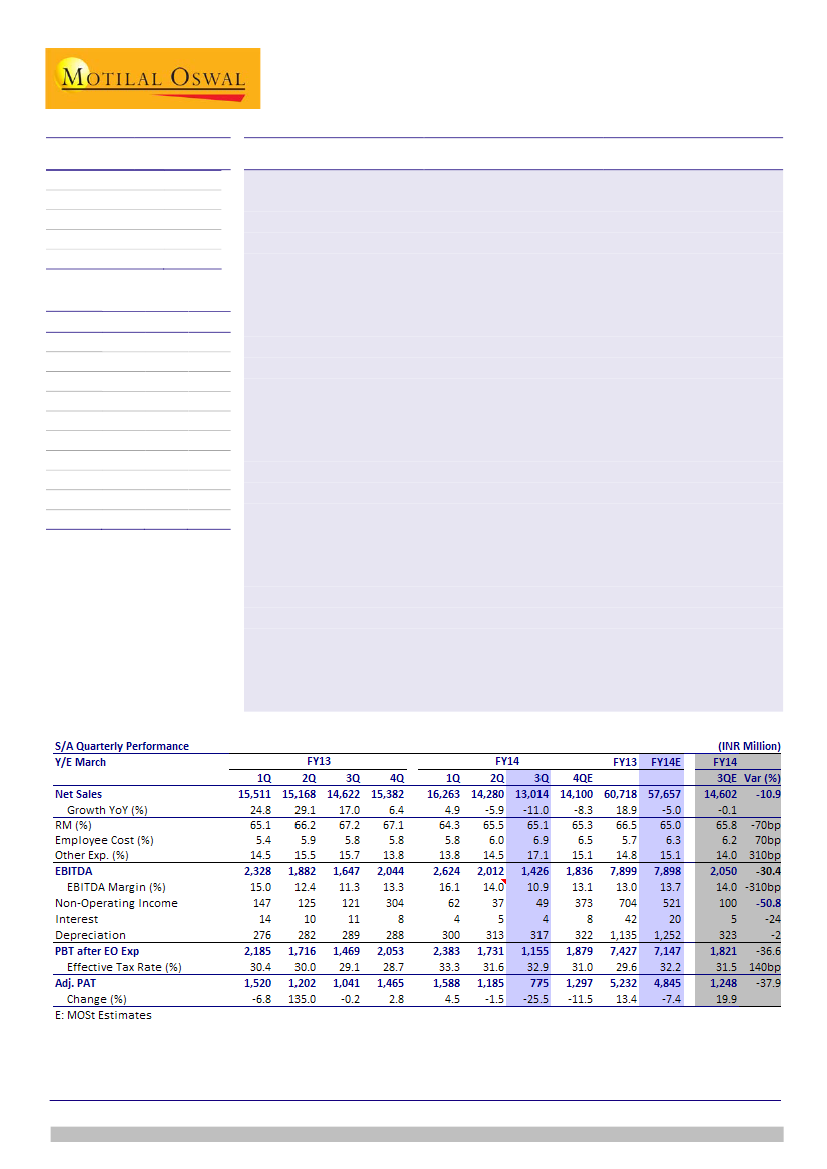

Low utilization and high marketing spends impact performance

Exide’s (EXID) 3QFY14 performance was sharply below our expectation, led by weak

89.1/1.4

demand across segments and consequent low capacity utilization. This coupled with

148/102

higher marketing spends impacted operating performance significantly.

-11/-27/-35

1, 6, 12 Rel. Per (%)

Result highlights:

Net sales de-grew 11% to INR13b (v/s est. INR14.6b) driven by weak demand

Financials & Valuation (INR Million)

across product categories. Auto OEMs declined 8%, Industrial by 17%, Inverters by

Y/E MAR 2014E 2015E 2016E

37%, while replacement segment was largely flat.

Net Sales 57,657 63,192 70,591

EBITDA margin stood at 10.9% (v/s est. 14%). Sequentially, margin declined by

EBITDA

7,898 8,398 9,634

310bp, led by a sharp increase in other expenditure to 17.1% (260bp QoQ), on

Adj PAT

4,845 5,450 6,215

higher marketing spends and low capacity utilization.

Adj.EPS

5.7

6.4

7.3

PAT declined 26% YoY to INR775m (on a low base) on weak operational

(INR)

Growth

-7.3

12.5

14.0

performance.

(%)

BV/Share

43.9

48.0

53.0

Earnings call highlights:

1) inverters (22-25% of FY13 revenue) declined sharply on

(INR)

RoE (%)

13.5

13.9

14.5

unfavorable weather and improvement in power availability. Structurally, the inverter

RoCE (%)

18.0

17.4

18.3

segment is unlikely to grow over the long term, 2) replacement demand expected to

P/E (x)

18.4

16.3

14.3

remain muted over the near term, reflecting weak OEM demand during FY12-14, 3)

P/BV (X)

2.4

2.2

2.0

average price cut of 8-10% effective Nov-13 post the 5-6% hike in Sept-13, 4) capex

guidance of INR2-2.8b for FY14 and 5) continues to focus on cost control and

technology upgradation initiatives.

Downgrade earnings, maintain Neutral:

We cut FY14E/15E/16E EPS by

12.7%/17%/16.4% to factor the dismal 3Q performance, weak demand outlook (for

inverters, replacement) and limited visibility on margin improvement. The stock trades

at 18.4x/16.3x/14.3x our current FY14E/15E/16E EPS of INR5.7/6.4/7.3 respectively.

Maintain

Neutral

with a target price of INR110 (13x FY16E EPS and INR15 for the

insurance valuation).

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Chirag Jain

(Chirag.Jain@MotilalOswal.com); +91 22 3982 5418

Investors are advised to refer through disclosures made at the end of the Research Report.