15 January 2014

3QFY14 Results Update | Sector:

Financials

Bajaj Finance

BSE SENSEX

21,289

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,321

BAF IN

49.8

77.1/1.3

1,591/966

1/7/7

CMP: INR1,548

TP: INR1,704

Buy

Financials & Valuation (INR Billion)

Y/E MAR

NII

PPP

PAT

EPS (INR)

EPS Gr. (%)

BV/Sh.

(INR)

RoA (%)

RoE (%)

P/E (x)

P/BV (x)

2014E 2015E 2016E

22.9

14.1

7.5

151

27

801

3.6

20.4

10.3

1.9

28.2

17.3

8.8

177

18

947

3.2

20.3

8.7

1.6

34.8

21.4

10.5

212

19

1,121

3.2

20.5

7.3

1.4

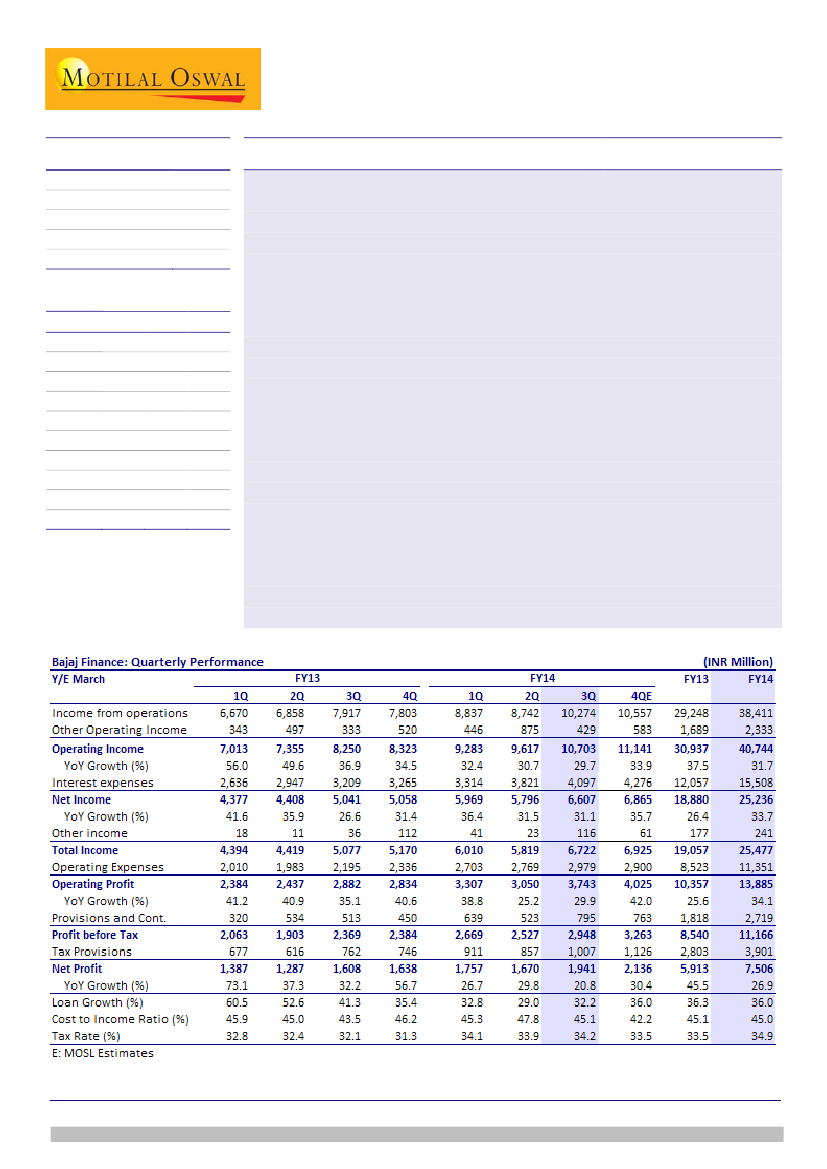

Bajaj Finance (BAF) 3QFY14 PAT stood at INR1.94b, up 21% YoY and 16% QoQ (in

line with our est. of INR1.93b). Strong AUM growth (+33% YoY and 13% QoQ),

stable asset quality QoQ (GNPA/NNPA 1.15/0.23%), margins expansion of 60bp

QoQ and 200bp improvement in PCR were the key highlights of the quarter.

AUM growth remained strong (up 33% YoY and 13% QoQ) at INR224.6b, driven by

a robust +29% YoY in consumer segment and +50% growth in SME business.

Commercial segment (CE and short term infrastructure loans) de-grew +30% YoY.

Estimated margins stood at 12.5% and were flat YoY and improved 60bp

sequentially. The sequential improvement in margins is a seasonal phenomenon

due to strong earnings from consumer electronic financing, though marginally it

was also led by 50bp sequential decline in cost of funds (est).

Other highlights:

1) as BAF continues to invest in systems and processes, opex

(10% above est.) grew 37% YoY and 7% QoQ, 2) asset quality was stable, with

GNPA/NNPA at 1.15%/0.23%; and 4) BAF has 95% of the loan book at 90dpd (only

CE and Infrastructure on 180dpd).

Valuation and view:

BAF continues to reap the benefits of healthy consumer

demand and is among the few companies doing well in this space. Despite the

fragile macro environment BAF continues to have one of the best asset quality

among the peer group. Superior margins, focused fee income strategy and control

over cost ratio will keep core operating profitability strong. We expect RoA/RoE to

remain strong at over 3.4%/21% during FY14-16. We maintain

Buy

rating with a

target price of INR1,704 (1.8x FY15E BV of INR950).

Sunesh Khanna

(Sunesh.Khanna@MotilalOswal.com) + 91 22 3982 5521

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Investors are advised to refer through disclosures made at the end of the Research Report.