21 January 2014

3QFY14 Results Update | Sector:

Financials

Kotak Mahindra Bank

BSE SENSEX

21,251

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

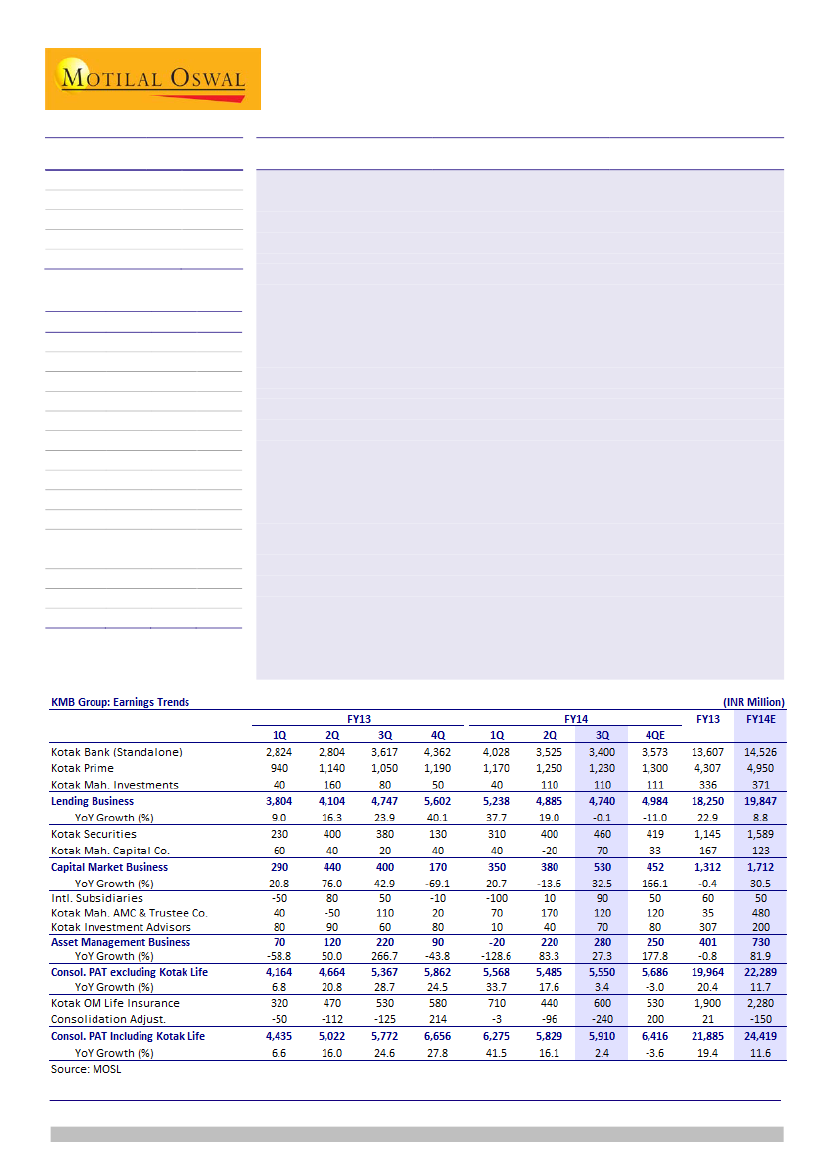

KMB’s consolidated PAT for 3QFY14 grew 2% YoY (lowest since 1QFY10) to INR5.9b

768.7

(4% below our estimate), marred by sharp moderation in loan growth to 6% YoY.

543.0/8.8

Lending business PAT was flat YoY (6% below estimate) at INR4.7b, whereas other

804/588

business PAT grew 23% YoY to INR1.4b v/s our expectation of INR1.1b.

-4/-3/7

S&P CNX

6,314

KMB IN

CMP: INR706

TP: INR720

Neutral

Financials & Valuation (INR Billion)

Y/E MAR

NII

OP

NP

NIM (%)

EPS (INR)

EPS Gr. (%)

Cons. BV.

(INR) RoE

Cons.

( )

RoA (%)

Payout (%)

Valuations

P/E(X)

(C (X)

P/BV )

(C

P/ABV)(X)

( Yield

Div. )

(%)

2014E

37.0

25.7

14.5

4.6

32.7

11.6

236.0

14.9

1.7

2.9

21.6

3.0

3.1

0.1

2015E

41.0

28.2

16.7

4.6

37.1

13.4

272.0

14.6

1.7

2.9

19.0

2.6

2.7

0.1

2016E

47.5

32.4

19.1

4.7

42.3

13.9

313.0

14.4

1.7

2.9

16.7

2.3

2.3

0.1

Standalone business:

Moderate loan growth led to stable NIM (calculated) QoQ at

4.7%. Risk aversion (in some segments) led to loan growth of just 6% YoY (estimate

of 10% YoY) and in-turn impacted NII (3% below estimate) and PAT (6% below

estimate). CV loans continued to decline (drop of 12% QoQ and 26% YoY). Corporate

(+13% QoQ) and agricultural (+14% QoQ) loans were the key drivers of sequential

loan growth.

Other highlights:

(1) KMB’s market share declined 10bp QoQ to 2.3%, (2)

Consolidated NIM was stable QoQ at 4.9%, (3) Consolidated GNPA (including stress

assets) increased to 1.7% (1.6% in 2QFY14), (4) PCR dropped to 46% from 51% in

2QFY14, and if PCR were to be maintained at 2QFY14 levels, standalone PBT would

have been lower by 12-13%, and (5) SA deposit growth was strong at 9% QoQ (38%

YoY) and CASA ratio was stable QoQ at 30%.

Maintain Neutral:

Management comments on the conference call on loan growth

and asset quality were relatively positive (as compared to the previous quarter).

However, considering the growth environment, loan growth will be lower than

historical levels (14% over FY13-16 v/s 31% over FY09-13). Core PPP/earnings CAGR

would be 14%/13% over FY13-16 as compared to 36%+ each over FY09-13. RoA is

likely to moderate to 1.7% over FY14-15 and RoE would be in mid-teens. On the back

of rich valuations, we maintain

Neutral.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Sohail Halai

(Sohail.Halai@MotilalOswal.com); +91 22 39825430

Investors are advised to refer through disclosures made at the end of the Research Report.