30 January 2014

3QFY14 Results Update | Sector:

Real Estate

Godrej Properties

BSE SENSEX

20,647

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,120

GPL IN

199.2

31.8/ 0.6

298/156

-1 /-36 /-48

CMP: INR160

TP: INR180

Neutral

Financials & Valuation (INR Billion)

Y/E Mar 2014E 2015E 2016E

Net Sales

EBITDA

NP

EPS (INR)

EPS Gr. (%)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA

( )

Div. Yld (%)

21.1

1.4

12.0

1.3

18.7

1.3

9.4

1.3

14.9

1.2

7.8

1.3

10.5

3.0

1.5

7.6

-14.5

8.2

9.2

15.4

13.2

4.0

1.7

8.6

12.9

120.7

7.3

8.5

13.7

16.0

4.8

2.1

10.7

25.1

130.3

8.5

9.5

10.9

BV/Sh (INR) 113.3

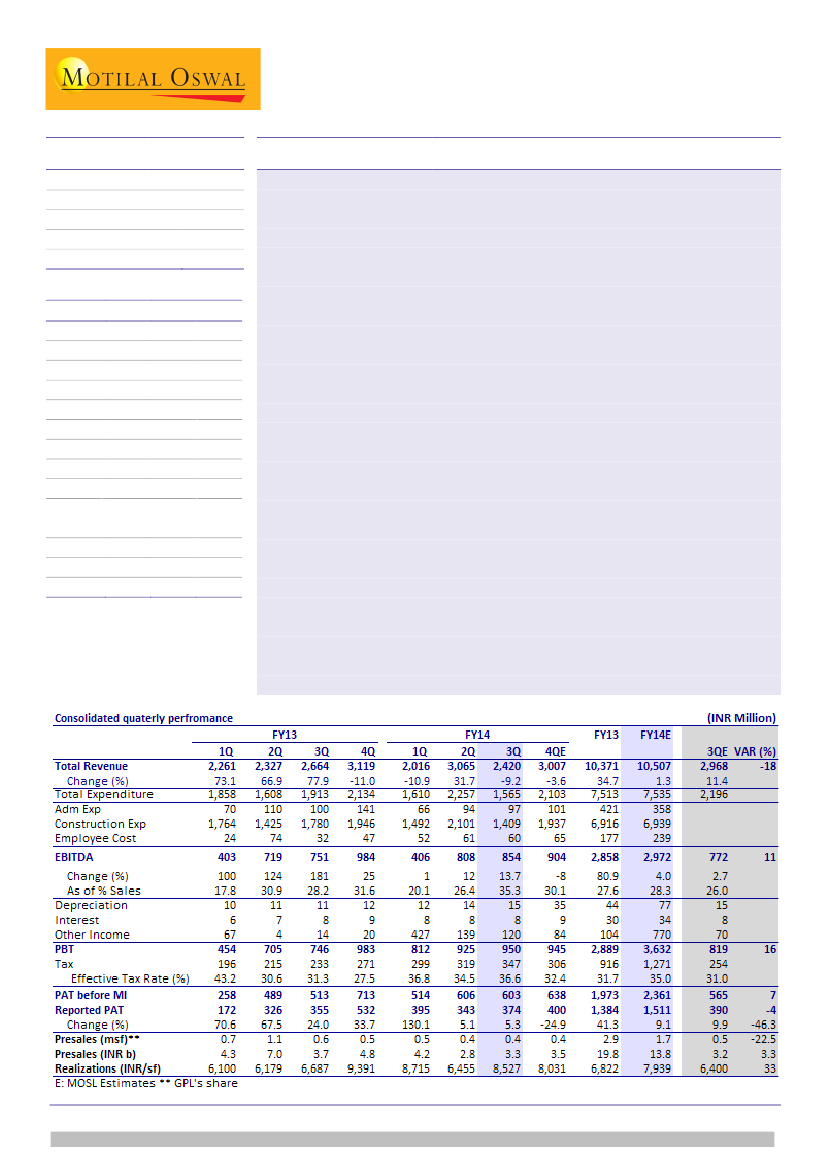

Revenue below est; margin beat on higher bookings from Vikhroli commercial:

Godrej Properties’ (GPL) 3QFY14 revenue grew 9.2% YoY (-21% QoQ) to INR2.4b

(below est. of INR3b). However, EBITDA grew 13.7% YoY (+6% QoQ) to INR854m

(above est. of INR772m), implying margin of 35.3% (+9pp QoQ). Better margin is

attributable to higher revenue from Vikhroli (commercial), which enjoys 40-

42% margins. Ex-Vikhroli, blended margin has improved to 29% in 3QFY14

(+10% QoQ). PAT stood at INR374m (+5% QoQ), marginally below estimate of

INR390m due to higher tax rate.

Pre-sales posted moderate QoQ improvement

but broadly remains weak in the

context of a seasonally strong quarter. GPL’s stake of 3QFY14 pre-sales stood at

0.39msf (INR3.3b) v/s 0.43msf (INR2.7b) in 2QFY14 and 0.56msf (INR3.7b) in

3QFY13. 9MFY14 pre-sales stood at INR10.3b (v/s INR19.8b in FY13) v/s annual

estimate of INR13.8b.

Disappointments on negative FCFE continue:

Cash flow weakness continues to

be the biggest concern as GPL posted negative FCFE of INR2.7b (v/s core-FCFE of

negative INR7.3b in 9MFY14). We estimate company’s operating cash flow

(OCF) in 3QFY14 of negative INR1.7b, which was impacted by non-regular

outflows of INR1.5-1.7b - refundable deposit for LBS project, FSI premium,

various approvals, EDC/IDC related to upcoming launches. GPL has also given

exit to Redford India RE Babur PE in Genesis during 3QFY14. Accordingly, net

debt was up by INR2.7b QoQ to INR15.3b (0.68x).

Maintain Neutral:

Our key concern has been company’s failure to improve

operating cash flow, which is likely to see further deterioration with almost

INR11b of cash outgo towards BKC project over FY14-16. We expect capital

efficiency and cash flow to remain subdued over FY15, before a recovery in

FY16, on the benefits of planned launches percolating. GPL trades at 14.9x

FY16E EPS and 1.2x FY16E BV (RoE of 9%). Maintain

Neutral.

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Investors are advised to refer through disclosures made at the end of the Research Report.