10 February 2014

3QFY14 Results Update | Sector:

Cement

Birla Corporation

BSE SENSEX

20,377

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,063

BCORP IN

77.0

18.1/0.3

294/191

-11/-4/-17

Financials & Valuation (INR Billion)

Y/E Mah

Sales

EBITDA

NP

EPS Gr. (%)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA

( )

EV/Ton (x)

6.7

0.7

3.5

22

8.1

0.7

4.6

22

6.0

0.6

2.9

21

2014E 2015E 2016E

25.6

3.5

2.7

12.8

11.0

10.7

24.9

30.1

2.8

2.2

29.1

-17.0

8.6

7.6

32.2

33.6

4.2

3.0

39.0

34.0

10.6

10.7

26.8

CMP: INR235

TP: INR302

Buy

Adj EPS (INR) 35.0

BV/Sh. (INR) 318.2 337.9 366.4

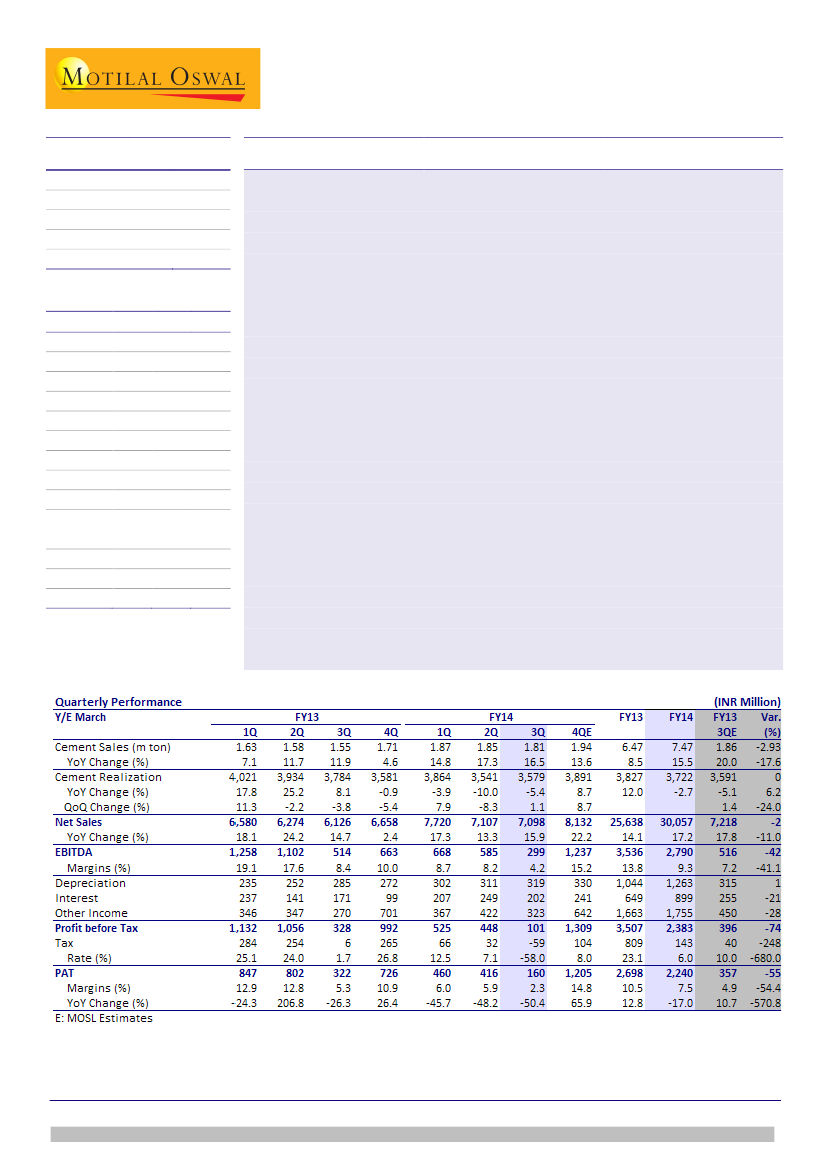

Birla Corp's (BCORP) 3QFY14 performance was below estimates, with EBITDA/ton

of INR279/ton (v/s est. INR376/ton).

Net sales grew by 16% YoY (flat QoQ) to INR7.1b (v/s est. INR7.2b) and EBITDA de-

grew by 42% YoY (-49% QoQ) to INR299m (v/s est. INR516m). However, tax write-

back boosted PAT to INR160m (v/s est. INR357m).

Cement volumes grew 16.5% YoY (-2.4% QoQ) to 1.81mt (v/s est. 1.86mt),

benefiting from commencement of mechanized mining at Rajasthan plant from

Aug-13. Cement realizations declined ~INR200/YoY (flat QoQ) to INR3,579/ton (v/s

est. INR3,591/ton).

Cement business EBITDA/ton was at INR279 (v/s est. INR376/ton v/s INR344/ton

in 2QFY14 v/s INR451/ton in 3QFY13), impacted by pricing pressure in key markets

of North and East India, and cost push on energy, freight and negative operating

leverage. This is despite the savings due to commencement of supply of captive

limestone at Rajasthan, although ~30% of Rajasthan plant’s requirement is still

met through open market limestone.

The Ministry of Coal de-allocated BCORP’s Bikram Coal Block due to lack of

development as per milestones. Company is in the process of taking appropriate

legal recourse.

We lower the estimates by 2%/9% to ~INR29/39 to factor the a) higher energy and

freight cost, b) lower tax and c) deferred capex at Rajasthan.

The stock trades at 8.1x/6x FY14E/FY15E EPS, EV/EBITDA of 4.6/2.9x and EV/ton of

USD22/21. Maintain

Buy

with a target price of ~INR302 (~4x FY15E EV/EBITDA or

~USD30/ton).

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Investors are advised to refer through disclosures made at the end of the Research Report.