13 February 2014

3QFY14 Results Update | Sector:

Oil & Gas

BPCL

BSE SENSEX

20,448

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,084

BPCL IN

723.0

263.8/4.3

428/256

13/14/-16

CMP: INR365

Buy

Financials & Valuation (INR Billion)

Y/E MAR

Sales

EBITDA

Adj. PAT

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

Payout* (%)

Valuation

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

9.9

1.4

7.9

2.9

9.5

1.3

7.4

3.0

8.9

1.2

6.8

2.7

2014E 2015E 2016E

2,542 2,574 2,694

74.0

26.6

36.8

41.3

256

15.1

8.8

35.1

71.0

27.8

38.4

4.6

282

14.3

7.9

35.1

71.8

29.6

40.9

6.4

311

13.8

7.7

28.6

*Based on standalone

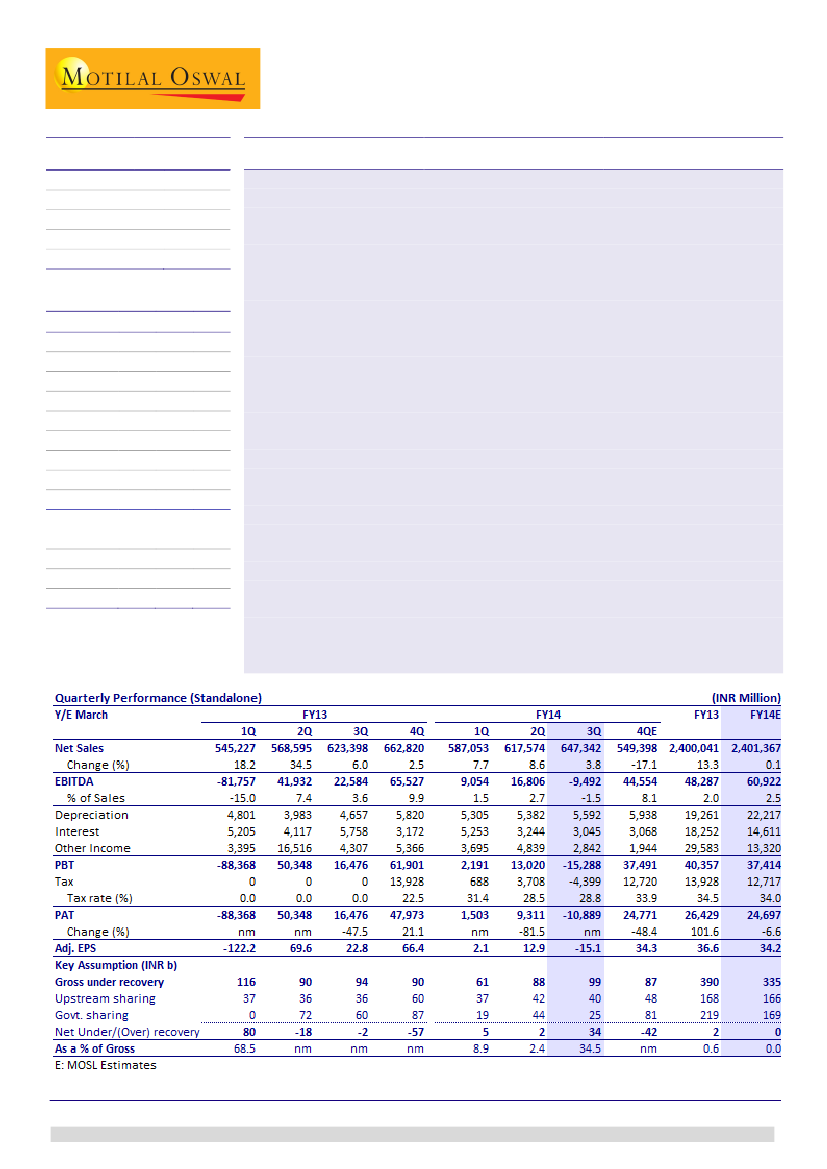

Ad Hoc subsidy leads to higher loss:

BPCL reported EBITDA loss of INR9.5b for

3QFY14 against our estimate of positive EBITDA of INR847m, led by (a) lower

government compensation at INR25b (our estimate: INR49.7b), (b) lower GRM at

USD1.8/bbl (our estimate: USD3.5/bbl). This was partly compensated by (a)

adventitious inventory gain of INR6.6b, and (b) forex gain of INR3b (accounted in

net expenditure). Reported PAT loss was INR10.9b (our estimate: INR3.9b).

Comparable PAT was INR16.5b in 3QFY13 and INR9.3b in 2QFY14.

Net under-recovery at INR34.6b:

While upstream compensated BPCL INR39.7b

(in-line) in 3QFY14, the government provided only INR253b (our estimate:

INR49.7b); leading to net under-recovery of INR34b for BPCL. Assuming nil sharing

by OMCs in FY14, call on government subsidy in 4QFY14 now rises to ~INR340b.

GRM lower at USD1.8/bbl due to shutdown impact:

3QFY14 GRM at USD1.7/bbl,

down 63% YoY and QoQ, led by partial maintenance shutdown at Kochi and

Mumbai in November and December, and lower product cracks. Adventitious

inventory gains stood at INR6.6b v/s INR3.3b in 3QFY13 and INR8.6b in 2QFY14.

Gross debt down:

BPCL’s gross debt reduced to INR167.4b from INR171b in

2QFY14, driven by lower working capital loans, in turn led by higher creditors.

Upside potential in E&P business:

We value BPCL’s E&P business at INR151/share

(Mozambique: INR139/share; Brazil: INR12/share) against benchmark

Mozambique value at ~INR200/share. Triggers include Mozambique FID and Brazil

reserve announcement.

Maintain Buy:

We expect gross under-recoveries to reduce by ~25%/35% in

FY15/FY16. Earnings growth in the initial reform period will be through lower

interest cost, which could be followed by likely increase in diesel marketing margin

(MM) post deregulation. INR0.5/liter increase in MM increases BPCL’s EPS by

~25%. The stock trades at 9.5x FY15E EPS of INR38.4 and 0.5x FY15E BV (adjusted

for investments). BPCL is our top pick among OMCs for its E&P potential.

Buy.

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Investors are advised to refer through disclosures made at the end of the Research Report.